Sample Letter Collections Form

What is the Sample Letter for Debt Collections

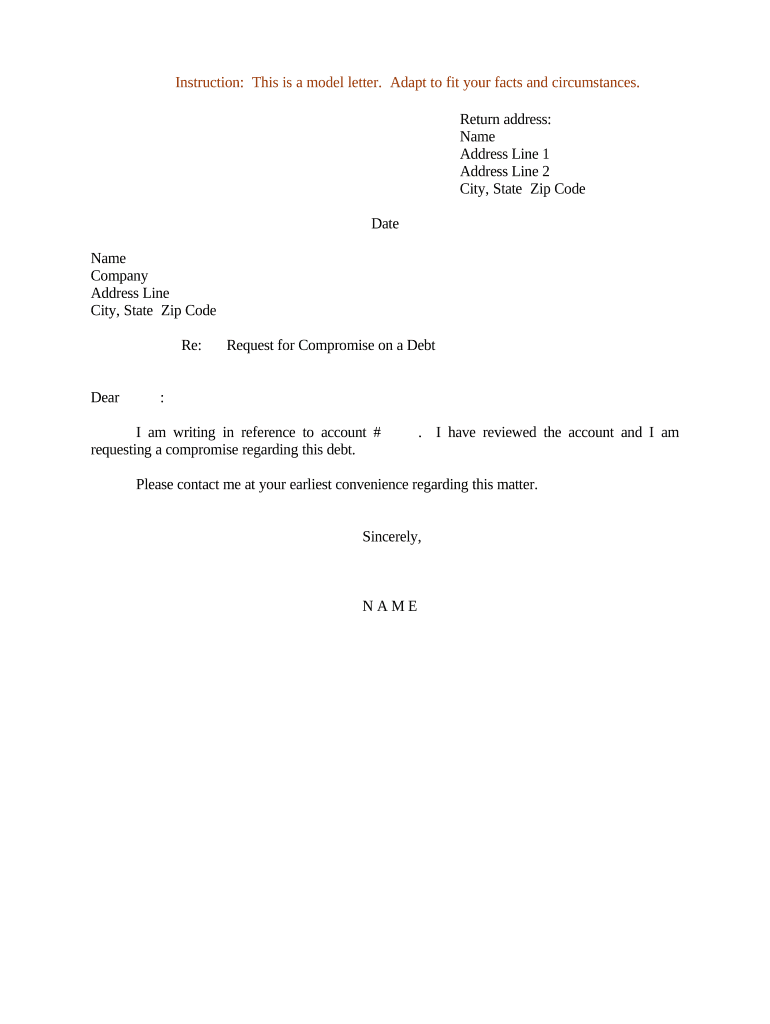

The sample letter for debt collections serves as a formal communication tool used by creditors to request payment from debtors. This letter outlines the amount owed, the nature of the debt, and any relevant account information. It is essential for establishing a clear record of the debt and initiating the collection process. A well-structured letter can facilitate negotiations and provide a basis for further action if necessary.

Key Elements of the Sample Letter for Debt Collections

When drafting a letter for debt collections, certain key elements should be included to ensure clarity and effectiveness:

- Creditor Information: Include the name, address, and contact information of the creditor.

- Debtor Information: Clearly state the name and address of the debtor.

- Debt Details: Specify the amount owed, the date the debt was incurred, and any relevant account numbers.

- Payment Instructions: Provide clear instructions on how the debtor can make the payment, including acceptable payment methods.

- Consequences of Non-Payment: Outline potential actions that may be taken if the debt remains unpaid, such as reporting to credit bureaus or legal action.

Steps to Complete the Sample Letter for Debt Collections

Completing a letter for debt collections involves several important steps:

- Gather Information: Collect all necessary information about the debt, including amounts, dates, and debtor details.

- Draft the Letter: Use a clear and professional tone. Include all key elements mentioned above.

- Review the Letter: Check for accuracy and ensure that all information is correct and up to date.

- Send the Letter: Choose a delivery method that provides proof of receipt, such as certified mail or an electronic signature service.

Legal Use of the Sample Letter for Debt Collections

Understanding the legal framework surrounding debt collection is crucial. The Fair Debt Collection Practices Act (FDCPA) outlines the rights of consumers and the obligations of debt collectors. A letter for debt collections must comply with these regulations to avoid potential legal issues. This includes providing accurate information, not using deceptive practices, and respecting the debtor's rights.

Examples of Using the Sample Letter for Debt Collections

There are various scenarios in which a sample letter for debt collections can be utilized:

- Initial Demand Letter: A creditor may send an initial letter to inform the debtor of the outstanding balance.

- Follow-Up Letter: If the initial letter does not result in payment, a follow-up letter can serve as a reminder.

- Settlement Offer: A letter can be used to propose a settlement or payment plan to the debtor.

How to Obtain the Sample Letter for Debt Collections

Obtaining a sample letter for debt collections can be done through various means:

- Online Templates: Many websites offer free or paid templates that can be customized to fit specific needs.

- Legal Resources: Legal aid organizations may provide resources or templates for debt collection letters.

- Professional Services: Hiring a legal professional or a collection agency can ensure that the letter meets all legal requirements.

Quick guide on how to complete sample letter collections

Prepare Sample Letter Collections effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all necessary tools to create, modify, and eSign your documents promptly without delays. Manage Sample Letter Collections on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Sample Letter Collections with ease

- Locate Sample Letter Collections and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Sample Letter Collections and ensure seamless communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter debt collections service?

A letter debt collections service provides a formal way to communicate with debtors, helping businesses collect outstanding payments effectively. It often involves sending demand letters that specify the amount owed, payment terms, and potential consequences of non-payment. Utilizing a reliable letter debt collections service can streamline the recovery process.

-

How can airSlate SignNow assist with letter debt collections?

airSlate SignNow simplifies the process of sending and signing letter debt collections by providing an easy-to-use digital platform. Businesses can create, distribute, and eSign debt collection letters quickly, ensuring they are legally binding and professional. This efficiency helps in maintaining communication with debtors and speeding up the collection process.

-

What features does airSlate SignNow offer for letter debt collections?

The platform offers features such as document templates for letter debt collections, real-time tracking of document status, and secure eSigning. These features support businesses in managing their collections more effectively by ensuring documents are signed promptly and tracked for follow-ups. Additionally, airSlate SignNow integrates seamlessly into daily workflows.

-

Is airSlate SignNow cost-effective for letter debt collections?

Yes, airSlate SignNow is designed to be a cost-effective solution for letter debt collections, offering affordable pricing plans with no hidden fees. Businesses can reduce overhead costs associated with traditional paper-based collections by using this digital solution. Furthermore, the time saved through efficient document management leads to additional cost savings.

-

Can I integrate airSlate SignNow with my existing software for letter debt collections?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and accounting software systems, allowing for streamlined letter debt collections. This integration facilitates easier data transfer and enhances overall workflow efficiency, enabling teams to manage collections without disrupting their operations.

-

What are the benefits of using airSlate SignNow for letter debt collections?

Using airSlate SignNow for letter debt collections offers numerous benefits, including increased efficiency, faster document turnaround times, and improved compliance. The ability to eSign letters ensures that your communications are legally binding while also saving time over traditional mailing methods. You can also track the status of your letters, providing clarity and accountability in the collection process.

-

How secure is airSlate SignNow for letter debt collections?

airSlate SignNow is built with security in mind, providing encryption and compliance with industry standards to protect sensitive information during letter debt collections. The platform ensures that all shared documents are securely stored and can only be accessed by authorized personnel. This level of security boosts confidence when dealing with sensitive financial communications.

Get more for Sample Letter Collections

Find out other Sample Letter Collections

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement