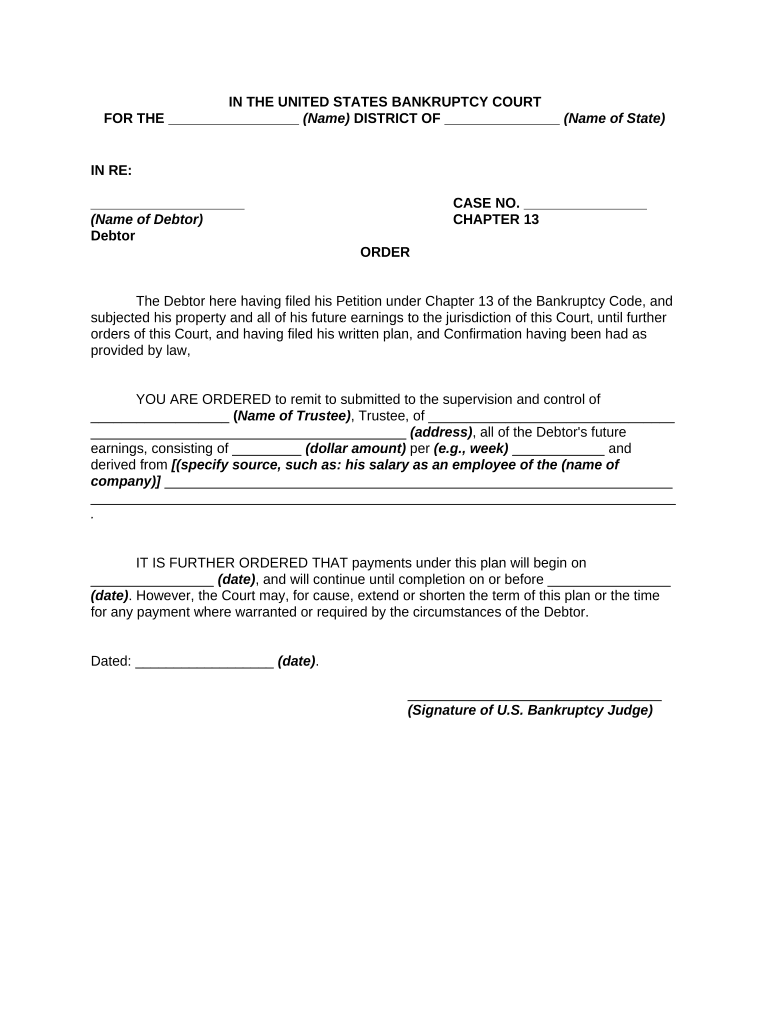

Order Debtor Form

What is the Order Debtor

The order debtor refers to the individual or entity that is obligated to pay a debt or fulfill a financial obligation as specified in a legal order. This term is often used in contexts involving employer deductions, where the employer may be required to withhold a portion of an employee's wages to satisfy a debt. Understanding the role of the order debtor is crucial for both employers and employees, as it clarifies responsibilities regarding financial obligations.

Steps to Complete the Order Debtor

Completing the order debtor form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the debtor's personal details and the specific deductions required. Next, accurately fill out the form, ensuring all sections are completed as per the guidelines. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the appropriate authority or employer, ensuring that it is done within any specified deadlines.

Legal Use of the Order Debtor

The legal use of the order debtor is governed by various laws and regulations that dictate how deductions should be handled. Employers must comply with federal and state laws regarding wage garnishment and other deductions. This ensures that the rights of the debtor are protected while allowing creditors to recover owed amounts. Employers should familiarize themselves with these regulations to avoid potential legal issues.

Required Documents

When completing the order debtor form, certain documents may be required to support the information provided. Commonly needed documents include proof of identity for the debtor, documentation of the debt, and any relevant court orders or agreements. Having these documents ready can streamline the process and help ensure that the order is executed correctly.

Filing Deadlines / Important Dates

Filing deadlines for the order debtor form can vary based on state regulations and the nature of the debt. It is essential for employers and debtors to be aware of these deadlines to ensure compliance. Missing a deadline may result in legal repercussions or the inability to enforce the order. Keeping a calendar of important dates related to the order debtor can help manage these obligations effectively.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the order debtor can lead to significant penalties for employers. These may include fines, legal action from creditors, and potential damage to the employer's reputation. It is crucial for employers to understand their responsibilities and the consequences of non-compliance to avoid these risks.

Quick guide on how to complete order debtor

Effortlessly complete Order Debtor on any device

Digital document management has become increasingly popular among companies and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely save it online. airSlate SignNow equips you with all the features needed to create, edit, and eSign your documents swiftly without delays. Manage Order Debtor on any platform using airSlate SignNow's Android or iOS applications, streamlining your document-related tasks today.

How to edit and eSign Order Debtor effortlessly

- Obtain Order Debtor and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools provided specifically by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional signature.

- Review all details and click the Done button to save your updates.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Order Debtor to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are employer deductions and how do they work?

Employer deductions refer to the amounts that employers withhold from employee wages for various purposes, including taxes, benefits, and retirement contributions. Understanding these deductions is crucial for compliance and managing payroll effectively, as they directly impact an employee's net pay.

-

How can airSlate SignNow help with tracking employer deductions?

airSlate SignNow streamlines document management, allowing businesses to easily track and manage documentation related to employer deductions. With eSignature capabilities, you can securely sign and store payroll documents that reflect these deductions, improving your overall payroll process.

-

What features does airSlate SignNow offer for employer deductions?

airSlate SignNow offers features such as customizable templates for payroll documents, easy document sharing, and secure eSigning, which all aid in managing employer deductions. These features ensure that your business remains organized and compliant with federal and state regulations regarding payroll.

-

Is airSlate SignNow cost-effective for managing employer deductions?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage employer deductions efficiently. With flexible pricing plans, organizations of all sizes can optimize their payroll processes without incurring excessive costs, ultimately saving money associated with errors and compliance issues.

-

Can I integrate airSlate SignNow with other payroll systems for employer deductions?

Absolutely! airSlate SignNow easily integrates with various payroll and HR systems, allowing for seamless management of employer deductions. This integration ensures accurate deductions are reflected in documents, minimizing the potential for errors and streamlining your payroll processes.

-

What benefits do employers gain from using airSlate SignNow for employer deductions?

Employers benefit from increased efficiency, accuracy, and compliance when using airSlate SignNow for employer deductions. The platform reduces time spent on administrative tasks related to payroll while ensuring that all documentation is securely stored and easily accessible.

-

How does airSlate SignNow ensure compliance regarding employer deductions?

With airSlate SignNow, businesses can maintain compliance regarding employer deductions through its secure eSigning features and organized document management. This way, all payroll-related documents are accurately executed and stored, reducing risks of penalties associated with non-compliance.

Get more for Order Debtor

Find out other Order Debtor

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online