Secured Note Form

What is the secured note?

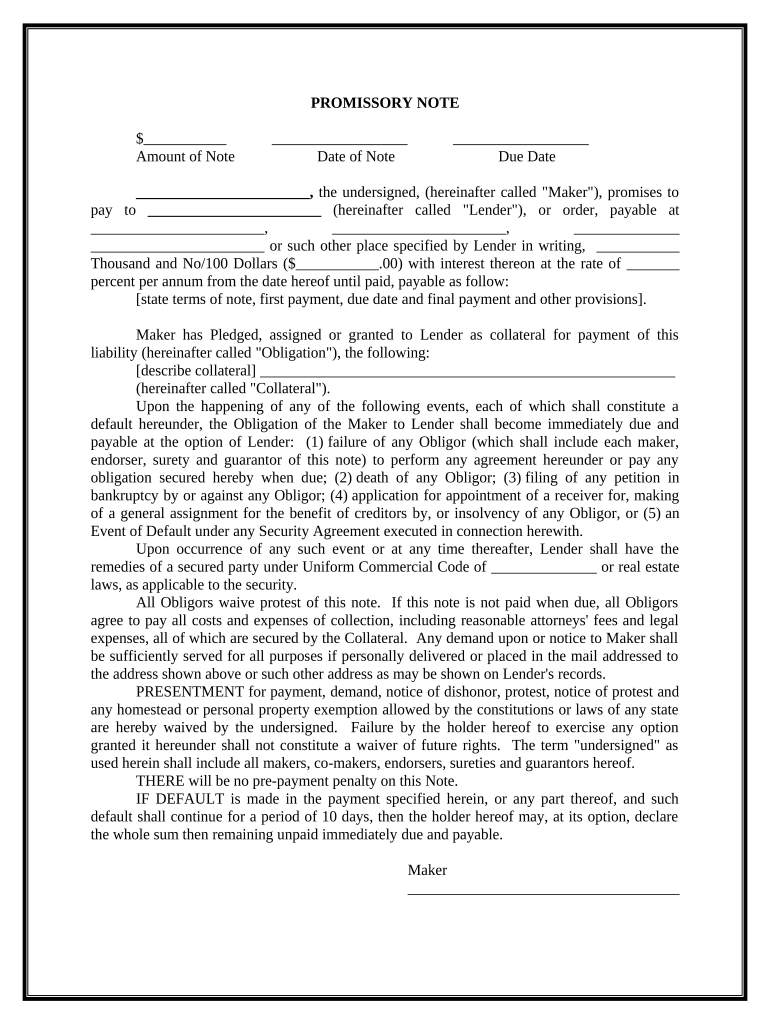

A secured note is a financial instrument that represents a loan secured by collateral. It serves as a written promise from the borrower to repay the lender, typically with interest. The collateral can be any asset of value, such as real estate or personal property, which provides the lender with a level of security in case the borrower defaults on the loan. This type of note is commonly used in real estate transactions and private lending arrangements.

How to use the secured note

Using a secured note involves several key steps. First, the borrower and lender should agree on the terms of the loan, including the amount, interest rate, and repayment schedule. Next, they must draft the secured note, ensuring it includes all necessary details such as the description of the collateral, the obligations of both parties, and any default provisions. Once the document is prepared, both parties should review and sign it, ideally in the presence of a notary to enhance its legal standing. Finally, the lender may need to file a lien against the collateral to protect their interest.

Steps to complete the secured note

Completing a secured note involves a systematic approach:

- Determine the loan amount and terms, including interest rates and payment schedules.

- Identify and describe the collateral that will secure the loan.

- Draft the secured note, ensuring all legal requirements are met.

- Review the document with legal counsel if necessary.

- Sign the secured note in the presence of a notary public.

- File any necessary documentation with local authorities to perfect the security interest.

Key elements of the secured note

Several essential elements must be included in a secured note to ensure its validity:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Collateral Description: A detailed description of the asset securing the loan.

- Repayment Terms: The schedule for payments, including due dates and amounts.

- Default Provisions: Conditions under which the lender can take possession of the collateral.

Legal use of the secured note

The legal use of a secured note is governed by state laws and regulations. It is crucial to ensure that the note complies with the Uniform Commercial Code (UCC) and any specific state statutes. Proper execution and recording of the secured note can provide the lender with legal recourse in case of default. Additionally, both parties should be aware of their rights and obligations under the law to avoid disputes.

Examples of using the secured note

Secured notes are commonly used in various scenarios, such as:

- Real estate transactions, where a property serves as collateral for a mortgage.

- Personal loans, where a vehicle or other asset secures the loan.

- Business financing, where equipment or inventory is pledged as collateral.

Quick guide on how to complete secured note

Effortlessly Prepare Secured Note on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents rapidly without delays. Handle Secured Note on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Secured Note with Ease

- Locate Secured Note and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether through email, SMS, or a link invitation, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Secured Note and ensure effective communication at every point of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a secured note?

A secured note is a financial instrument backed by collateral, which provides the lender with security in case of default. This type of note can be particularly advantageous for businesses seeking funding while minimizing risk. With airSlate SignNow, you can easily create, send, and eSign secured notes to streamline the documentation process.

-

How can airSlate SignNow help with secured notes?

airSlate SignNow simplifies the process of handling secured notes by providing an intuitive platform for sending and eSigning documents. Users can easily customize templates for secured notes, ensuring all critical terms and conditions are included. This saves time and enhances accuracy, allowing you to focus on what matters most.

-

Is there a pricing plan for using airSlate SignNow for secured notes?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for handling secured notes. The plans are designed to be cost-effective, allowing businesses to utilize the platform without exceeding their budget. You can choose a plan that best fits your requirements for managing secured notes and other documents.

-

What features does airSlate SignNow include for secured notes?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage to efficiently manage secured notes. Additionally, the platform offers advanced eSigning capabilities, ensuring your secured notes are signed quickly and legally. These features help streamline the process and enhance overall productivity.

-

Are secured notes legally binding when signed via airSlate SignNow?

Yes, secured notes signed through airSlate SignNow are legally binding, provided they comply with local laws and regulations. The platform adheres to strict legal standards and provides a secure environment for eSigning documents. This ensures that your secured notes are enforceable and recognized by courts.

-

Can I integrate airSlate SignNow with other applications for managing secured notes?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enabling you to manage secured notes efficiently. Whether you use CRM systems, payment platforms, or document management tools, the integrations enhance workflow and ensure all relevant data is synchronized for better decision-making.

-

What are the benefits of using airSlate SignNow for secured notes?

Using airSlate SignNow for secured notes offers several benefits, including increased efficiency, reduced paper usage, and improved document security. The platform’s user-friendly interface allows quick creation and signing of secured notes, which accelerates the overall process. Additionally, the secure environment gives businesses peace of mind when handling sensitive financial documents.

Get more for Secured Note

Find out other Secured Note

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document