Qualified Personal Residence Trust Example Form

What is the Qualified Personal Residence Trust Example

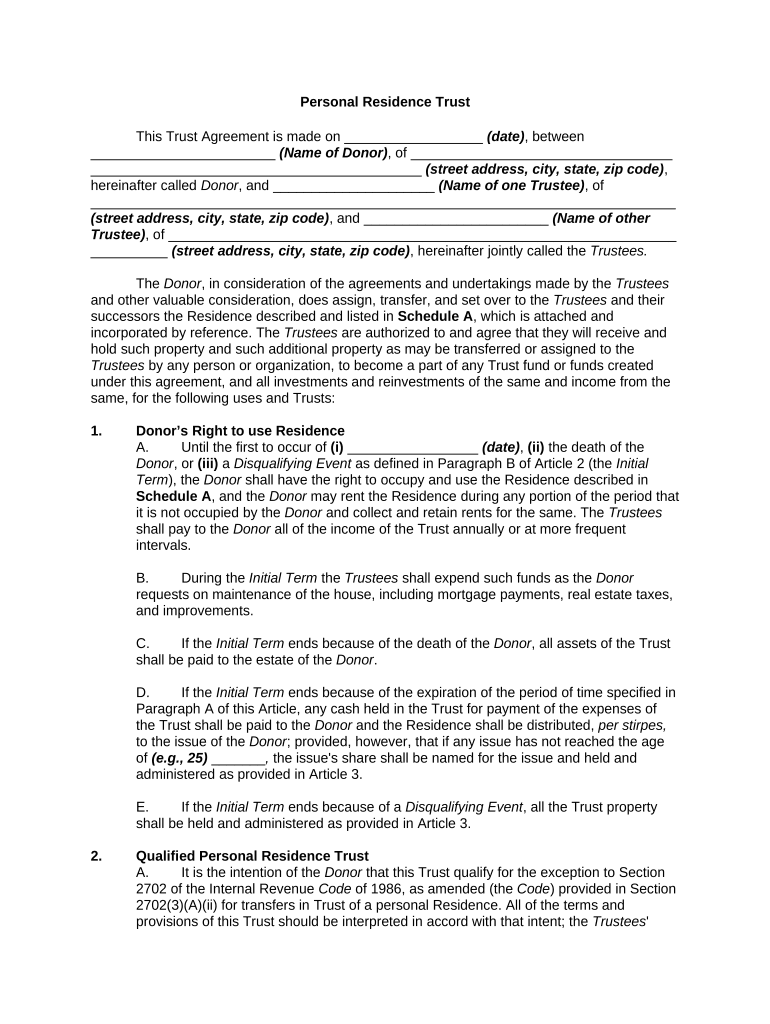

A qualified personal residence trust (QPRT) is a legal arrangement that allows individuals to transfer ownership of their personal residence into a trust while retaining the right to live in it for a specified period. This strategy is often used for estate planning purposes, as it can help reduce the taxable value of an estate. By placing the residence in a QPRT, the grantor can potentially lower estate taxes when the property is eventually passed on to beneficiaries. The trust must meet specific IRS requirements to qualify as a QPRT, including the duration of the grantor's retained interest and the valuation of the property at the time of transfer.

How to use the Qualified Personal Residence Trust Example

To effectively use a qualified personal residence trust example, individuals should first consult with an estate planning attorney to determine if this strategy aligns with their financial goals. Once confirmed, the following steps are typically involved:

- Draft the trust document, specifying the terms and conditions.

- Transfer the title of the residence into the trust.

- Retain the right to live in the property for a predetermined number of years.

- Ensure that the trust is properly funded and maintained throughout its duration.

It is crucial to follow all legal requirements to ensure that the trust remains valid and effective for estate planning purposes.

Key elements of the Qualified Personal Residence Trust Example

Several key elements define a qualified personal residence trust, including:

- Retained Interest: The grantor retains the right to live in the residence for a set term, which can significantly affect the trust's valuation.

- Term Length: The duration of the retained interest must be specified, typically ranging from two to fifteen years.

- Property Valuation: The property must be appraised at the time of transfer to determine the gift tax implications.

- Beneficiaries: The trust must clearly outline who will receive the property after the grantor's retained interest expires.

Understanding these elements is essential for ensuring the trust operates effectively within the framework of estate planning.

Steps to complete the Qualified Personal Residence Trust Example

Completing a qualified personal residence trust involves several important steps:

- Consult with a qualified estate planning attorney to discuss the appropriateness of a QPRT for your situation.

- Draft the trust document, ensuring compliance with IRS regulations.

- Transfer the property title into the trust, which may require filing specific forms with local authorities.

- Maintain documentation of the trust's terms and any property appraisals.

- Monitor the trust throughout its duration to ensure compliance with any legal requirements.

Following these steps carefully will help ensure that the qualified personal residence trust is set up correctly and serves its intended purpose.

Legal use of the Qualified Personal Residence Trust Example

The legal use of a qualified personal residence trust is governed by specific IRS rules and regulations. To ensure compliance, the trust must meet the following criteria:

- The grantor must retain the right to use the property for a specified term.

- The property must be a personal residence, which can include a primary home or vacation home.

- The trust must be irrevocable, meaning the grantor cannot alter its terms once established.

- Proper documentation and formalities must be observed to avoid challenges from the IRS or other parties.

Adhering to these legal requirements is essential for the trust to function as intended and provide the intended estate tax benefits.

IRS Guidelines

The IRS has established specific guidelines regarding qualified personal residence trusts to ensure they are used appropriately for estate planning. Key aspects include:

- The property must be appraised at fair market value at the time of transfer.

- The value of the retained interest must be calculated using IRS tables to determine gift tax implications.

- Any changes to the trust must comply with IRS regulations to maintain its qualified status.

Understanding these guidelines is crucial for individuals considering a QPRT, as non-compliance can lead to significant tax consequences.

Quick guide on how to complete qualified personal residence trust example

Complete Qualified Personal Residence Trust Example effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle Qualified Personal Residence Trust Example on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Qualified Personal Residence Trust Example without any hassle

- Locate Qualified Personal Residence Trust Example and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Qualified Personal Residence Trust Example and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a qualified personal residence trust example?

A qualified personal residence trust example is a legal arrangement that allows individuals to transfer their primary residence into a trust while retaining the right to live there for a specified period. This can signNowly reduce estate taxes for wealthy individuals and help preserve their assets for heirs. At airSlate SignNow, we can assist you in eSigning documents related to your qualified personal residence trust example.

-

How can airSlate SignNow facilitate the process of creating a qualified personal residence trust?

AirSlate SignNow provides an easy-to-use platform for drafting and eSigning documents associated with a qualified personal residence trust. With our integrated tools, you can securely send, manage, and store all necessary documents in one place, ensuring compliance and streamline the process. Our service simplifies the legal requirements involved in establishing a trust.

-

What are the benefits of using a qualified personal residence trust?

Using a qualified personal residence trust example can signNowly reduce your taxable estate, allowing for more wealth to be passed on to your heirs. This financial strategy not only helps in tax management but also protects your home from creditors. Additionally, airSlate SignNow ensures you have a seamless experience in managing your trust documentation.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers features like document templates, advanced eSigning options, secure cloud storage, and robust compliance measures. This makes handling your qualified personal residence trust example documents straightforward and efficient. With these tools, you can focus on the important aspects of estate planning without worrying about document security.

-

Is there a pricing plan available for using airSlate SignNow for trust documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and enterprises. Each plan includes essential features to manage documents related to a qualified personal residence trust example. You can choose a plan that fits your budget and the volume of eSigning required.

-

How secure is the data stored with airSlate SignNow during the trust documentation process?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure access controls to safeguard your data, especially when dealing with sensitive documents related to a qualified personal residence trust example. Our platform complies with industry standards to protect your information.

-

Can I integrate airSlate SignNow with other applications for managing my trust documents?

Absolutely! airSlate SignNow easily integrates with numerous applications, helping you streamline your workflow for managing documents related to a qualified personal residence trust example. These integrations include various CRM systems and cloud storage services, enabling you to manage all your business documents efficiently.

Get more for Qualified Personal Residence Trust Example

Find out other Qualified Personal Residence Trust Example

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile