Transfer Assets Form

What is the Transfer Assets

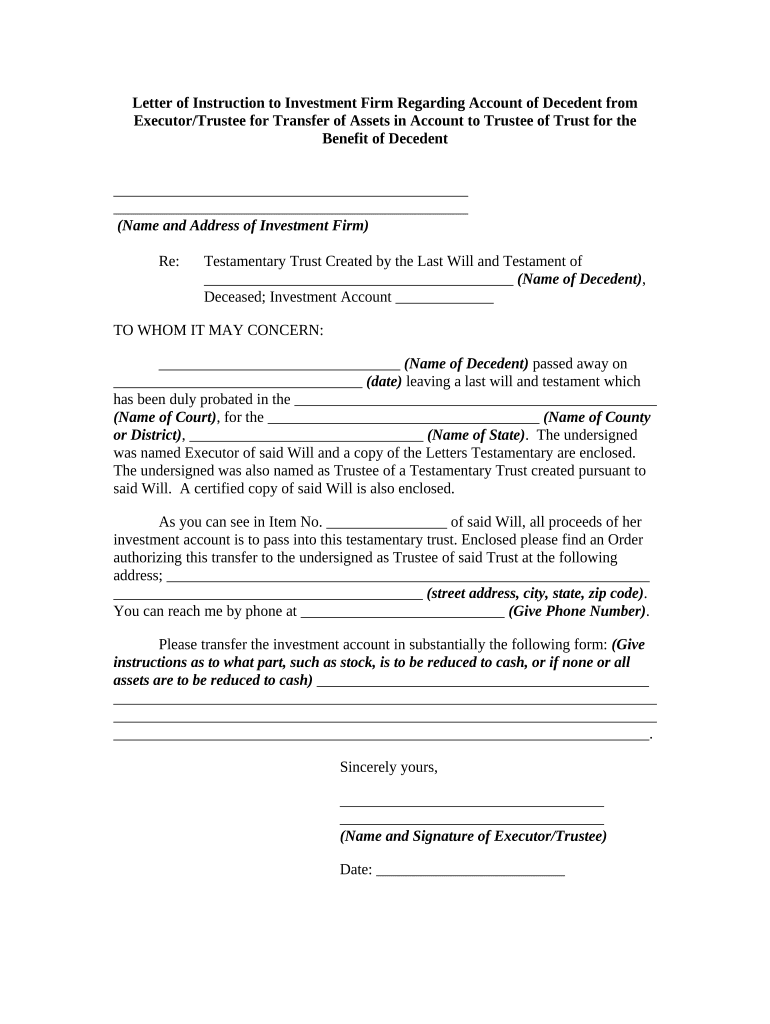

The transfer assets form is a legal document used to facilitate the transfer of ownership of assets from one party to another. This form is crucial in various contexts, including estate planning, business transactions, and trust management. It ensures that the transfer is documented properly, providing a clear record for both parties involved. The form typically includes details about the assets being transferred, the parties involved, and any conditions or stipulations related to the transfer.

Steps to Complete the Transfer Assets

Completing the transfer assets form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the assets, including descriptions, values, and any relevant identification numbers. Next, fill out the form carefully, ensuring that all required fields are completed. It is important to review the form for any errors or omissions before signing. Once completed, the form should be signed by all parties involved, and copies should be distributed to ensure everyone has a record of the transaction.

Legal Use of the Transfer Assets

The legal use of the transfer assets form is essential for ensuring that the transfer is recognized by relevant authorities. To be legally binding, the form must adhere to state-specific regulations and requirements. This includes proper signatures, notarization if necessary, and compliance with any applicable laws governing asset transfers. Understanding the legal implications of this form can help prevent disputes and ensure that the transfer is executed smoothly.

Required Documents

When completing the transfer assets form, several documents may be required to support the transaction. These can include proof of ownership for the assets being transferred, identification for all parties involved, and any existing agreements related to the assets. It is advisable to check with legal counsel or relevant authorities to ensure that all necessary documentation is gathered to avoid delays or complications.

State-Specific Rules for the Transfer Assets

Each state may have specific rules and regulations governing the transfer of assets. These rules can dictate how the form must be completed, what additional documentation is required, and any fees associated with the transfer. It is important to familiarize yourself with your state's guidelines to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide clarity on these state-specific requirements.

Examples of Using the Transfer Assets

There are various scenarios in which the transfer assets form can be utilized. For instance, it may be used when transferring real estate ownership between family members, moving assets into a trust, or selling a business. Each example highlights the importance of documenting the transfer to protect the interests of all parties involved. Understanding these applications can help individuals recognize when to use the form effectively.

Quick guide on how to complete transfer assets

Effortlessly Prepare Transfer Assets on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Handle Transfer Assets on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Transfer Assets with ease

- Find Transfer Assets and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Transfer Assets and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an account executor in airSlate SignNow?

An account executor in airSlate SignNow refers to an individual authorized to manage and execute tasks within an account. This includes signing documents, sending agreements, and overseeing workflow processes. By designating an account executor, organizations can ensure efficient document management and enhance workflow productivity.

-

How do I add an account executor to my airSlate SignNow account?

To add an account executor in airSlate SignNow, navigate to the user management section in your settings. From there, you can invite new users by entering their email addresses and assigning executor roles. This allows them to access the necessary tools to manage your documents effectively.

-

What features does airSlate SignNow offer for account executors?

airSlate SignNow provides account executors with a range of features to facilitate document management. These include eSigning capabilities, team collaboration tools, and secure storage options. Additionally, executors can track document status and automate workflows, improving overall operational efficiency.

-

Is there a cost associated with having multiple account executors?

Yes, airSlate SignNow offers various pricing plans that may include additional costs for multiple account executors. However, these plans are designed to provide cost-effective solutions tailored to your business needs. Consider reviewing our pricing page to find the best option that fits your requirements.

-

Can account executors integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows account executors to integrate with various third-party applications, streamlining workflows across platforms. This includes popular tools like Google Drive, Salesforce, and Microsoft Office, enhancing collaboration and document management processes.

-

What are the benefits of having a dedicated account executor?

Having a dedicated account executor enables better control over document transactions and improves accountability within your workflow. They can streamline the signing process, ensuring that documents are processed efficiently. This role aids in maintaining compliance and improves the overall user experience for your team.

-

Are training resources available for account executors?

Yes, airSlate SignNow offers comprehensive training resources for account executors, including tutorials, webinars, and support documentation. These resources are designed to help executors make the most of the platform’s features. By leveraging these materials, they can quickly become proficient in managing document workflows.

Get more for Transfer Assets

Find out other Transfer Assets

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer