Wv Gsr 01 Form 2014

What is the WV GSR 01 Form

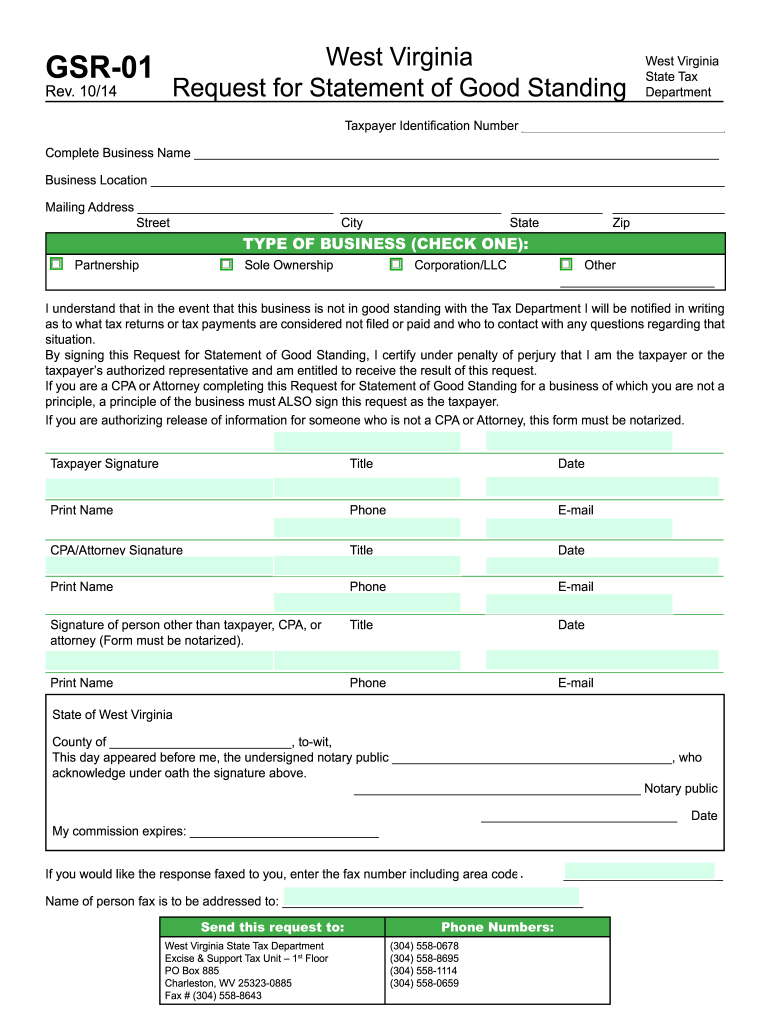

The WV GSR 01 form is a crucial document issued by the West Virginia State Tax Department. It serves as a certificate of good standing for businesses operating within the state. This form verifies that a business is compliant with state tax regulations and is authorized to conduct business activities. It is often required for various legal and financial transactions, such as applying for loans or entering into contracts.

How to Obtain the WV GSR 01 Form

To obtain the WV GSR 01 form, businesses can visit the West Virginia State Tax Department's official website. The form is available for download in a printable format, allowing users to fill it out at their convenience. Additionally, businesses can request the form directly from the tax department by contacting their office. It is essential to ensure that the most current version of the form is used to avoid any compliance issues.

Steps to Complete the WV GSR 01 Form

Completing the WV GSR 01 form involves several key steps:

- Begin by entering the business name and address accurately.

- Provide the business registration number and the type of business entity.

- Indicate the effective date of the good standing request.

- Sign and date the form to certify its accuracy.

Once completed, the form can be submitted online, mailed, or delivered in person to the appropriate office of the West Virginia State Tax Department.

Legal Use of the WV GSR 01 Form

The legal use of the WV GSR 01 form is significant in various business contexts. It is often required for securing financing, entering into contracts, or applying for licenses. The form confirms that a business is in good standing with the state, which can influence decisions made by lenders and partners. Proper completion and submission of this form ensure compliance with state regulations and can help prevent legal complications.

Form Submission Methods

Businesses have multiple options for submitting the WV GSR 01 form. The form can be submitted online through the West Virginia State Tax Department's website, which offers a streamlined process for electronic filing. Alternatively, businesses can mail the completed form to the tax department or deliver it in person to ensure timely processing. Each submission method has its own processing times, so businesses should choose the one that best fits their needs.

Required Documents

When completing the WV GSR 01 form, certain documents may be required to verify the business's status. These can include:

- Proof of business registration with the state.

- Tax identification number.

- Any previous tax filings or compliance documents.

Having these documents ready can facilitate a smoother completion process and ensure that the form is accepted without delays.

Quick guide on how to complete west virginia state tax department form gsr 01

Complete Wv Gsr 01 Form seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Wv Gsr 01 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The optimal way to modify and eSign Wv Gsr 01 Form effortlessly

- Obtain Wv Gsr 01 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and eSign Wv Gsr 01 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct west virginia state tax department form gsr 01

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the west virginia state tax department form gsr 01

How to generate an electronic signature for your West Virginia State Tax Department Form Gsr 01 online

How to make an electronic signature for your West Virginia State Tax Department Form Gsr 01 in Chrome

How to generate an electronic signature for putting it on the West Virginia State Tax Department Form Gsr 01 in Gmail

How to create an eSignature for the West Virginia State Tax Department Form Gsr 01 straight from your smartphone

How to generate an electronic signature for the West Virginia State Tax Department Form Gsr 01 on iOS

How to generate an electronic signature for the West Virginia State Tax Department Form Gsr 01 on Android OS

People also ask

-

What are wv state tax forms printable?

WV state tax forms printable are official documents that allow West Virginia residents to file their state taxes efficiently. These forms can be easily downloaded, filled out, and submitted electronically or by mail. Utilizing these forms ensures you are compliant with state tax regulations.

-

How can I access wv state tax forms printable using airSlate SignNow?

You can access wv state tax forms printable through airSlate SignNow by logging into your account and navigating to the templates section. Here, you can find a variety of state tax forms ready for eSignature and easy submission. This feature streamlines the process of completing your tax documentation.

-

Are airSlate SignNow's services for wv state tax forms printable cost-effective?

Yes, airSlate SignNow offers competitive pricing for its document signing services, making the process of managing wv state tax forms printable both affordable and efficient. With various subscription plans, you can choose one that fits your business needs without breaking the bank.

-

What features does airSlate SignNow offer for wv state tax forms printable?

AirSlate SignNow offers various features for wv state tax forms printable, including eSignature capabilities, document tracking, and templates for quick access to common forms. These features enhance your efficiency in handling tax paperwork and ensure a smooth signing process.

-

Can I integrate airSlate SignNow with other software for managing wv state tax forms printable?

Absolutely! AirSlate SignNow integrates with multiple applications, allowing you to connect it seamlessly with your existing workflow tools. This integration helps streamline the process for managing wv state tax forms printable and enhances overall productivity.

-

Is it safe to use airSlate SignNow for wv state tax forms printable?

Yes, airSlate SignNow prioritizes security and complies with industry standards to ensure that your wv state tax forms printable remain safe. With features like encryption and secure access, your sensitive tax information is well-protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for wv state tax forms printable?

Using airSlate SignNow for wv state tax forms printable offers several benefits, including convenience, speed, and reliability. You can quickly get documents signed and submitted without the hassle of printing and mailing, helping you save time and resources.

Get more for Wv Gsr 01 Form

- La name change 497309310 form

- Louisiana unsecured installment payment promissory note for fixed rate louisiana form

- Louisiana note 497309312 form

- Louisiana installments fixed rate promissory note secured by personal property louisiana form

- Louisiana note 497309314 form

- Notice of option for recording louisiana form

- Louisiana documents form

- Essential legal life documents for baby boomers louisiana form

Find out other Wv Gsr 01 Form

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free