Form 1040 ES Form 1040 ES, Estimated Tax for Individuals 2021

What is the Form 1040 ES

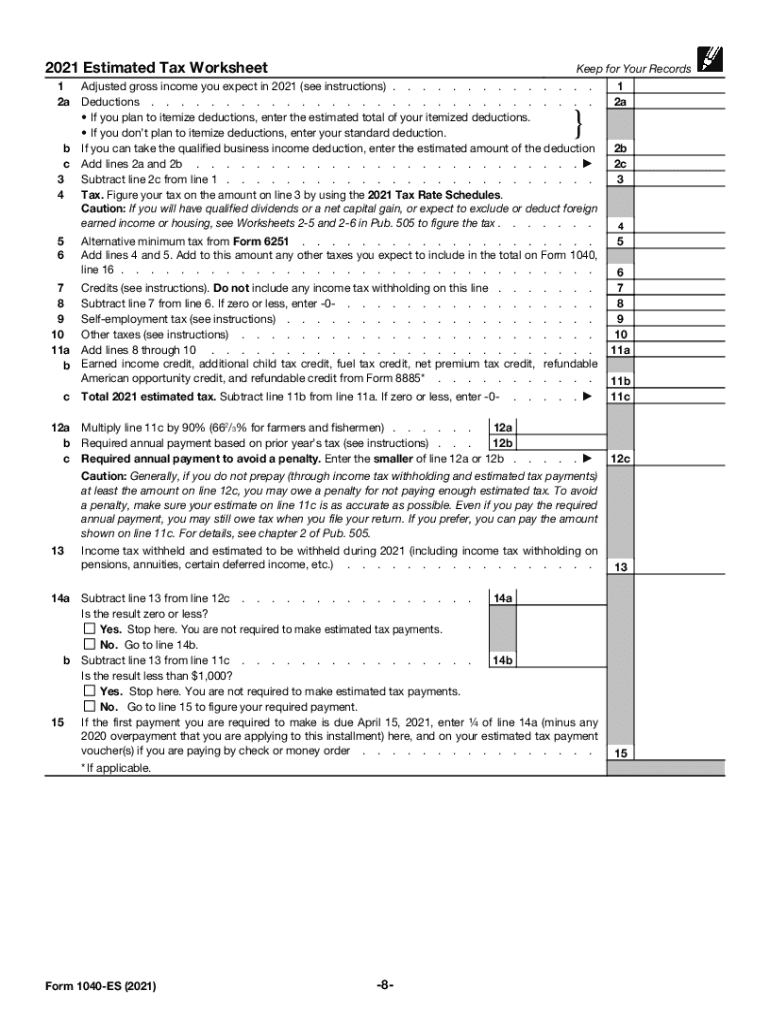

The Form 1040 ES is an essential document used by individuals in the United States to report and pay estimated taxes. This form is particularly important for those who are self-employed, have income that is not subject to withholding, or expect to owe tax of $1,000 or more when they file their annual tax return. The estimated tax payments made using this form help taxpayers avoid penalties for underpayment when they file their annual income tax return.

How to Use the Form 1040 ES

Using the Form 1040 ES involves several steps. First, taxpayers must determine their estimated tax liability for the year. This can be done by reviewing previous tax returns and considering any changes in income or deductions. Once the estimated tax amount is calculated, individuals can fill out the form, which includes details such as their name, address, and Social Security number. The form also requires taxpayers to indicate the amount of estimated tax they plan to pay for each quarter.

Steps to Complete the Form 1040 ES

Completing the Form 1040 ES involves the following steps:

- Calculate your estimated tax liability based on your expected income and deductions.

- Obtain the Form 1040 ES from the IRS website or through tax preparation software.

- Fill out the form with your personal information and estimated tax amounts for each quarter.

- Review the form for accuracy before submission.

- Submit your payment along with the form by the due date to avoid penalties.

Filing Deadlines / Important Dates

Timely filing of the Form 1040 ES is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should ensure that payments are made by these deadlines to remain compliant with IRS regulations.

Legal Use of the Form 1040 ES

The Form 1040 ES is legally recognized as a valid method for reporting and paying estimated taxes. Compliance with IRS guidelines is essential for the form to be considered legally binding. Taxpayers must ensure that they accurately estimate their tax liability and submit the form on time to avoid penalties. Utilizing a trusted eSignature solution can help ensure that the form is signed and submitted securely.

IRS Guidelines

The IRS provides specific guidelines for filling out and submitting the Form 1040 ES. It is important for taxpayers to refer to these guidelines to ensure compliance. The IRS outlines the eligibility criteria for using the form, the methods of payment, and how to handle any changes in income that may affect estimated tax payments. Staying informed about IRS updates can help taxpayers manage their estimated tax obligations effectively.

Quick guide on how to complete 2021 form 1040 es form 1040 es estimated tax for individuals

Easily Prepare Form 1040 ES Form 1040 ES, Estimated Tax For Individuals on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly, without any delays. Handle Form 1040 ES Form 1040 ES, Estimated Tax For Individuals on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric workflow today.

How to Edit and Electronically Sign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals Effortlessly

- Obtain Form 1040 ES Form 1040 ES, Estimated Tax For Individuals and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form 1040 ES Form 1040 ES, Estimated Tax For Individuals to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1040 es form 1040 es estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1040 es form 1040 es estimated tax for individuals

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is form 1040 es and why is it important?

Form 1040 ES is used by taxpayers to estimate and pay their federal income tax throughout the year. It is important because it helps individuals avoid penalties for underpayment when filing their annual tax returns. Using airSlate SignNow makes filing and managing your form 1040 ES easier and more efficient.

-

How can airSlate SignNow help me with form 1040 es?

airSlate SignNow allows you to easily prepare, send, and eSign your form 1040 ES documents. With our user-friendly platform, you can streamline the process, ensuring that your tax estimates are submitted accurately and on time. This means less stress during tax season and more time to focus on other important tasks.

-

Is there a cost associated with using airSlate SignNow for form 1040 es?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be cost-effective for both individuals and businesses. Our pricing includes access to all features, making it simple to handle your form 1040 ES and other documents without breaking the bank. We provide different tiers, so you can choose the one that suits your needs best.

-

What features does airSlate SignNow offer for managing form 1040 es?

airSlate SignNow comes equipped with features such as eSignatures, document templates, and real-time tracking, which are essential for managing form 1040 ES effectively. These features help users save time, reduce errors, and ensure compliance with tax regulations. Our platform also allows for easy collaboration with tax advisors or accountants.

-

Can I integrate airSlate SignNow with other applications for form 1040 es?

Absolutely! airSlate SignNow offers integrations with various applications that can help you manage your form 1040 ES more efficiently. Whether you use accounting software or customer relationship management tools, our API and integration options enable a seamless workflow, enhancing productivity and ensuring your documents are always accessible.

-

Is my data secure when using airSlate SignNow for form 1040 es?

Yes, airSlate SignNow prioritizes data security and compliance. All documents, including form 1040 ES, are encrypted during transmission and storage, ensuring that your personal and financial information is protected. We adhere to industry standards and regulations to safeguard sensitive data.

-

What are the benefits of using airSlate SignNow for form 1040 es compared to traditional methods?

Using airSlate SignNow for form 1040 ES provides numerous benefits over traditional paper methods. It eliminates the need for printing and mailing, which saves time and reduces costs. Additionally, eSigning and electronic storage help ensure that your documents are easily accessible and organized, streamlining your tax filing process.

Get more for Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

Find out other Form 1040 ES Form 1040 ES, Estimated Tax For Individuals

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors