Disclosures Required Form

What are the disclosures required within 3 days for residential real property?

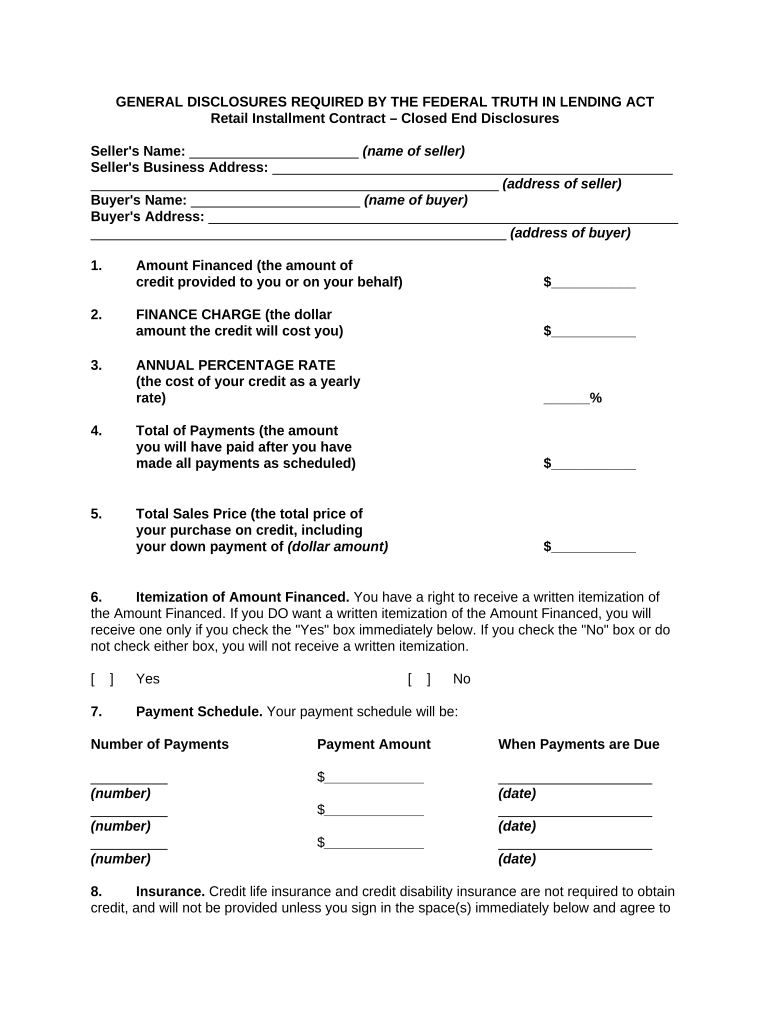

The disclosures required within three days for residential real property typically include essential information that must be provided to potential buyers after a purchase agreement is signed. These disclosures are mandated by the Truth in Lending Act (TILA) and other federal regulations to ensure transparency in real estate transactions. Key documents often include the Loan Estimate, which outlines the terms of the loan, projected payments, and closing costs. Additionally, the buyer should receive the Closing Disclosure, detailing the final terms and costs of the mortgage. These disclosures aim to provide clarity and protect consumers from unexpected financial burdens.

Key elements of the disclosures required

Understanding the key elements of the disclosures required within three days is crucial for both buyers and sellers. The Loan Estimate includes information such as:

- Loan terms: The amount borrowed, interest rate, and monthly payment.

- Projected payments: A breakdown of principal, interest, taxes, insurance, and any mortgage insurance.

- Closing costs: An estimate of fees required to close the loan, including lender fees, title insurance, and recording fees.

The Closing Disclosure further elaborates on these terms and provides the final details that must be reviewed at least three days before closing. This document is essential for ensuring that buyers understand their financial obligations and the costs associated with their mortgage.

Steps to complete the disclosures required

Completing the disclosures required within three days involves several important steps. Initially, once a purchase agreement is signed, the lender must prepare the Loan Estimate and provide it to the borrower within three business days. The borrower should review this document carefully, noting any discrepancies or questions. Following this, the lender prepares the Closing Disclosure, which must be provided at least three days before the closing date. The borrower should again review this document, comparing it with the Loan Estimate to ensure consistency. Any concerns should be addressed with the lender promptly to avoid delays in the closing process.

Legal use of the disclosures required

The legal use of disclosures required within three days is governed by federal laws, particularly the Truth in Lending Act and the Real Estate Settlement Procedures Act (RESPA). These laws mandate that lenders provide clear and accurate information to borrowers to facilitate informed decision-making. Failure to comply with these requirements can result in significant penalties for lenders, including fines and potential legal action. Therefore, it is essential for both parties in a real estate transaction to understand their rights and obligations regarding these disclosures.

Examples of using the disclosures required

Examples of using the disclosures required within three days can be observed in various real estate transactions. For instance, when a buyer applies for a mortgage, the lender issues a Loan Estimate that outlines the loan terms. This document allows the buyer to compare offers from different lenders. Additionally, when the buyer receives the Closing Disclosure, they can verify that the final terms match what was initially agreed upon. This process helps prevent last-minute surprises at closing, ensuring a smoother transaction for all parties involved.

Quick guide on how to complete disclosures required

Effortlessly Prepare Disclosures Required on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to easily find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Disclosures Required across all platforms with the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Modify and Electronically Sign Disclosures Required with Ease

- Locate Disclosures Required and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Disclosures Required to ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key disclosures required within 3 days for residential real property?

The key disclosures required within 3 days for residential real property typically include information about lead-based paint, property condition, and other material facts that could impact the buyer's decision. Ensuring these disclosures are complete is crucial for compliance and transparency in transactions.

-

How can airSlate SignNow assist in managing disclosures required within 3 days for residential real property?

airSlate SignNow streamlines the process of gathering and distributing disclosures required within 3 days for residential real property. Our platform allows users to easily send, receive, and electronically sign these critical documents, ensuring full compliance in a timely manner.

-

Is there a cost associated with using airSlate SignNow for disclosures required within 3 days for residential real property?

Yes, airSlate SignNow offers flexible pricing plans to suit different business needs. The cost for using the service to manage disclosures required within 3 days for residential real property will depend on the selected plan, with options for individuals and large teams.

-

What features does airSlate SignNow offer for handling real estate disclosures?

AirSlate SignNow includes features such as document templates, secure eSignature capabilities, and automated workflows tailored for real estate professionals. These features help manage disclosures required within 3 days for residential real property efficiently and effortlessly.

-

How do I integrate airSlate SignNow with my existing real estate software?

Integrating airSlate SignNow with your real estate software is straightforward, thanks to our robust API and available integrations with popular platforms. This ensures you can manage disclosures required within 3 days for residential real property seamlessly within your current systems.

-

What benefits can I expect from using airSlate SignNow for real estate transactions?

Using airSlate SignNow for real estate transactions enhances efficiency by reducing paperwork and streamlining communication. This is especially beneficial for managing disclosures required within 3 days for residential real property, allowing for quicker closings and improved client satisfaction.

-

Can airSlate SignNow help with compliance regulations regarding disclosures?

Absolutely, airSlate SignNow is designed to assist users in adhering to compliance regulations concerning disclosures required within 3 days for residential real property. Our platform ensures that all necessary documents are signed and stored securely, providing an audit trail for accountability.

Get more for Disclosures Required

- Fillable form ssa 521free printable pdf sampleformswift

- Proppraprocurementrequest for proposalfree 30 day form

- Form ssa 2 information you need to apply for social security

- Fillable online business unr any form of cheating in

- Safety and healthdepartment of labor form

- Include area codedsn form

- 2018 2021 form sba 1919 fill online printable fillable

- Dd form 293 ampquotapplication for the review of dischargefrom the armed forces of the united statesampquot

Find out other Disclosures Required

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement