Credit Card Application for Unsecured Open End Credit Form

What is the Credit Card Application For Unsecured Open End Credit

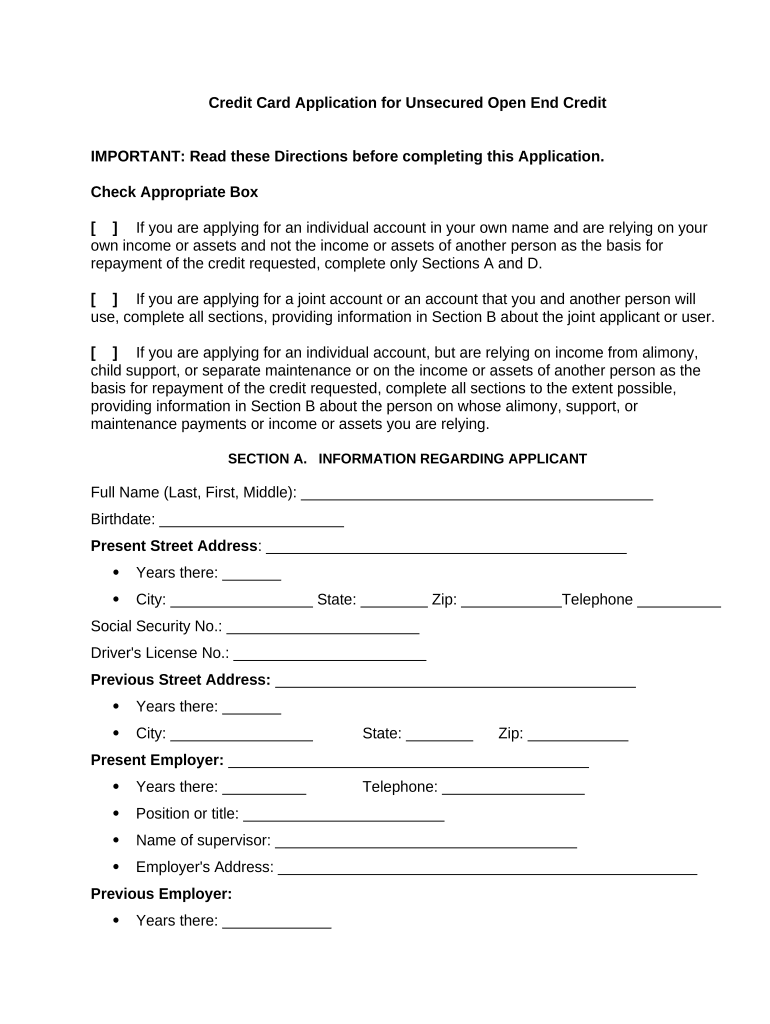

The Credit Card Application for Unsecured Open End Credit is a formal request submitted by individuals seeking to obtain a credit card that does not require collateral. This type of credit card allows users to borrow funds up to a specified limit without the need for secured assets, such as property or savings. The application typically requires personal information, including income, employment details, and credit history, to assess the applicant's creditworthiness. Understanding this application is crucial for anyone looking to manage their finances effectively while enjoying the benefits of credit access.

Steps to complete the Credit Card Application For Unsecured Open End Credit

Completing the Credit Card Application for Unsecured Open End Credit involves several key steps:

- Gather necessary information: Collect personal details, including your Social Security number, income, employment status, and housing information.

- Choose a credit card: Research various credit card options to find one that suits your needs, such as rewards programs or low-interest rates.

- Fill out the application: Accurately complete the application form, ensuring all information is correct and up to date.

- Review your application: Double-check for any errors or omissions before submitting.

- Submit the application: Send your completed application electronically or via mail, depending on the issuer's requirements.

Legal use of the Credit Card Application For Unsecured Open End Credit

The legal use of the Credit Card Application for Unsecured Open End Credit is governed by federal and state laws that protect consumers during the application process. Compliance with the Fair Credit Reporting Act (FCRA) ensures that applicants are informed about how their credit information will be used. Additionally, the Equal Credit Opportunity Act (ECOA) prohibits discrimination based on race, color, religion, national origin, sex, marital status, or age. Understanding these legal frameworks helps applicants navigate the process with confidence and security.

Eligibility Criteria

Eligibility for the Credit Card Application for Unsecured Open End Credit typically includes several important criteria:

- Age: Applicants must be at least eighteen years old.

- Residency: Applicants must be U.S. residents or citizens.

- Income: A stable source of income is usually required to demonstrate the ability to repay borrowed funds.

- Credit history: A satisfactory credit score is often necessary to qualify for unsecured credit.

How to obtain the Credit Card Application For Unsecured Open End Credit

Obtaining the Credit Card Application for Unsecured Open End Credit is a straightforward process. Most credit card issuers provide applications online through their websites. Applicants can also request a physical application by contacting customer service or visiting a local bank branch. It is advisable to compare different credit card options before applying to ensure the best fit for your financial situation.

Application Process & Approval Time

The application process for the Credit Card Application for Unsecured Open End Credit generally involves submitting your application and waiting for a decision from the credit card issuer. Approval times can vary significantly based on the issuer's policies and the applicant's credit profile. Many issuers provide instant approval for applicants with strong credit histories, while others may take several days to review applications. Once approved, cardholders typically receive their credit card in the mail within one to two weeks.

Quick guide on how to complete credit card application for unsecured open end credit

Complete Credit Card Application For Unsecured Open End Credit effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Credit Card Application For Unsecured Open End Credit on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Credit Card Application For Unsecured Open End Credit with ease

- Locate Credit Card Application For Unsecured Open End Credit and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tiresome form searches, or mistakes that necessitate new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Credit Card Application For Unsecured Open End Credit and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to complete a Credit Card Application For Unsecured Open End Credit?

To complete the Credit Card Application For Unsecured Open End Credit, simply visit our website and fill out the online application form. Ensure you provide accurate information to expedite the approval process. Once submitted, you will receive an email confirmation along with next steps.

-

What are the eligibility requirements for a Credit Card Application For Unsecured Open End Credit?

Eligibility requirements for a Credit Card Application For Unsecured Open End Credit typically include being at least 18 years old, having a steady income, and a good credit score. Each lender may have specific criteria, so it's essential to review their requirements before applying. Meeting these criteria can increase your chances of approval.

-

What benefits does an unsecured credit card offer over secured options?

An unsecured credit card, such as what is offered through a Credit Card Application For Unsecured Open End Credit, does not require a security deposit, making it more accessible for many users. You also may benefit from higher credit limits and potentially better rewards programs. This provides greater flexibility in managing your finances.

-

Are there any fees associated with the Credit Card Application For Unsecured Open End Credit?

When applying for a Credit Card Application For Unsecured Open End Credit, you may encounter annual fees, late payment fees, or cash advance fees depending on the card issuer. It's important to read the terms and conditions closely to understand these costs. This way, you can choose the best card that suits your budget.

-

How does airSlate SignNow help in the credit card application process?

airSlate SignNow simplifies the Credit Card Application For Unsecured Open End Credit by allowing users to quickly eSign necessary documents. Our platform is user-friendly and ensures that all documents are securely stored and easily accessible. This reduces the administrative burden and streamlines the entire application process.

-

Can I integrate airSlate SignNow with other accounting or financial tools?

Yes, airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage your Credit Card Application For Unsecured Open End Credit alongside your other financial tools. This seamless integration improves workflow efficiency and ensures all your documents are in one place. Visit our integrations page to see all available options.

-

What should I do if my Credit Card Application For Unsecured Open End Credit is denied?

If your Credit Card Application For Unsecured Open End Credit is denied, review the reasons provided by the lender, as they typically include low credit scores or insufficient income. Consider taking steps to improve your credit profile before reapplying. You may also explore alternative credit options suitable for your circumstances.

Get more for Credit Card Application For Unsecured Open End Credit

- Bugema university application form download

- Enrollment verification request thomas nelson community tncc form

- Christine wyka memorial scholarship grant lucascubs form

- Multi family affidavit form

- Baigacademy form

- Course change request mayo high school form

- Pfd filler form

- Dichotomous key worksheet answers pdf form

Find out other Credit Card Application For Unsecured Open End Credit

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement