Letter Settlement Offer Form

What is the Letter Settlement Offer

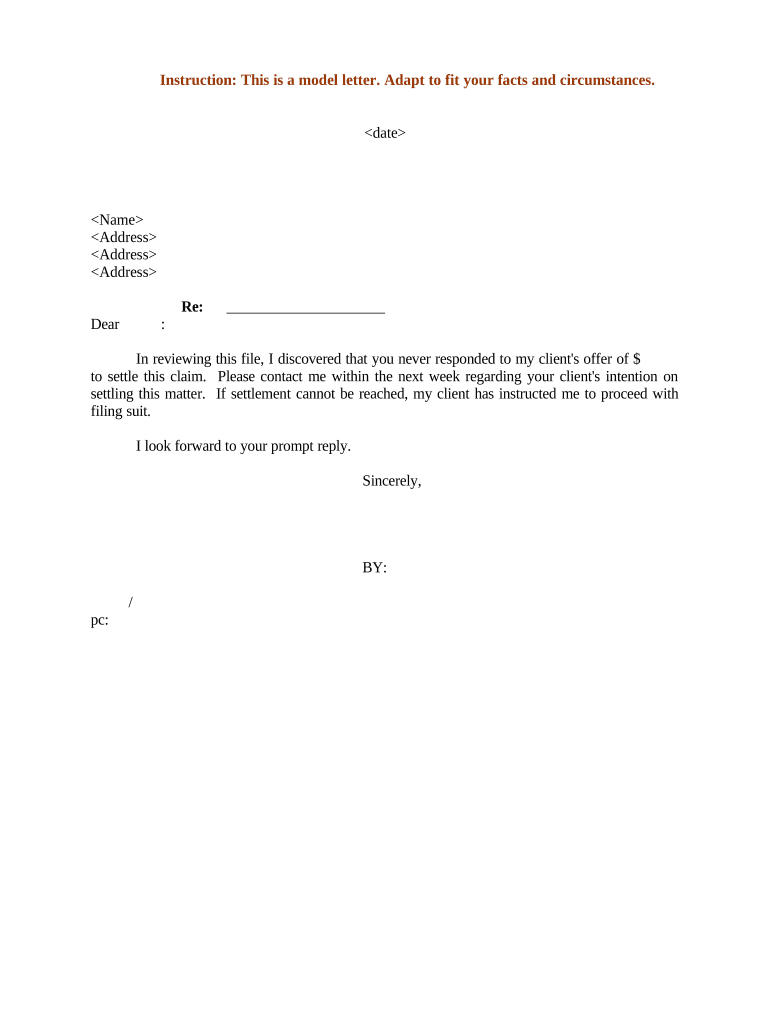

A letter settlement offer is a formal document that outlines the terms under which one party proposes to resolve a dispute with another party, often related to financial obligations such as a car loan. This letter serves as a means of communication to negotiate the terms of repayment or settlement, aiming to avoid further legal action. It typically includes details such as the amount being offered, the reasons for the offer, and any conditions that must be met for the settlement to be accepted.

Key elements of the Letter Settlement Offer

When drafting a letter settlement offer, it is crucial to include specific key elements to ensure clarity and effectiveness. These elements typically include:

- Contact Information: Full names, addresses, and contact details of both parties involved.

- Loan Details: Information about the car loan, including the original amount, current balance, and any relevant account numbers.

- Settlement Amount: The specific amount being offered to settle the debt.

- Payment Terms: How and when the payment will be made, including any deadlines.

- Conditions: Any conditions that must be met for the offer to be valid, such as the acceptance of the offer by the lender.

Steps to complete the Letter Settlement Offer

Completing a letter settlement offer involves several important steps to ensure it is effective and legally binding. Here are the steps to follow:

- Gather Documentation: Collect all relevant documents related to the car loan, including loan agreements and payment history.

- Determine Offer Amount: Decide on a reasonable settlement amount based on your financial situation and the loan details.

- Draft the Letter: Write the letter clearly, incorporating all key elements and ensuring it is professional in tone.

- Review and Edit: Carefully review the letter for accuracy and clarity, making any necessary edits.

- Send the Letter: Deliver the letter to the lender via a method that provides proof of delivery, such as certified mail or email with a read receipt.

Legal use of the Letter Settlement Offer

The legal use of a letter settlement offer is important in the context of debt resolution. This document can serve as evidence of an attempt to negotiate a settlement, which may be beneficial if the matter escalates to court. It is essential that the letter is clear, concise, and includes all necessary details to avoid misunderstandings. Additionally, both parties should keep copies of the letter and any correspondence related to the settlement for their records.

Examples of using the Letter Settlement Offer

Examples of situations where a letter settlement offer may be used include:

- Car Loan Defaults: A borrower may propose a settlement to pay a reduced amount to resolve a defaulted car loan.

- Negotiating Payment Terms: A borrower facing financial hardship may request a settlement offer to adjust payment terms or reduce the total owed.

- Disputes Over Charges: A borrower may dispute additional charges and propose a settlement to resolve the disagreement amicably.

Quick guide on how to complete letter settlement offer

Prepare Letter Settlement Offer easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Letter Settlement Offer on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Letter Settlement Offer effortlessly

- Locate Letter Settlement Offer and click Get Form to begin.

- Use the tools we provide to complete your form.

- Spotlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Letter Settlement Offer and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter to respond to the summon car loan?

A sample letter to respond to the summon car loan is a document that outlines your response to a legal summons regarding your car loan. It is essential for addressing the specific concerns raised in the summons and providing your defense or explanation. Using a well-crafted sample letter can help ensure that you respond appropriately and effectively.

-

How can airSlate SignNow help me create a sample letter to respond to the summon car loan?

airSlate SignNow offers customizable templates that can be tailored to create a sample letter to respond to the summon car loan. With our easy-to-use interface, you can quickly fill in your information, ensuring that your response is not only professional but also legally sound. This speeds up the process and reduces the hassle of document preparation.

-

What features does airSlate SignNow provide for document signing?

airSlate SignNow includes features such as eSigning, document templates, and real-time tracking to streamline the signing process. When crafting a sample letter to respond to the summon car loan, these features ensure that your letter is signed quickly and securely, making it easy to send it to the relevant parties without delay.

-

Is there a cost associated with using airSlate SignNow for document preparation?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. By investing in our platform, you can access premium features, including creating a sample letter to respond to the summon car loan without worrying about hidden fees. The cost is often outweighed by the time saved and the professionalism gained in your document handling.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, such as Google Drive, Dropbox, and various CRMs. This means you can easily access and store your sample letter to respond to the summon car loan alongside other important documents, maintaining organization across your workflow.

-

What are the benefits of using airSlate SignNow for legal document needs?

Using airSlate SignNow for your legal document needs, including creating a sample letter to respond to the summon car loan, provides numerous benefits. These include increased efficiency, reduced paper waste, and a simplified signing process. Our platform ensures that your documents are processed promptly and securely, which is critical during legal matters.

-

How secure is my information while using airSlate SignNow?

airSlate SignNow prioritizes the security of your information. We utilize advanced encryption methods to protect all documents, including your sample letter to respond to the summon car loan. This ensures that your sensitive data remains confidential and secure throughout the signing process.

Get more for Letter Settlement Offer

- Fidelity and guaranty beneficiary change form

- Waiver of prepayment of filing fee form

- Applicants last name first name maine board of bar examiners mainebarexaminers form

- Maine cn 1 form

- Edited from httpmichigan michbar form

- Standard inventory inspection form templatenet

- Remainder of the form is to be completed by the qualified professional who is

- Minnesota delegation of power by parent form flanders law firm

Find out other Letter Settlement Offer

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free