Self Employed Independent Contractor Form

What is the self employed independent contractor?

A self employed independent contractor is an individual who provides services to clients or businesses without being an employee. This arrangement allows for greater flexibility and autonomy in work. Independent contractors typically operate under a contract that outlines the terms of their engagement, including payment, scope of work, and deadlines. Unlike traditional employees, independent contractors are responsible for their own taxes, benefits, and business expenses.

Key elements of the self employed independent contractor

Understanding the key elements of a self employed independent contractor is crucial for both the contractor and the hiring entity. These elements include:

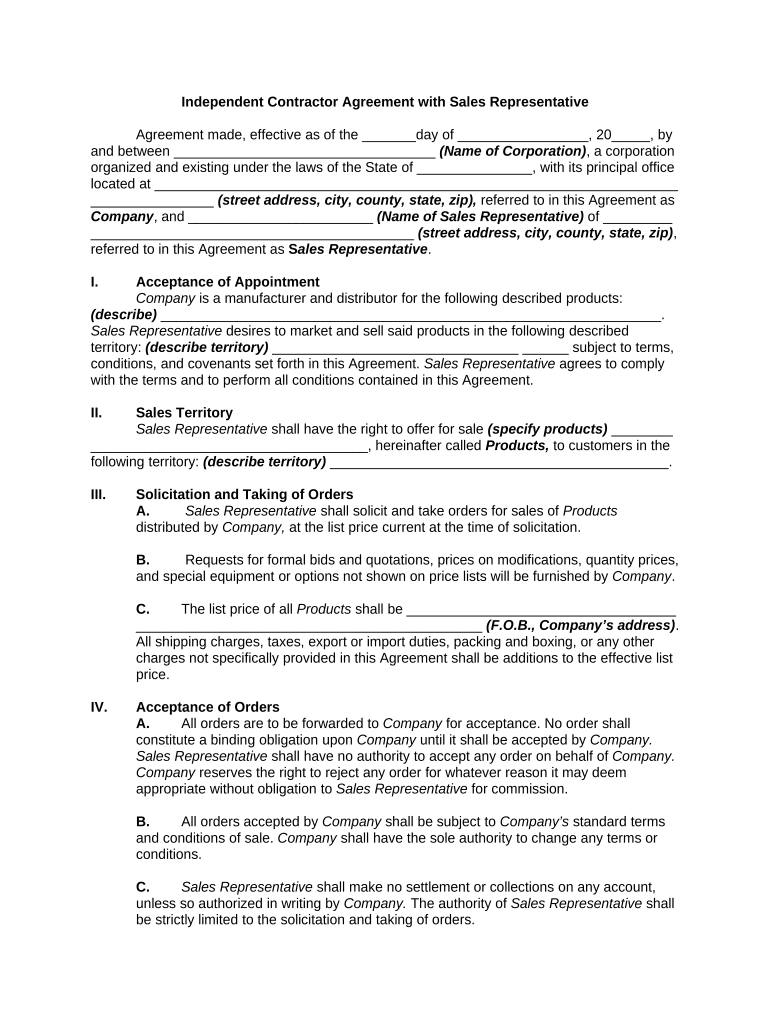

- Contractual Agreement: A formal contract that specifies the work to be performed, payment terms, and duration of the engagement.

- Tax Responsibilities: Independent contractors must file their own taxes, including self-employment tax, and may need to make estimated tax payments throughout the year.

- Business Expenses: Contractors can deduct certain business-related expenses from their taxable income, which can include equipment, travel, and office supplies.

- Autonomy: Independent contractors have the freedom to choose their clients, set their own schedules, and determine how to complete their work.

Steps to complete the self employed independent contractor

Completing the self employed independent contractor form involves several important steps to ensure compliance and accuracy:

- Gather Necessary Information: Collect all relevant personal and business information, including your Social Security number, business name, and contact details.

- Review Contract Terms: Carefully read through the independent contractor agreement to understand your obligations and rights.

- Fill Out the Form: Accurately complete the self employed independent contractor form, ensuring all required fields are filled in.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure you keep a copy for your records.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for self employed independent contractors. These guidelines include:

- Defining the criteria that distinguish independent contractors from employees, primarily focusing on the degree of control over work.

- Outlining tax obligations, including the requirement to report income and pay self-employment taxes.

- Providing information on allowable deductions for business expenses that independent contractors can claim on their tax returns.

Legal use of the self employed independent contractor

To ensure the legal use of the self employed independent contractor form, it is essential to comply with federal and state regulations. This includes:

- Adhering to the definitions and classifications set forth by the IRS to avoid misclassification issues.

- Ensuring that the independent contractor agreement is clear and comprehensive to protect both parties.

- Maintaining proper documentation of all transactions and communications related to the independent contractor relationship.

Eligibility Criteria

To qualify as a self employed independent contractor, individuals must meet certain eligibility criteria, which generally include:

- Having the necessary skills or expertise to perform the contracted work.

- Operating under a business structure, such as a sole proprietorship or LLC, if applicable.

- Being able to demonstrate that they are not under the direct control of the hiring entity regarding how the work is performed.

Quick guide on how to complete self employed independent contractor

Effortlessly Prepare Self Employed Independent Contractor on Any Device

Managing documents online has gained popularity among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed materials, as you can easily access the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Self Employed Independent Contractor on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Self Employed Independent Contractor Seamlessly

- Find Self Employed Independent Contractor and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using the specific tools provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Self Employed Independent Contractor to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help a self employed independent contractor?

airSlate SignNow is a powerful eSignature platform that allows self employed independent contractors to easily send, sign, and manage documents online. Its user-friendly interface simplifies workflows, helping contractors save time and increase productivity. By automating document processes, you can focus more on your business and less on paperwork.

-

What are the pricing options for self employed independent contractors using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for self employed independent contractors. You can choose from monthly or annual subscriptions, with options that cater to different usage levels. This ensures that you only pay for the features you need while enjoying a cost-effective solution.

-

What features does airSlate SignNow provide for self employed independent contractors?

airSlate SignNow provides a variety of features ideal for self employed independent contractors, including easy document creation, customizable templates, and secure cloud storage. You also have access to tracking tools that let you monitor document progress, making it easier to follow up with clients. These features streamline your operations and enhance collaboration.

-

How does airSlate SignNow benefit self employed independent contractors in managing client contracts?

For self employed independent contractors, airSlate SignNow streamlines contract management by allowing you to send, sign, and store contracts electronically. This reduces turnaround time and minimizes delays in securing agreements. It also helps maintain a professional image, which is crucial when building trust with clients.

-

Can airSlate SignNow integrate with other tools I use as a self employed independent contractor?

Yes, airSlate SignNow offers integrations with numerous popular applications that a self employed independent contractor may already use, such as Google Drive, Dropbox, and Salesforce. This ensures seamless connectivity between your tools and airSlate SignNow, making your workflow smoother and more efficient. Custom integrations are also possible via APIs.

-

Is airSlate SignNow secure for self employed independent contractors to use?

Absolutely, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your documents. As a self employed independent contractor, you can confidently store and share sensitive information, knowing that your data is secure. Compliance with industry standards further highlights our commitment to safeguarding your business.

-

How can self employed independent contractors get started with airSlate SignNow?

Starting with airSlate SignNow is simple for self employed independent contractors. You can sign up for a free trial to explore the features and see how it meets your needs. Once you're ready, choosing a subscription plan that's right for you will grant immediate access to all functionalities designed to enhance your contracting business.

Get more for Self Employed Independent Contractor

- Printable client intake form for zoning appeal development application

- Anthem mediblue hmo national united brokers nub form

- Clinic yes form

- Please click here to download adobe acrobat form

- For official use only rush university medical center rush form

- Controlling tuberculosis in the united states form

- Screening questionnaire and consent form cair

- How to file a claimamerican family insurance form

Find out other Self Employed Independent Contractor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors