Closely Held Corporation Definition Form

What is the closely held corporation definition

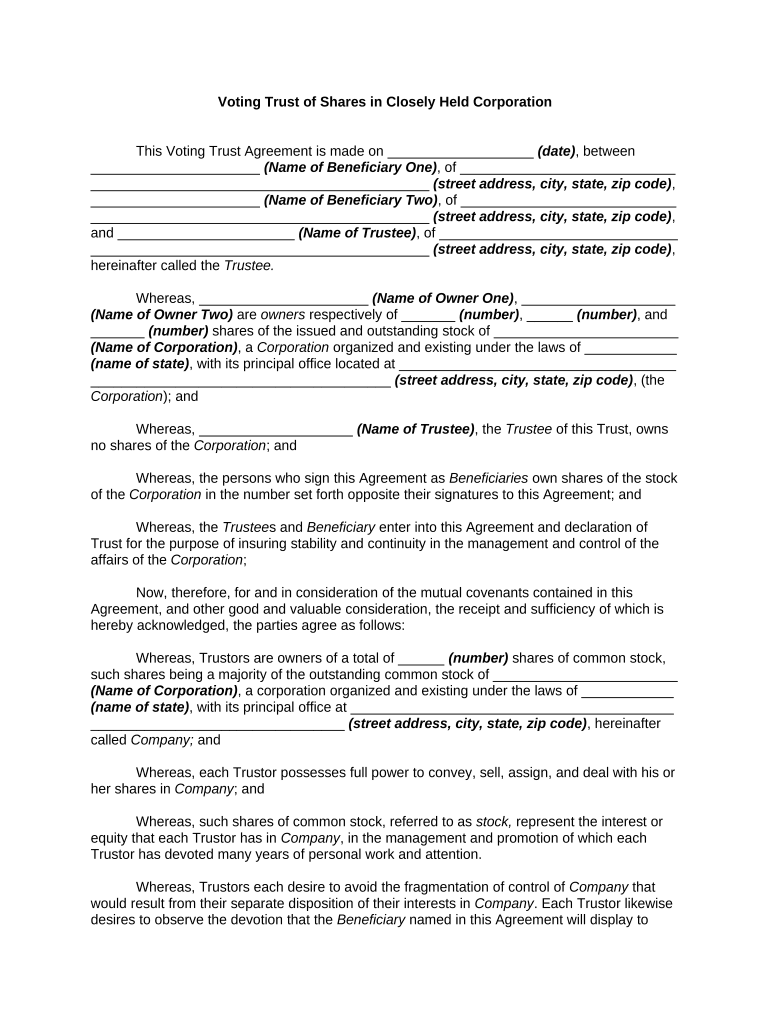

A closely held corporation is a type of business entity that is owned by a small number of shareholders, often family members or close associates. This structure allows for greater control over management and operations, as ownership is concentrated among a limited group. In the United States, closely held corporations are typically subject to specific regulations that govern their formation and operation, including provisions in state corporate laws. These corporations often enjoy certain tax advantages and may have fewer reporting requirements compared to publicly traded companies.

Key elements of the closely held corporation definition

Several key elements define a closely held corporation. Firstly, ownership is limited to a small number of shareholders, usually fewer than 50. Secondly, shares are not publicly traded, meaning they cannot be easily bought or sold on the stock market. Additionally, closely held corporations often have restrictions on the transfer of shares to maintain control among existing owners. This structure can lead to more straightforward decision-making processes and a strong alignment of interests among shareholders.

Steps to complete the closely held corporation definition

To properly define a closely held corporation, several steps should be followed. Start by identifying the number of shareholders and ensuring it falls within the acceptable limit. Next, outline the ownership structure, including any restrictions on share transfers. It is also essential to draft corporate bylaws that govern the operation of the corporation, detailing the rights and responsibilities of shareholders. Finally, ensure compliance with state regulations by filing the necessary formation documents with the appropriate state agency.

Legal use of the closely held corporation definition

The legal use of the closely held corporation definition is crucial for ensuring compliance with applicable laws. This includes adhering to state-specific regulations regarding corporate governance and shareholder rights. It is important to maintain accurate records of ownership and any changes in share distribution. Furthermore, closely held corporations must comply with federal tax laws, which may involve filing specific forms and maintaining proper accounting practices to avoid penalties.

Examples of using the closely held corporation definition

Examples of closely held corporations include family-owned businesses, small partnerships, and companies owned by a small group of friends or colleagues. A family-run restaurant or a local manufacturing firm often operates as a closely held corporation. These entities benefit from the ability to make quick decisions without the complexities associated with larger, publicly traded companies. Understanding the closely held corporation definition helps these businesses navigate legal and operational challenges effectively.

Who issues the form

The form related to the closely held corporation definition is typically issued by the state government where the corporation is formed. Each state has its own regulatory body, often the Secretary of State or a similar agency, responsible for overseeing business registrations. These forms may include articles of incorporation or similar documents that outline the structure and purpose of the corporation. It is essential to consult the appropriate state agency to obtain the correct forms and ensure compliance with local laws.

Quick guide on how to complete closely held corporation definition

Effortlessly Prepare Closely Held Corporation Definition on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documentation, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly without delays. Handle Closely Held Corporation Definition on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Edit and Electronically Sign Closely Held Corporation Definition with Ease

- Find Closely Held Corporation Definition and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose your preferred method for sharing your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Edit and electronically sign Closely Held Corporation Definition and ensure effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are voting shares and how do they work?

Voting shares are a type of equity that grants shareholders the right to vote on key company decisions, such as electing the board of directors or approving mergers. Each voting share typically corresponds to one vote, allowing shareholders to influence the management of the company. Understanding voting shares is essential for those involved in corporate governance or investment.

-

How can airSlate SignNow facilitate the management of voting shares?

airSlate SignNow simplifies the process of managing voting shares by allowing businesses to send, eSign, and track important documents related to shareholder voting securely. Users can create customized voting forms and ensure that all shareholder agreements are properly executed without the hassle of physical signatures. This feature enhances efficiency and compliance in managing voting shares.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring that managing voting shares remains cost-effective. Our pricing tiers include essential features that allow for document management, including eSigning and document tracking. Businesses can choose the plan that best fits their needs without compromising on functionality.

-

What are the benefits of using airSlate SignNow for voting shares?

Using airSlate SignNow for managing voting shares enhances efficiency, reduces paperwork, and increases security during shareholder voting processes. The platform's easy-to-use interface allows users to navigate and send documents effortlessly, ensuring timely responses. Additionally, airSlate SignNow maintains compliance with legal standards for electronic signatures.

-

Does airSlate SignNow integrate with other tools for managing voting shares?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and applications, making it easier to manage voting shares alongside your existing workflows. Whether you use CRM systems, document storage solutions, or communication platforms, our integrations enhance productivity and collaboration. This flexibility allows businesses to streamline the voting process effectively.

-

How secure is the platform when handling voting shares?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive documents like those related to voting shares. Our platform employs advanced encryption and security protocols to protect your data from unauthorized access. Users can rest assured that their voting share documents are secure and compliant with regulations.

-

Can airSlate SignNow help with the automation of voting share processes?

Absolutely! airSlate SignNow includes automation features that can signNowly streamline the processes associated with voting shares. By automating document routing, reminders, and approvals, businesses can ensure that shareholder votes are collected and processed efficiently, saving time and reducing the risk of errors.

Get more for Closely Held Corporation Definition

Find out other Closely Held Corporation Definition

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship