Form 8805 2011

What is the Form 8805

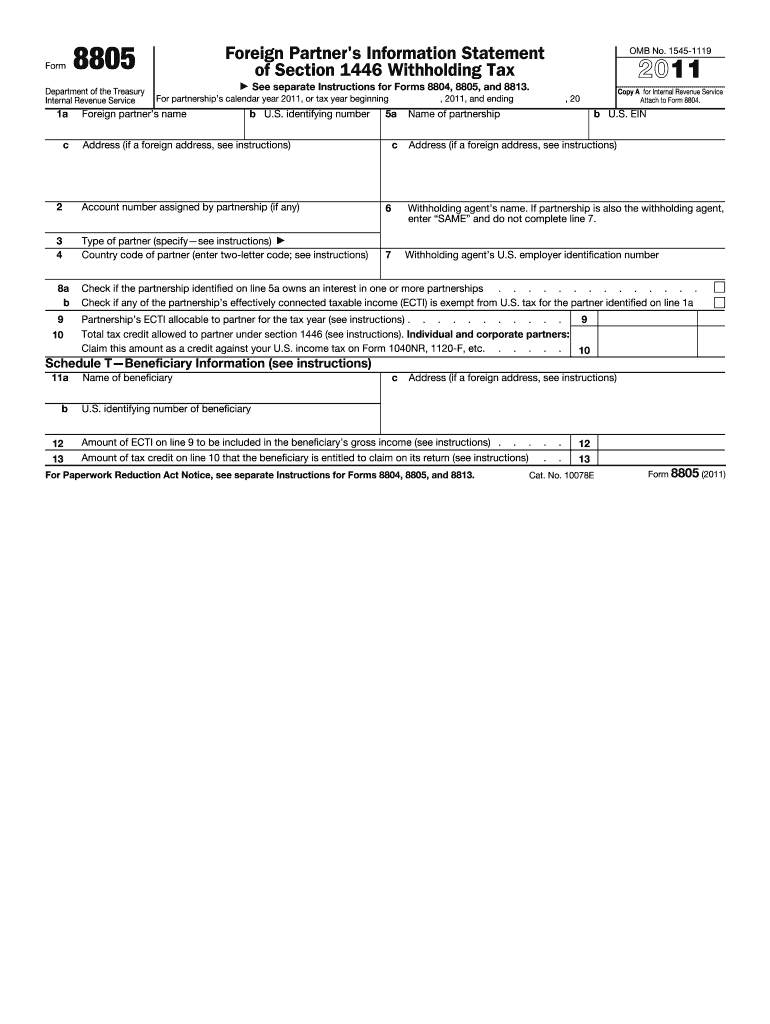

The Form 8805 is a tax document used by partnerships to report the income, deductions, and credits allocated to foreign partners. This form is essential for ensuring that foreign partners meet their tax obligations in the United States. It provides the Internal Revenue Service (IRS) with necessary details about the partnership's financial activities and the respective shares of each partner. Understanding the Form 8805 is crucial for compliance with U.S. tax laws, particularly for partnerships that have international stakeholders.

How to use the Form 8805

Using the Form 8805 involves several steps that ensure accurate reporting of income and tax obligations for foreign partners. Partnerships must complete the form by detailing the income earned, deductions claimed, and credits available to each foreign partner. This information must be reported accurately to avoid penalties. Once completed, the form is submitted to the IRS, typically alongside other required tax documents. It is important for partnerships to maintain thorough records to support the information reported on the Form 8805.

Steps to complete the Form 8805

Completing the Form 8805 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents related to the partnership’s income and expenses.

- Identify each foreign partner and their respective shares of income, deductions, and credits.

- Fill out the form, ensuring that all sections are completed accurately, including identifying information for the partnership and each partner.

- Review the completed form for accuracy and completeness.

- Submit the Form 8805 to the IRS by the required deadline, typically along with Form 1065, the partnership return.

Legal use of the Form 8805

The legal use of the Form 8805 is governed by IRS regulations, which require partnerships to report income and tax information accurately for foreign partners. Compliance with these regulations is essential to avoid legal repercussions, including penalties and interest for late or inaccurate filings. The form must be filed in accordance with IRS guidelines, ensuring that all information is truthful and substantiated by proper documentation.

Filing Deadlines / Important Dates

Partnerships must be aware of specific deadlines for filing the Form 8805 to ensure compliance with IRS regulations. Generally, the form is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by March 15. It is crucial for partnerships to mark these dates on their calendars to avoid late filing penalties.

Penalties for Non-Compliance

Failing to file the Form 8805 or submitting inaccurate information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, partnerships may face penalties for failing to provide accurate information regarding foreign partners’ income and tax obligations. Understanding these potential consequences emphasizes the importance of timely and accurate completion of the Form 8805.

Quick guide on how to complete 2011 form 8805

Prepare Form 8805 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Form 8805 across any platform using airSlate SignNow mobile applications on Android or iOS and simplify any document-related task today.

How to modify and eSign Form 8805 with ease

- Find Form 8805 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or black out confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 8805 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 8805

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 8805

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 8805 and why is it important?

Form 8805 is used for reporting income from a partnership or partnership-related activities to the IRS. It is crucial for taxpayers to accurately submit this form to ensure compliance and avoid penalties. Understanding Form 8805 can help enhance your tax reporting process.

-

How does airSlate SignNow facilitate the signing of Form 8805?

airSlate SignNow allows users to easily upload, send, and eSign Form 8805 digitally. This streamlines the process, making it simpler to get required signatures promptly. With airSlate SignNow, managing your Form 8805 has never been easier.

-

What are the pricing options for using airSlate SignNow to manage Form 8805?

airSlate SignNow offers various pricing plans designed to fit different business needs, from individuals to large enterprises. Each plan includes features to efficiently handle documents like Form 8805 while ensuring a cost-effective solution. Please visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for handling Form 8805?

Yes, airSlate SignNow supports integration with a variety of software applications such as CRMs and project management tools. This allows you to streamline workflows and manage Form 8805 alongside your other business operations. Integration adds efficiency to your document management process.

-

What features does airSlate SignNow offer that are beneficial for Form 8805 processing?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure cloud storage that enhance the processing of Form 8805. These features ensure that your documents are signed efficiently and securely. Our solution maximizes productivity for tax-related documents.

-

Is airSlate SignNow user-friendly for completing Form 8805?

Absolutely! airSlate SignNow is designed with user experience in mind, making it intuitive for individuals and businesses to complete Form 8805 with ease. Our platform guides users through the signing process, ensuring a smooth experience for all.

-

How can airSlate SignNow help ensure compliance when submitting Form 8805?

With airSlate SignNow, you can maintain compliance by utilizing secure signing and tracking features that provide proof of signature. This ensures that your Form 8805 is completed and submitted correctly. Compliance is a critical focus for us, making sure your documents adhere to legal standards.

Get more for Form 8805

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential hawaii form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property hawaii form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property hawaii form

- Hi landlord 497304447 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497304449 form

- Hawaii violating form

- Hawaii violating 497304451 form

- Hawaii violating 497304452 form

Find out other Form 8805

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document