Small Business Form

What is the franchise feasibility form?

The franchise feasibility form is a crucial document that helps potential franchisees assess the viability of investing in a specific franchise opportunity. It typically includes detailed information about the franchise system, financial projections, market analysis, and operational requirements. By completing this form, individuals can evaluate whether the franchise aligns with their business goals and financial capabilities, allowing for informed decision-making.

Steps to complete the franchise feasibility form

Completing the franchise feasibility form involves several key steps to ensure accuracy and thoroughness. First, gather all necessary financial documents, including personal financial statements and credit history. Next, research the franchise opportunity to understand its market position and growth potential. Fill out the form with detailed and honest information regarding your financial situation, business experience, and any relevant qualifications. Finally, review the completed form for clarity and completeness before submission.

Legal use of the franchise feasibility form

To ensure the legal validity of the franchise feasibility form, it is essential to comply with relevant laws and regulations. This includes adhering to the Federal Trade Commission (FTC) guidelines that govern franchise sales and disclosures. The form must accurately represent the franchise opportunity and not contain misleading information. Additionally, obtaining legal advice before submitting the form can help clarify obligations and rights under franchise law.

Key elements of the franchise feasibility form

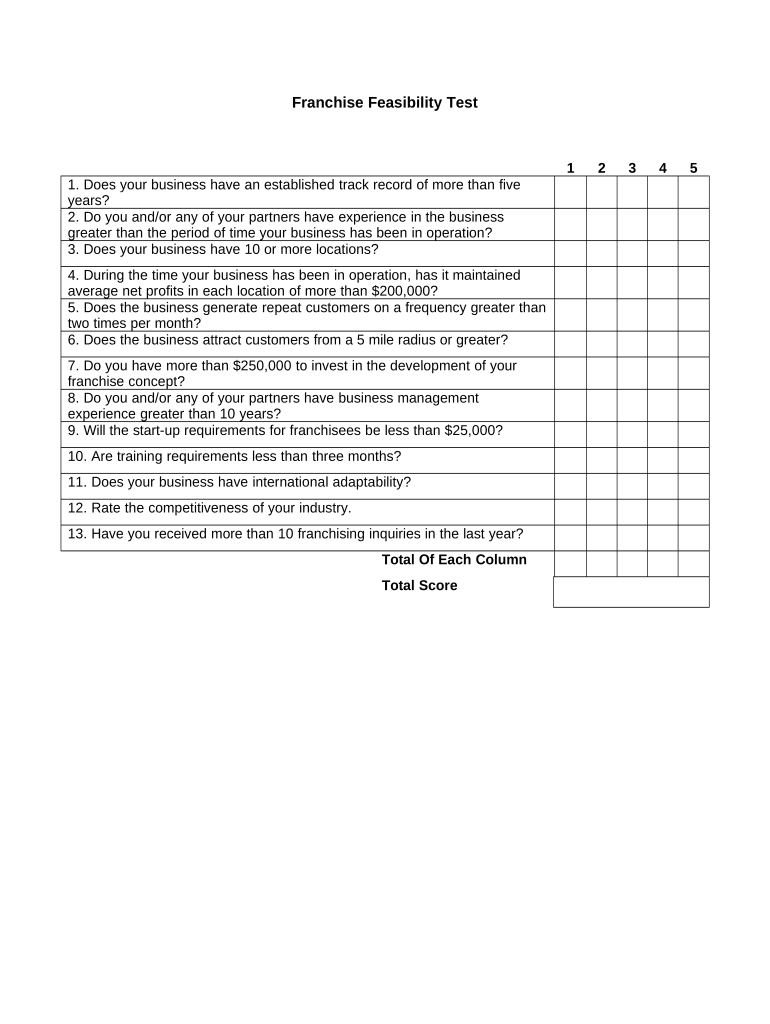

Several key elements must be included in the franchise feasibility form to provide a comprehensive overview of the franchise opportunity. These elements typically encompass:

- Franchise Overview: A summary of the franchise concept, including its history and market presence.

- Financial Projections: Estimated startup costs, ongoing fees, and potential revenue streams.

- Market Analysis: Information on target demographics, competition, and market trends.

- Operational Requirements: Details on training, support, and operational standards expected from franchisees.

Examples of using the franchise feasibility form

Utilizing the franchise feasibility form can take various forms depending on individual circumstances. For instance, a prospective franchisee may use the form to compare multiple franchise opportunities side by side, evaluating which aligns best with their financial and personal goals. Additionally, existing franchisees may complete the form when considering expansion into new territories, assessing the feasibility of adding another location. These examples illustrate how the form serves as a valuable tool in the decision-making process.

Eligibility criteria for the franchise feasibility form

Eligibility to complete the franchise feasibility form typically requires a genuine interest in becoming a franchisee. Potential franchisees should possess a basic understanding of business operations and have the financial means to invest in a franchise. Some franchisors may also have specific criteria regarding prior business experience or educational background. Meeting these eligibility criteria ensures that candidates are well-prepared to evaluate their potential involvement in the franchise system.

Quick guide on how to complete small business form

Effortlessly prepare Small Business Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Small Business Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

Easily modify and eSign Small Business Form without effort

- Obtain Small Business Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize crucial parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional hand-signed signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Small Business Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is franchise feasibility, and why is it important?

Franchise feasibility is an assessment that evaluates the potential success of a franchise business model. It is important because it helps prospective franchise owners make informed decisions by analyzing market demand, financial projections, and operational requirements before investing.

-

How can airSlate SignNow assist with franchise feasibility assessments?

airSlate SignNow streamlines the documentation process required for franchise feasibility assessments. With its eSigning capabilities, businesses can efficiently gather necessary approvals and signatures, allowing for faster decision-making and a more comprehensive evaluation of franchise opportunities.

-

What features does airSlate SignNow offer that support franchise feasibility?

airSlate SignNow offers features such as customizable templates, document tracking, and team collaboration tools. These features help businesses efficiently manage the paperwork associated with franchise feasibility studies and ensure all stakeholders are on the same page.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore its features before making a commitment. This enables businesses to see how the platform can assist with their franchise feasibility needs without any initial investment.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Whether you're a small franchise or a large enterprise, there is a cost-effective solution that can support your franchise feasibility efforts.

-

Can airSlate SignNow integrate with other business applications for franchise feasibility?

Absolutely, airSlate SignNow integrates seamlessly with a wide range of business applications. This integration capability enhances the franchise feasibility assessment process by allowing data to flow smoothly between different platforms, improving efficiency and accuracy.

-

What benefits does airSlate SignNow provide for franchise business owners?

The primary benefits of using airSlate SignNow for franchise business owners include increased efficiency, reduced paperwork, and enhanced security for sensitive documents. These advantages simplify the franchise feasibility process, allowing owners to focus on strategic growth rather than administrative tasks.

Get more for Small Business Form

- Montana introduction family law form

- Alaska certified payroll form fill in 2008

- 10 hour shift waiver form alaska

- Alaska pamphlet 300 form

- Minimum wage exemption for handicapped persons alaska labor alaska form

- Pamphlet 400 form

- Title 36 complaint form alaska department of labor and workforce labor alaska

- Pdf labor alaska search form

Find out other Small Business Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors