Oregon Form 41 2020

What is the Oregon Form 41

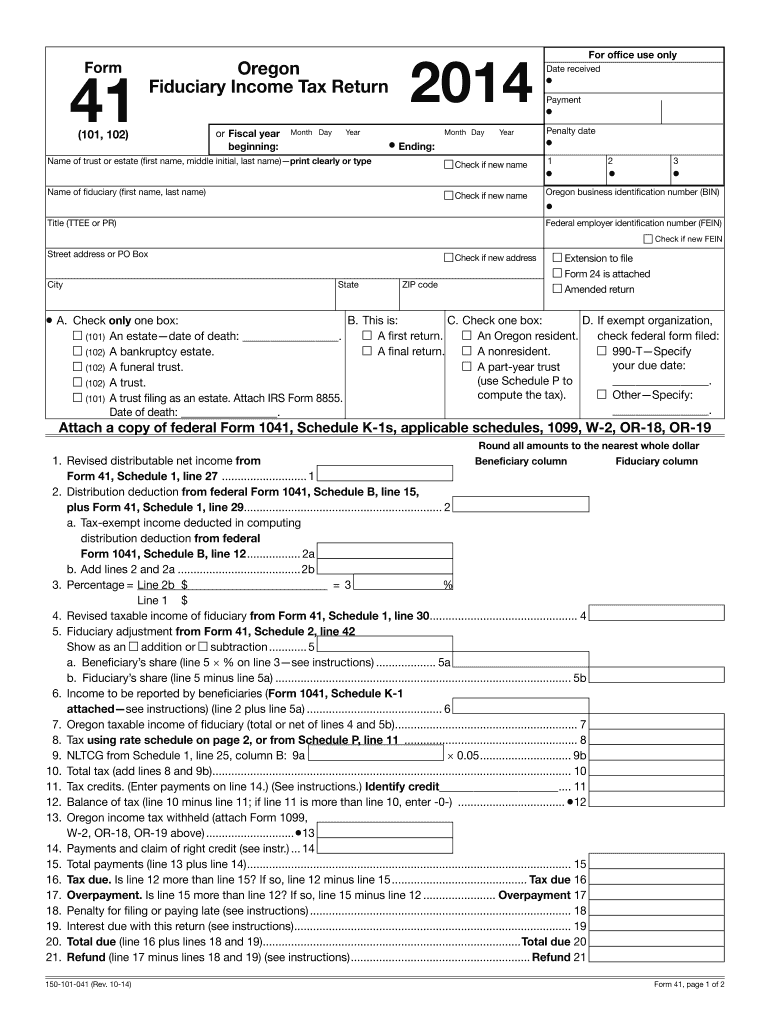

The Oregon Form 41 is a tax form used by corporations operating in the state of Oregon. It is specifically designed for the reporting of corporate income and is essential for ensuring compliance with state tax regulations. This form allows corporations to calculate their tax liability based on their income, deductions, and credits. Understanding the purpose and requirements of Form 41 is crucial for businesses to maintain good standing with the Oregon Department of Revenue.

How to use the Oregon Form 41

Using the Oregon Form 41 involves several key steps that ensure accurate reporting of corporate income. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by entering income, deductions, and any applicable credits. It is important to review the instructions carefully to ensure all entries are accurate. Once completed, the form must be filed with the Oregon Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Oregon Form 41

Completing the Oregon Form 41 involves a systematic approach:

- Gather financial documents, including income statements and expense reports.

- Fill out the form, starting with basic information such as the corporation's name and identification number.

- Report total income, including revenue from sales and services.

- Deduct allowable expenses, ensuring all deductions comply with state regulations.

- Calculate the tax owed based on the net income.

- Review the completed form for accuracy and completeness.

- Submit the form to the Oregon Department of Revenue by the deadline.

Legal use of the Oregon Form 41

The legal use of the Oregon Form 41 is governed by state tax laws. Corporations must file this form accurately to report their income and tax liability. Failure to do so can result in penalties, including fines and interest on unpaid taxes. It is essential for corporations to understand the legal implications of their filings and to ensure compliance with all relevant regulations to avoid legal complications.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Oregon Form 41. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by April 15. It is important to mark these dates on the calendar to ensure timely submission and avoid penalties for late filing.

Who Issues the Form

The Oregon Form 41 is issued by the Oregon Department of Revenue. This state agency is responsible for the administration of tax laws and the collection of taxes in Oregon. Corporations can obtain the form directly from the department’s website or through authorized tax professionals. Understanding the role of the Oregon Department of Revenue is important for corporations to ensure compliance and access necessary resources.

Quick guide on how to complete 2014 oregon form 41

Complete Oregon Form 41 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Oregon Form 41 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Oregon Form 41 with ease

- Find Oregon Form 41 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oregon Form 41 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 oregon form 41

Create this form in 5 minutes!

How to create an eSignature for the 2014 oregon form 41

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Oregon Form 41 and why is it important?

The Oregon Form 41 is a critical tax form used by corporations and limited liability companies operating in Oregon. It is important because it helps ensure compliance with state tax regulations and provides accurate reporting of income and expenses.

-

How can airSlate SignNow help with the Oregon Form 41?

airSlate SignNow facilitates the electronic signing and management of the Oregon Form 41, streamlining the process for businesses. With an easy-to-use interface, you can quickly send, receive, and sign this crucial document without any hassle.

-

Is airSlate SignNow a cost-effective solution for managing the Oregon Form 41?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the Oregon Form 41. With various pricing plans available, you can choose one that fits your budget while ensuring compliance with state regulations.

-

What features does airSlate SignNow offer for the Oregon Form 41?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSignatures for the Oregon Form 41. These features help simplify document management and ensure that your forms are completed correctly and promptly.

-

Can I integrate airSlate SignNow with other software for my Oregon Form 41 processing?

Absolutely! airSlate SignNow supports integrations with various popular software solutions. This allows you to seamlessly connect your existing tools for a more efficient workflow when preparing and filing the Oregon Form 41.

-

What are the benefits of using airSlate SignNow for the Oregon Form 41?

Using airSlate SignNow for the Oregon Form 41 comes with multiple benefits such as improved efficiency, reduced paper usage, and enhanced security. Additionally, it helps you stay organized and ensures that your important documents are easily accessible.

-

How secure is the information submitted through airSlate SignNow for Oregon Form 41?

The information submitted through airSlate SignNow for the Oregon Form 41 is highly secure. The platform utilizes advanced encryption and follows strict security protocols to protect your sensitive data at all times.

Get more for Oregon Form 41

- Tn unemployment login form

- Psychiatric advance directive template form

- Sample letter for emergency travel document form

- Affidavit of loss school report card form

- Crest dematerialisation form

- Printable temporary license plate mn 149508 form

- Concussion doctors note 100686911 form

- Insurance premium tax exemption form

Find out other Oregon Form 41

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free