Loan Agreement Form

What is the consumer loan agreement?

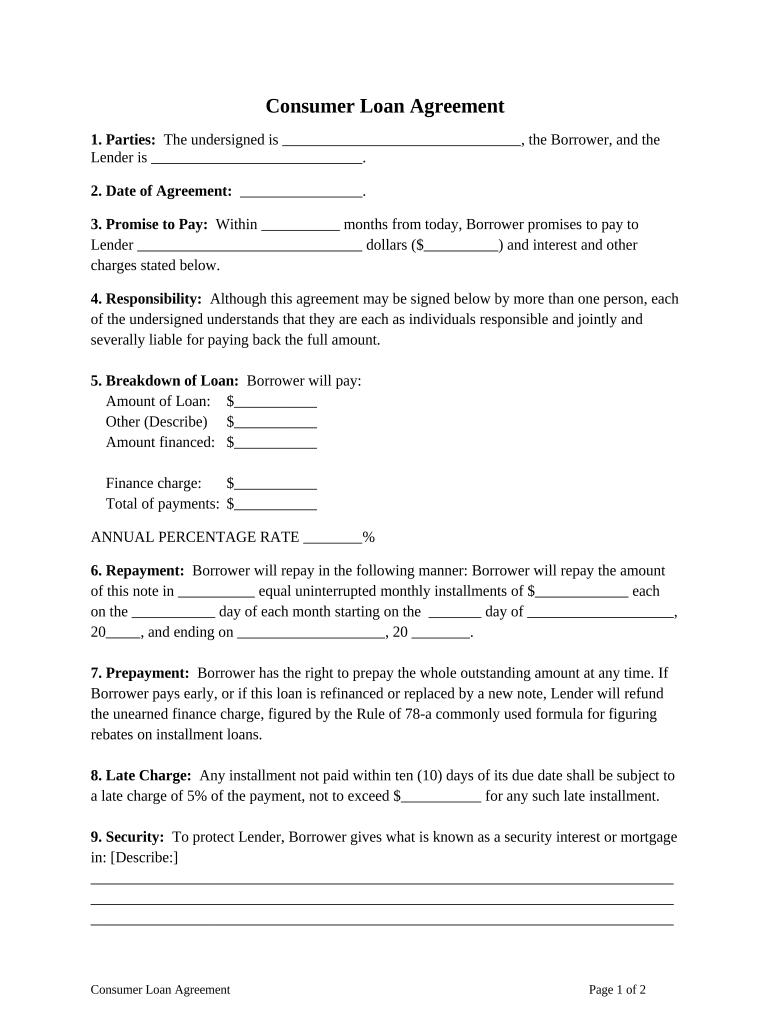

A consumer loan agreement is a legally binding document between a borrower and a lender that outlines the terms and conditions of a loan. This agreement specifies the amount borrowed, the interest rate, repayment schedule, and any fees associated with the loan. It serves to protect both parties by clearly defining their rights and responsibilities. Understanding the components of this agreement is crucial for borrowers to ensure they are aware of their obligations and the implications of the loan.

Key elements of the consumer loan agreement

Several key elements must be included in a consumer loan agreement to ensure its validity and clarity:

- Loan amount: The total sum being borrowed.

- Interest rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment terms: The schedule for repaying the loan, including the frequency of payments (monthly, bi-weekly, etc.) and the duration of the loan.

- Fees and charges: Any additional costs associated with the loan, such as origination fees or late payment penalties.

- Default conditions: Circumstances under which the borrower may be considered in default and the lender's rights in such situations.

Steps to complete the consumer loan application

Completing a consumer loan application involves several important steps to ensure accuracy and compliance:

- Gather necessary documents: Collect personal identification, proof of income, and any other required financial information.

- Fill out the application: Provide accurate information regarding your financial status, employment, and the loan amount requested.

- Review the terms: Carefully read the loan agreement to understand all terms and conditions before signing.

- Submit the application: Send the completed application and any supporting documents to the lender, either online or in person.

Legal use of the consumer loan agreement

The legal use of a consumer loan agreement is governed by various federal and state laws. These regulations ensure that the terms of the agreement are fair and transparent. For the agreement to be legally binding, it must include essential elements such as clear terms, signatures from both parties, and compliance with applicable laws, such as the Truth in Lending Act. This act mandates lenders to disclose key information about the loan, helping borrowers make informed decisions.

Required documents for the consumer loan application

When applying for a consumer loan, several documents are typically required to verify your identity and financial status:

- Identification: A government-issued ID, such as a driver's license or passport.

- Proof of income: Recent pay stubs, tax returns, or bank statements to demonstrate your ability to repay the loan.

- Credit report: Some lenders may request permission to check your credit history to assess creditworthiness.

- Employment verification: Documentation from your employer confirming your employment status and income.

Application process & approval time

The application process for a consumer loan typically involves several stages, starting from submission to approval. After submitting the application, lenders will review your financial information and credit history. The approval time can vary based on the lender and the complexity of the application. Generally, it may take anywhere from a few hours to several days. Once approved, the lender will provide the terms of the loan agreement, which you must review and sign before receiving the funds.

Quick guide on how to complete loan agreement 497331208

Complete Loan Agreement seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Loan Agreement on any device using airSlate SignNow Android or iOS applications and streamline any document process today.

How to modify and eSign Loan Agreement effortlessly

- Obtain Loan Agreement and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and eSign Loan Agreement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement form?

A loan agreement form is a legal document outlining the terms and conditions of a loan between a lender and a borrower. It specifies details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Using airSlate SignNow, you can easily create, customize, and eSign your loan agreement form quickly and securely.

-

How can I create a loan agreement form using airSlate SignNow?

Creating a loan agreement form with airSlate SignNow is straightforward. Simply choose from our templates or start from scratch to customize your form. Our user-friendly interface allows you to add necessary fields and clauses, ensuring your loan agreement form meets all legal requirements.

-

What are the benefits of using an electronic loan agreement form?

Using an electronic loan agreement form streamlines the lending process by reducing paperwork and enhancing convenience. It allows for quick editing and sharing, plus you can track the status of documents in real-time. With airSlate SignNow, you can also enjoy added security features, ensuring your data remains protected.

-

Is there a cost associated with using airSlate SignNow for loan agreement forms?

Yes, airSlate SignNow offers several pricing plans to accommodate various business needs, including options for individuals and teams. Each plan provides access to features that enable you to create and manage loan agreement forms efficiently. Check our pricing page for more details on the best option for your requirements.

-

Can I integrate airSlate SignNow with other applications for my loan agreement form workflow?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing your loan agreement form workflow. Connect with CRM software, payment processors, and cloud storage to streamline your documents and ensure seamless collaboration within your team.

-

What security measures does airSlate SignNow have in place for loan agreement forms?

airSlate SignNow prioritizes the security of your loan agreement forms by employing advanced encryption protocols and secure storage solutions. Additionally, we comply with industry standards and regulations to ensure your documents remain safe from unauthorized access or bsignNowes.

-

Can I track the status of my loan agreement forms with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your loan agreement forms in real time. You can see when the document has been opened, signed, or completed, providing you with greater control over your lending processes and ensuring timely follow-ups.

Get more for Loan Agreement

- Calculate number of days between two dates stack overflow form

- Tailgate meeting form cable crew bsafetreebbnzb

- Baseball tryout registration form

- Subscriber agreement pdf form

- Documentary release form template

- Ping questionnaire form

- Short term missions trip application packet thank you for your interest in a redeemer bible church short term missions trip form

- Carc candidateamp39s name carc training documentation form asapnys

Find out other Loan Agreement

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form