Form 8844 2008

What is the Form 8844

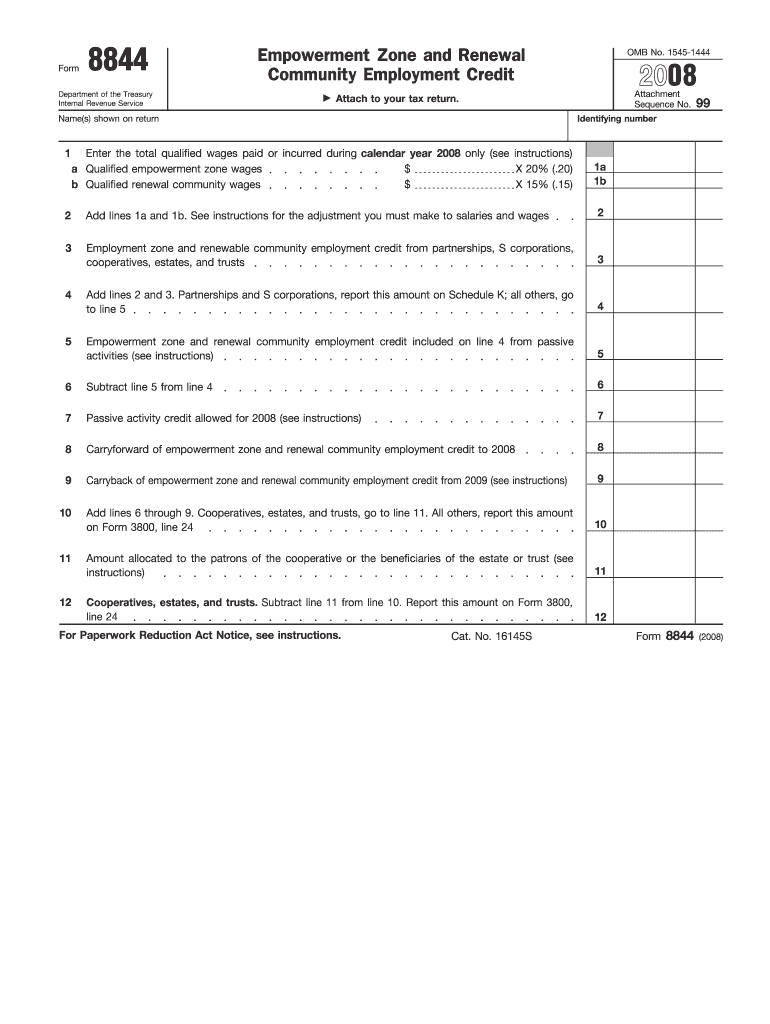

The Form 8844, officially known as the "Empowerment Zone Employment Credit," is a tax form used by businesses to claim a credit for hiring individuals who reside in designated empowerment zones. This form is part of the federal tax incentives aimed at stimulating economic growth in specific areas by encouraging businesses to create jobs. The credit is designed to support employers in providing opportunities to individuals in economically distressed regions, thereby fostering community development and reducing unemployment rates.

How to use the Form 8844

To use the Form 8844 effectively, employers must first determine their eligibility based on the location of their business and the residency of their employees. Once eligibility is confirmed, employers should gather the necessary information about their employees, including their residency status and the duration of employment. The form requires detailed information about the business, such as the number of qualified employees and the amount of credit being claimed. After completing the form, it should be submitted with the employer's annual tax return to the IRS.

Steps to complete the Form 8844

Completing the Form 8844 involves several key steps:

- Gather employee information: Collect details about employees who qualify for the credit, including their names, Social Security numbers, and the dates they began working.

- Determine eligibility: Verify that the employees reside in an empowerment zone and that your business meets the criteria set by the IRS.

- Fill out the form: Complete all required sections of the Form 8844, ensuring accuracy in the information provided.

- Calculate the credit: Use the instructions provided with the form to determine the amount of credit for which you are eligible.

- Submit the form: Include the completed Form 8844 with your business's tax return when filing.

Legal use of the Form 8844

The legal use of Form 8844 is governed by IRS regulations that specify the criteria for claiming the empowerment zone employment credit. Employers must ensure that they are compliant with these regulations, which include maintaining accurate records of employee residency and employment dates. Failure to adhere to these guidelines can result in penalties or disqualification from claiming the credit. It is essential for businesses to keep thorough documentation to support their claims in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for Form 8844 coincide with the general tax return deadlines for businesses. Typically, this means that the form must be submitted by the due date of the employer's tax return, including any extensions. Employers should be aware of the specific dates applicable to their business type, as failure to file on time may result in the loss of the credit. It is advisable to consult the IRS website or a tax professional for the most current deadlines and any changes in regulations.

Eligibility Criteria

To qualify for the empowerment zone employment credit using Form 8844, businesses must meet specific eligibility criteria. These include:

- The business must be located within a designated empowerment zone.

- Employees must be residents of the empowerment zone and meet the income requirements set by the IRS.

- The credit is applicable only for employees hired after the business's designation as an empowerment zone.

Employers should review the IRS guidelines to ensure they meet all eligibility requirements before claiming the credit.

Quick guide on how to complete form 8844 2008

Handle Form 8844 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly replacement for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly without hindrance. Manage Form 8844 on any device through airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign Form 8844 effortlessly

- Locate Form 8844 and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No need to worry about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8844 to ensure effective communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8844 2008

Create this form in 5 minutes!

How to create an eSignature for the form 8844 2008

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8844 and who needs it?

Form 8844 is a tax form used by certain business entities to claim the American Samoa Economic Development Credit. Businesses that engage in qualifying activities in American Samoa, such as manufacturing or providing qualified services, may need Form 8844 to benefit from available tax credits.

-

How can airSlate SignNow help with Form 8844?

airSlate SignNow streamlines the process of sending and eSigning documents, including Form 8844. With its user-friendly interface, businesses can quickly prepare and send Form 8844 to the necessary parties for review and signature, saving time and ensuring compliance.

-

What features does airSlate SignNow offer for Form 8844?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure cloud storage, all of which enhance the handling of Form 8844. These features ensure that your documents are easily accessible and can be managed efficiently throughout the signing process.

-

Is airSlate SignNow cost-effective for handling Form 8844?

Yes, airSlate SignNow provides a cost-effective solution for managing Form 8844 and other related documents. With various pricing plans, businesses can select an option that fits their needs, ensuring they get value while efficiently handling their documentation.

-

Can I integrate airSlate SignNow with other platforms when handling Form 8844?

Absolutely! airSlate SignNow integrates seamlessly with a variety of platforms, allowing you to manage Form 8844 alongside your other business tools. This integration helps streamline workflows, making it easier to keep track of your documents and their statuses across systems.

-

How secure is airSlate SignNow for submitting Form 8844?

airSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to ensure that your Form 8844 and other documents are safe. Users can confidently send sensitive tax forms knowing that their information remains protected from unauthorized access.

-

What are the key benefits of using airSlate SignNow for Form 8844?

Using airSlate SignNow for Form 8844 provides numerous benefits, including faster processing times and improved accuracy through automated workflows. Furthermore, the platform enhances collaboration among team members, ensuring that all necessary signatures are obtained efficiently.

Get more for Form 8844

- Letter from tenant to landlord containing request for permission to sublease hawaii form

- Hawaii sublease form

- Hawaii landlord tenant form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable hawaii form

- Hi lease form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497304421 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement hawaii form

- Letter landlord rental form

Find out other Form 8844

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement