Oregon Form 41 2020

What is the Oregon Form 41

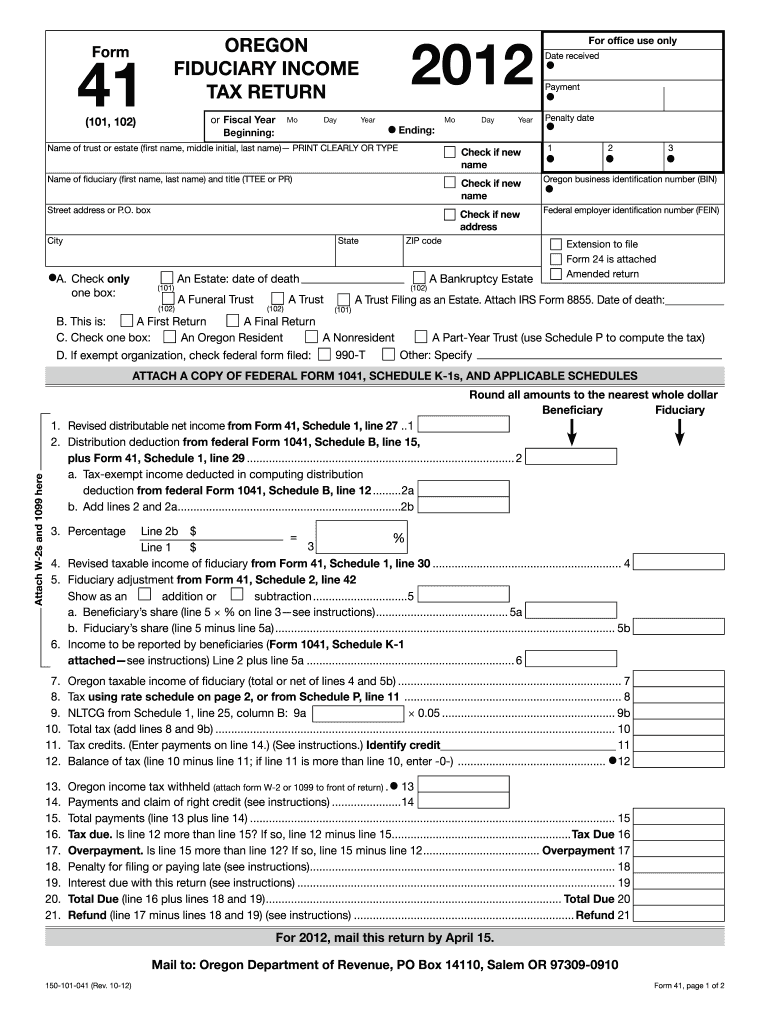

The Oregon Form 41 is a tax form used primarily by corporations and partnerships operating within the state of Oregon. This form is essential for reporting income, deductions, and tax liabilities to the Oregon Department of Revenue. It serves as a means for businesses to comply with state tax regulations, ensuring that they accurately report their financial activities for the tax year. Understanding the purpose of this form is crucial for maintaining compliance and avoiding potential penalties.

How to use the Oregon Form 41

Using the Oregon Form 41 involves several steps to ensure that all necessary information is accurately reported. First, gather all financial documents related to the business’s income and expenses for the tax year. Next, fill out the form by providing required details such as the business name, federal employer identification number (EIN), and income figures. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form must be submitted to the Oregon Department of Revenue by the designated deadline.

Steps to complete the Oregon Form 41

Completing the Oregon Form 41 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial records, including income statements and expense reports.

- Obtain the most recent version of the Oregon Form 41 from the Oregon Department of Revenue website.

- Fill in the business information, including name, address, and federal EIN.

- Report total income and allowable deductions accurately.

- Calculate the tax owed based on the provided information.

- Review the form for accuracy and completeness.

- Submit the form by the deadline, either electronically or by mail.

Legal use of the Oregon Form 41

The legal use of the Oregon Form 41 is governed by state tax laws. Businesses must ensure that they use the form correctly to maintain compliance with Oregon tax regulations. This includes accurately reporting income, adhering to deadlines, and providing truthful information. Failure to comply can result in penalties, including fines and interest on unpaid taxes. Therefore, it is advisable for businesses to consult with a tax professional if they have questions regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form 41 are critical for businesses to note. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the form must be filed by April 15 of the following year. It is important for businesses to stay informed about any changes to these deadlines, as they can affect compliance and potential penalties for late submissions.

Who Issues the Form

The Oregon Form 41 is issued by the Oregon Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. The department provides resources and guidance for businesses on how to properly complete and submit the form, as well as updates on any changes in tax regulations that may affect filing requirements.

Quick guide on how to complete oregon form 41 2012

Complete Oregon Form 41 seamlessly on any device

Managing documents online has gained traction among enterprises and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, as you can locate the correct template and securely archive it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Oregon Form 41 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Oregon Form 41 with ease

- Obtain Oregon Form 41 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device of your choice. Modify and electronically sign Oregon Form 41 and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon form 41 2012

Create this form in 5 minutes!

How to create an eSignature for the oregon form 41 2012

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Oregon Form 41?

Oregon Form 41 is a tax form used for corporate income tax reporting in the state of Oregon. It is essential for businesses operating in Oregon to accurately report their income and deductions. airSlate SignNow helps streamline the eSigning process for Oregon Form 41, making it easier for businesses to submit their documents on time.

-

How can airSlate SignNow help with Oregon Form 41 submissions?

airSlate SignNow provides an intuitive platform that allows businesses to electronically sign and send Oregon Form 41 documents quickly and securely. This ensures timely submissions while minimizing the risk of errors. The platform's user-friendly interface simplifies the overall process, making compliance easier for businesses.

-

Is there a cost associated with using airSlate SignNow for Oregon Form 41?

Yes, airSlate SignNow offers flexible pricing plans based on your business needs. You can choose a plan that fits your budget while ensuring efficient management of your Oregon Form 41 submissions. With affordable rates, businesses can save time and money compared to traditional signing methods.

-

What features does airSlate SignNow offer for Oregon Form 41 users?

airSlate SignNow offers a variety of features specifically designed for users dealing with Oregon Form 41, including customizable templates, cloud storage, and real-time tracking. These features streamline the eSigning experience and enhance document management. By simplifying the workflow, businesses can focus on their core operations.

-

Can I integrate airSlate SignNow with other applications for Oregon Form 41?

Yes, airSlate SignNow supports numerous integrations with popular applications like Google Drive, Dropbox, and various CRM systems. This allows for seamless collaboration when preparing and submitting your Oregon Form 41. Integrations help centralize your document management, improving efficiency across your business.

-

What are the benefits of eSigning Oregon Form 41 with airSlate SignNow?

ESigning Oregon Form 41 with airSlate SignNow brings numerous benefits, such as faster processing times and improved document security. By eliminating paper-based methods, businesses can reduce their carbon footprint while enhancing overall productivity. Additionally, the audit trail feature provides a secure record of all transactions.

-

Is airSlate SignNow secure for handling sensitive Oregon Form 41 documents?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect sensitive documents, including Oregon Form 41. The platform ensures that all data is securely transmitted and stored, giving businesses peace of mind when managing their important tax documents.

Get more for Oregon Form 41

Find out other Oregon Form 41

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now