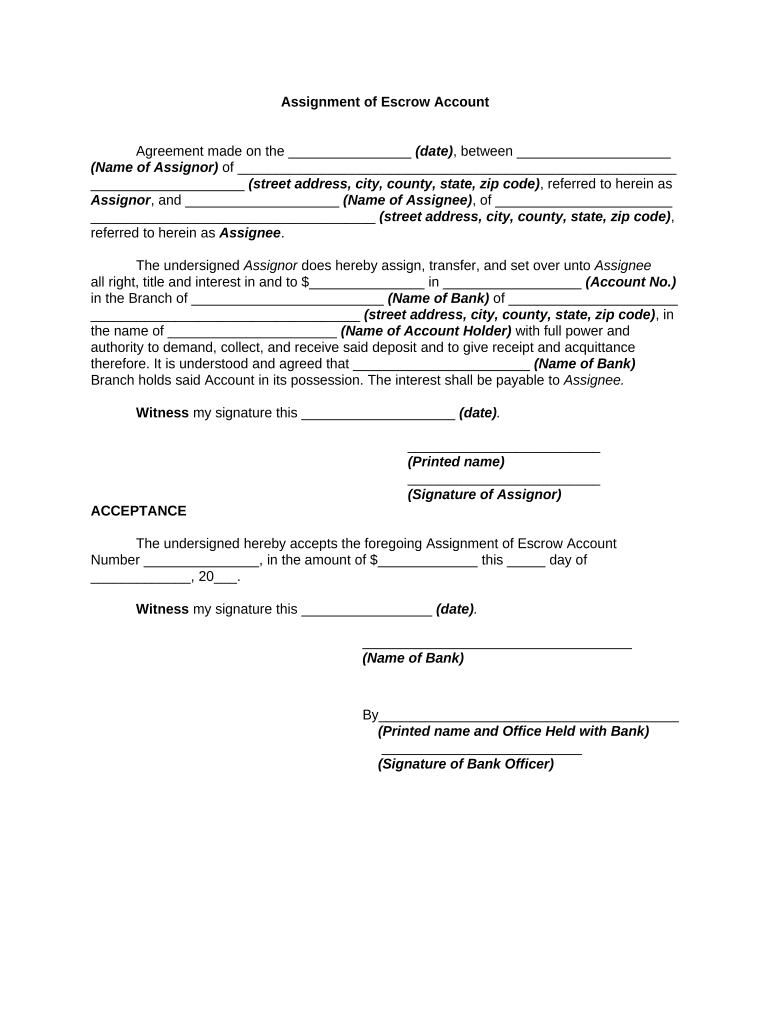

Escrow Account Form

What is the Escrow Account

An escrow account is a financial arrangement where a third party holds funds or assets on behalf of two parties involved in a transaction. This arrangement ensures that the funds are securely managed and only released when specific conditions are met. Escrow accounts are commonly used in real estate transactions, where they facilitate the collection and disbursement of funds for property taxes, insurance, and other related costs. The New Jersey Department of Environmental Protection (NJDEP) provides specific forms for managing escrow accounts related to environmental remediation and other regulatory requirements.

How to Use the Escrow Account

Using an escrow account involves several key steps. First, both parties must agree on the terms of the escrow arrangement, including the conditions under which the funds will be released. Once these terms are established, the buyer deposits the required funds into the escrow account. The escrow agent then manages these funds according to the agreed-upon terms, ensuring that payments for taxes and insurance are made on time. It is essential to maintain clear communication with the escrow agent to ensure compliance with all requirements and deadlines.

Steps to Complete the Escrow Account

Completing the escrow account process typically involves the following steps:

- Establish the terms of the escrow agreement, including the roles of each party.

- Complete the NJDEP escrow account report forms, providing necessary information about the transaction.

- Submit the required documentation to the escrow agent, including any supporting materials.

- Deposit the agreed-upon funds into the escrow account.

- Monitor the account to ensure that all payments are made according to the established schedule.

Legal Use of the Escrow Account

The legal use of an escrow account is governed by specific regulations and requirements that vary by state. In New Jersey, for instance, the NJDEP has established guidelines for the use of escrow accounts in environmental remediation projects. Compliance with these regulations is crucial to ensure that the escrow account is valid and enforceable. It is advisable to consult legal counsel or a financial advisor familiar with local laws to navigate these requirements effectively.

Required Documents

To establish and maintain an escrow account, several documents are typically required. These may include:

- The NJDEP escrow account report forms, which outline the details of the escrow arrangement.

- Proof of identity for all parties involved in the transaction.

- Any applicable contracts or agreements related to the transaction.

- Documentation of the funds being deposited into the escrow account.

Form Submission Methods

Submitting the NJDEP escrow account report forms can be done through various methods. Depending on the specific requirements of the NJDEP, forms may be submitted online, via mail, or in person. It is important to check the NJDEP's guidelines for the preferred submission method to ensure timely processing. Electronic submissions often provide quicker confirmation and tracking of your documents.

Quick guide on how to complete escrow account

Complete Escrow Account smoothly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Escrow Account on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to alter and electronically sign Escrow Account effortlessly

- Locate Escrow Account and click on Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, time-consuming form hunting, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Adjust and electronically sign Escrow Account while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are escrow account laws?

Escrow account laws govern the handling of funds placed in escrow accounts during real estate transactions. These laws ensure the proper management and disbursement of funds between involved parties, providing legal protection. Understanding escrow account laws is crucial for anyone involved in property transactions.

-

How does airSlate SignNow ensure compliance with escrow account laws?

airSlate SignNow is designed to facilitate compliance with escrow account laws by providing secure electronic signatures and document management. Our platform adheres to legal standards, ensuring that all eSigned documents meet regulations concerning escrow accounts. This helps businesses operate smoothly within legal frameworks.

-

What features does airSlate SignNow offer for managing escrow account documents?

airSlate SignNow offers features that simplify the management of escrow account documents, including customizable templates, in-app notifications, and secure storage. These features enable users to streamline the signature process while ensuring compliance with escrow account laws. As a result, businesses can save time and reduce paperwork.

-

Are there any costs associated with using airSlate SignNow for escrow account law documents?

Yes, there are pricing plans for using airSlate SignNow that cater to varying business needs. Each plan includes a robust suite of features to help manage documents related to escrow account laws effectively. Contact our sales team for detailed pricing information and to find the best fit for your business.

-

Can airSlate SignNow integrate with other platforms for managing escrow accounts?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as CRM systems and accounting software, which can help manage escrow accounts. By doing so, it enhances your workflow and ensures you remain compliant with escrow account laws. Explore our integration options to see how they fit into your existing systems.

-

What are the benefits of using airSlate SignNow for businesses dealing with escrow account laws?

Using airSlate SignNow allows businesses to simplify the document signing process while ensuring compliance with escrow account laws. It reduces the risk of errors and delays, resulting in faster transaction completions. Overall, it enhances operational efficiency and fosters trust with clients.

-

Is airSlate SignNow secure for handling sensitive escrow account information?

Yes, airSlate SignNow utilizes industry-standard security protocols to protect sensitive information related to escrow accounts. Data encryption and secure access controls are in place to ensure compliance with escrow account laws. You can trust our platform to safeguard your essential documents and information.

Get more for Escrow Account

- Contracts agreements for services foothill de anza form

- Committee service guidelines the university of new mexico form

- On campus proctor sheet form

- Experimental technical services agreement form

- Central piedmont community college steps to complete form

- Authorized users signature log department of form

- Direct admission pre application form

- Advanced certificate in public health form

Find out other Escrow Account

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed