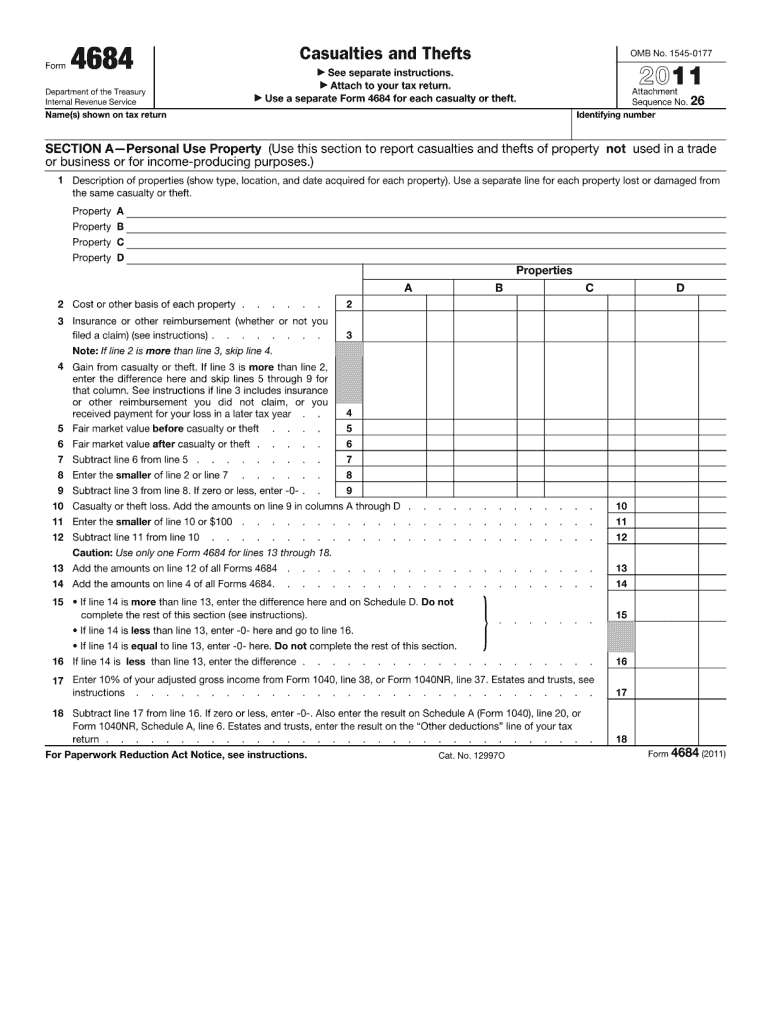

Example of Form 4684 Filled Out 2011

What is the Example Of Form 4684 Filled Out

The Example of Form 4684 is a tax form used by individuals to report casualty and theft losses for the purpose of claiming deductions on their federal income tax returns. This form is particularly relevant for taxpayers who have experienced losses due to events such as natural disasters, vandalism, or theft. By filling out this form, individuals can detail the nature and extent of their losses, which can potentially reduce their taxable income and, consequently, their tax liability.

Steps to complete the Example Of Form 4684 Filled Out

Completing the Example of Form 4684 involves several key steps:

- Gather necessary documentation, including receipts, photographs, and any police reports related to the loss.

- Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

- Detail the type of loss you are claiming, specifying whether it is a casualty or theft loss.

- Calculate the amount of your loss by following the guidelines provided in the form, ensuring to include any insurance reimbursements.

- Complete the required sections regarding the location and date of the loss.

- Review the form for accuracy and completeness before submission.

Legal use of the Example Of Form 4684 Filled Out

The Example of Form 4684 is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal standing, taxpayers must adhere to the requirements set forth by the IRS, including proper documentation of losses and adherence to filing deadlines. Additionally, the form must be signed and dated by the taxpayer, affirming that the information provided is true and correct to the best of their knowledge. Failure to comply with these regulations may result in penalties or denial of the claimed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Example of Form 4684 align with the annual tax return deadlines. Typically, individual taxpayers must submit their completed forms by April 15 of the following tax year. If additional time is needed, taxpayers can file for an extension, which usually provides an additional six months to submit their tax returns, including Form 4684. It is crucial to stay informed about any changes in deadlines, especially in the context of natural disasters or other significant events that may affect filing dates.

Required Documents

To successfully complete the Example of Form 4684, several documents are necessary:

- Proof of ownership for the property or item lost, such as receipts or titles.

- Documentation of the loss, including photographs and any relevant police reports.

- Insurance documentation detailing any reimbursements received or expected.

- Any additional records that support the claim, such as appraisals or estimates for repairs.

Form Submission Methods (Online / Mail / In-Person)

The Example of Form 4684 can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. Taxpayers have the option to file electronically using approved tax software, which may streamline the process and reduce errors. Alternatively, the completed form can be mailed to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. In-person submission is generally not available, as the IRS encourages electronic and mail submissions for efficiency.

Quick guide on how to complete example of form 4684 filled out 2011

Complete Example Of Form 4684 Filled Out effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Example Of Form 4684 Filled Out on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-centric process today.

How to modify and eSign Example Of Form 4684 Filled Out with ease

- Locate Example Of Form 4684 Filled Out and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious document hunting, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in a few clicks from any device you prefer. Alter and eSign Example Of Form 4684 Filled Out, ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct example of form 4684 filled out 2011

Create this form in 5 minutes!

How to create an eSignature for the example of form 4684 filled out 2011

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Example Of Form 4684 Filled Out used for?

The Example Of Form 4684 Filled Out is typically used for reporting losses from theft or casualty on your tax return. By accurately filling this form, individuals can seek deductions and potentially lower their tax liabilities. It's crucial for users to understand its importance in documenting financial losses.

-

How can airSlate SignNow help with filling out the Example Of Form 4684 Filled Out?

With airSlate SignNow, you can easily fill out the Example Of Form 4684 Filled Out online. Our platform allows you to create, edit, and sign documents securely, ensuring that your information is accurately captured and stored. This makes the process of completing important forms like 4684 straightforward and efficient.

-

Is there a cost associated with using airSlate SignNow for the Example Of Form 4684 Filled Out?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Users can access features for eSigning and document management, ensuring that filling out the Example Of Form 4684 Filled Out is cost-effective and user-friendly. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for the Example Of Form 4684 Filled Out?

AirSlate SignNow provides an array of features that make completing the Example Of Form 4684 Filled Out easy. These include customizable templates, electronic signatures, and secure cloud storage. Our user-friendly interface ensures you can navigate the form without hassle.

-

Can I integrate airSlate SignNow with other applications for filling out the Example Of Form 4684 Filled Out?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to access and fill out the Example Of Form 4684 Filled Out directly from your preferred tools, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for the Example Of Form 4684 Filled Out?

Using airSlate SignNow for the Example Of Form 4684 Filled Out offers numerous benefits, including convenience, time savings, and enhanced security. You can fill out, sign, and share documents from anywhere, ensuring compliance and organization. Additionally, you can track the status of your forms easily.

-

How secure is airSlate SignNow when completing the Example Of Form 4684 Filled Out?

Safety is a priority at airSlate SignNow. When filling out the Example Of Form 4684 Filled Out, your documents are protected by advanced encryption methods and secured access controls. Our platform ensures that your sensitive information remains confidential and secure.

Get more for Example Of Form 4684 Filled Out

- Residential rental lease application connecticut form

- Salary verification form for potential lease connecticut

- Ct landlord tenant form

- Notice of default on residential lease connecticut form

- Landlord tenant lease co signer agreement connecticut form

- Application for sublease connecticut form

- Inventory and condition of leased premises for pre lease and post lease connecticut form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out connecticut form

Find out other Example Of Form 4684 Filled Out

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure