Consumer Credit Application Form

What is the Consumer Credit Application

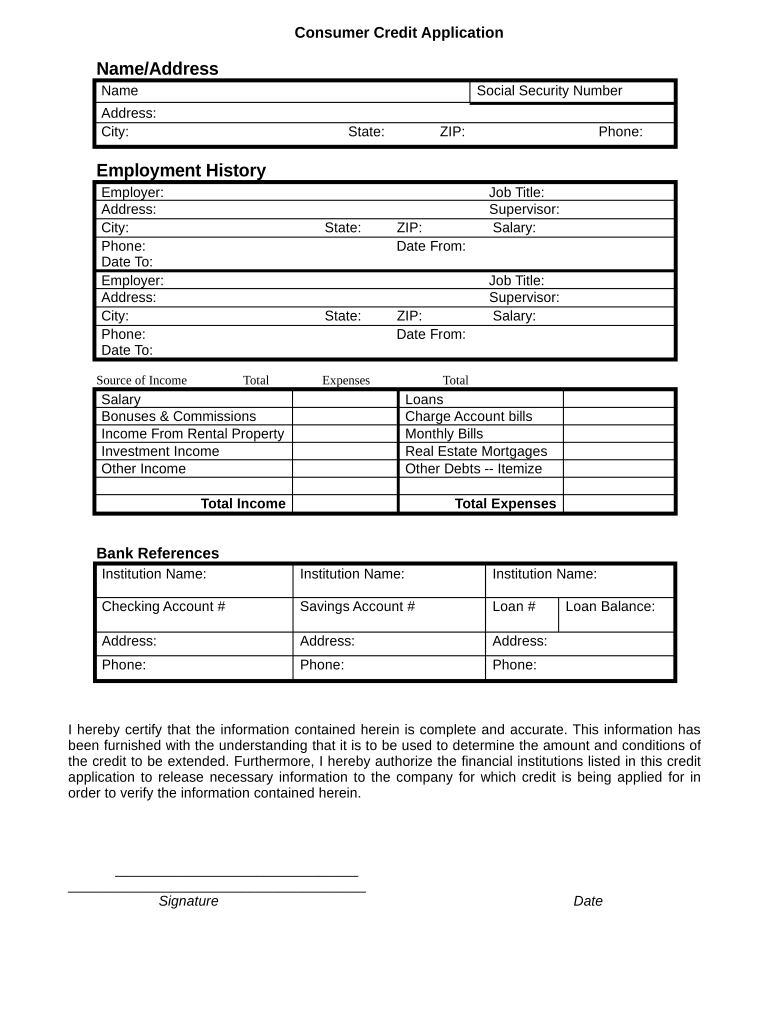

The Consumer Credit Application is a formal document used by individuals to apply for credit from financial institutions. This form collects essential information about the applicant's financial status, including income, employment history, and existing debts. By providing this information, lenders can assess the creditworthiness of the applicant and make informed decisions regarding loan approvals.

How to use the Consumer Credit Application

Using the Consumer Credit Application involves several straightforward steps. First, gather all necessary personal and financial information, such as Social Security number, income details, and employment history. Next, complete the application form accurately, ensuring all fields are filled out. After filling out the form, review it for any errors or omissions. Finally, submit the application electronically or in person, depending on the lender's requirements.

Steps to complete the Consumer Credit Application

Completing the Consumer Credit Application requires careful attention to detail. Follow these steps:

- Gather personal information, including your full name, address, and contact details.

- Provide your Social Security number and date of birth.

- List your employment information, including your employer's name, address, and your job title.

- Detail your income sources, including salary, bonuses, and any additional income.

- Disclose any existing debts, such as loans or credit cards, along with their balances.

- Review the application for accuracy before submission.

Legal use of the Consumer Credit Application

The legal use of the Consumer Credit Application is governed by various regulations that ensure fair lending practices. Lenders must comply with the Equal Credit Opportunity Act (ECOA), which prohibits discrimination based on race, gender, or other protected characteristics. Additionally, the Fair Credit Reporting Act (FCRA) mandates that lenders inform applicants if their credit report was used in the decision-making process. Understanding these legal frameworks helps ensure that the application process is conducted fairly and transparently.

Key elements of the Consumer Credit Application

Several key elements are essential to the Consumer Credit Application. These include:

- Personal Information: This section collects basic details about the applicant.

- Employment Information: Provides insight into the applicant's job stability and income.

- Financial Information: Details about income and existing debts help assess creditworthiness.

- Signature: The applicant's signature indicates consent for the lender to review their credit history.

Eligibility Criteria

Eligibility for the Consumer Credit Application varies by lender but generally includes specific criteria that applicants must meet. Common requirements include:

- Minimum age of eighteen years.

- Proof of income or employment.

- Valid Social Security number.

- Residency in the United States.

Quick guide on how to complete consumer credit application

Prepare Consumer Credit Application effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Consumer Credit Application on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and eSign Consumer Credit Application with ease

- Find Consumer Credit Application and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Consumer Credit Application while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Consumer Credit Application?

A Consumer Credit Application is a form that potential borrowers fill out to apply for credit. It collects essential information, such as personal details and financial history, to assist lenders in determining creditworthiness. airSlate SignNow makes it easy to create, send, and eSign these applications securely.

-

How does airSlate SignNow simplify the Consumer Credit Application process?

airSlate SignNow streamlines the Consumer Credit Application process by providing a user-friendly interface for creating and sending applications. It allows for seamless eSigning, which reduces processing time and ensures that documents are returned swiftly. This efficiency helps businesses get the necessary approvals faster.

-

What are the key features of airSlate SignNow for handling Consumer Credit Applications?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSigning capabilities. These tools enable businesses to tailor their Consumer Credit Application to meet specific needs while ensuring compliance and security. Additionally, tracking and notifications help streamline the entire process.

-

Is airSlate SignNow affordable for managing Consumer Credit Applications?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. Its competitive pricing for processing Consumer Credit Applications ensures that companies can manage their document needs without breaking the bank. Customers can choose a plan that aligns with their volume and budget.

-

Can I integrate airSlate SignNow with other software while using the Consumer Credit Application?

Absolutely! airSlate SignNow supports various integrations with popular software platforms such as CRM and financial applications. This allows businesses to streamline their workflows when managing Consumer Credit Applications and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for Consumer Credit Applications?

The benefits of using airSlate SignNow for Consumer Credit Applications include increased efficiency, reduced paperwork, and improved customer experience. By automating the process and enabling eSigning, businesses can focus on decision-making rather than administrative tasks. This ultimately leads to faster loan approvals.

-

Is the Consumer Credit Application process secure with airSlate SignNow?

Yes, security is a top priority with airSlate SignNow. The platform employs advanced encryption and secure storage to protect all Consumer Credit Application data. This ensures that sensitive information remains confidential and compliant with industry regulations.

Get more for Consumer Credit Application

- How to cancel modere membership form

- Fellowship application cover sheet chronicle books form

- Usra license form

- Amend standing form

- Carolina tax trusts ampamp estates ep intake form

- Case ih combine inspection form

- Guidance on the use of concentration ranges pursuant to the form

- 2019 summer camp volunteer application form

Find out other Consumer Credit Application

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now