Commission Summary Form

What is the Commission Summary

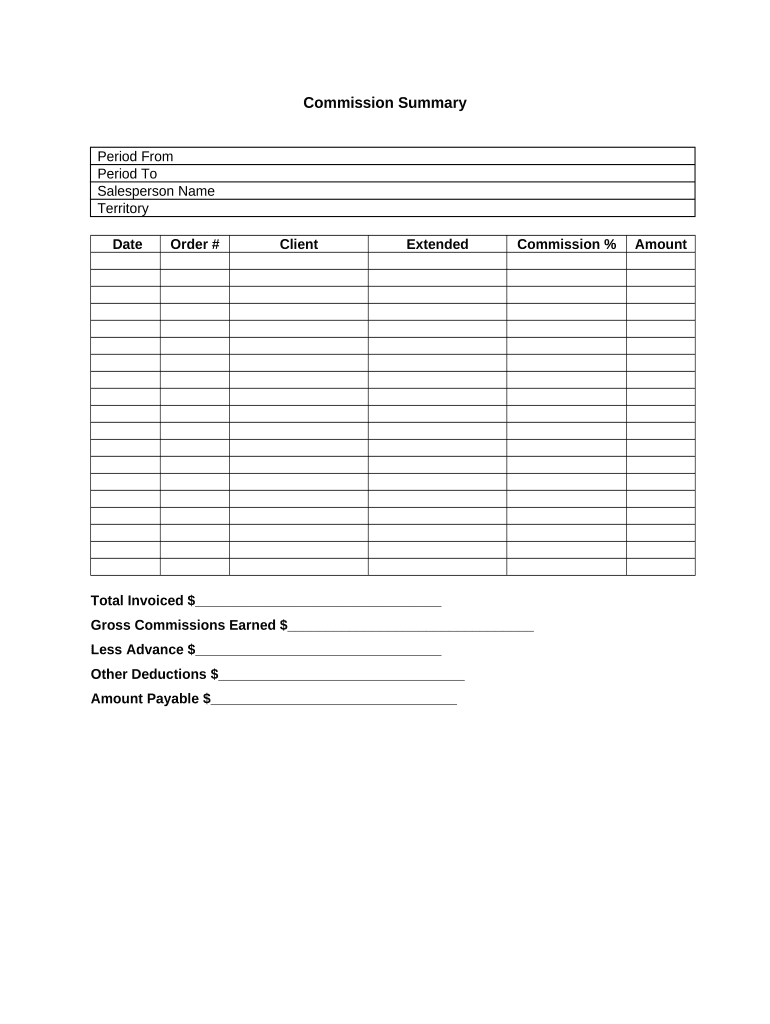

The Commission Summary is a vital document used primarily to outline the earnings and commissions of sales professionals or agents. This form provides a detailed account of the commissions earned over a specific period, often required for tax reporting and financial transparency. It typically includes information such as the total sales made, the commission rates applied, and any deductions or adjustments necessary for accurate reporting. Understanding this document is crucial for both the individual earning the commissions and the businesses that employ them.

How to use the Commission Summary

Using the Commission Summary effectively involves several key steps. First, gather all relevant sales data, including invoices and sales receipts. Next, calculate the total commissions earned based on the sales figures and agreed-upon commission rates. It is essential to ensure that all figures are accurate to avoid discrepancies during tax filing or audits. Once the calculations are complete, the Commission Summary can be filled out, detailing each component clearly. This document can then be used for personal records, submitted to employers, or included in tax filings.

Steps to complete the Commission Summary

Completing the Commission Summary involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all sales data for the reporting period.

- Calculate total sales and applicable commission rates.

- Document any adjustments or deductions that affect the final commission amount.

- Fill out the Commission Summary form, ensuring all figures are clearly presented.

- Review the completed form for accuracy before submission.

Legal use of the Commission Summary

The Commission Summary is legally binding when completed accurately and in accordance with applicable laws. It serves as a formal record of earnings and is often required for tax reporting purposes. Compliance with IRS guidelines is essential, as inaccuracies can lead to penalties or audits. Utilizing a reliable platform for electronic signatures can further enhance the legal standing of the Commission Summary, ensuring that all parties involved are in agreement regarding the information presented.

Key elements of the Commission Summary

Several key elements must be included in the Commission Summary to ensure it serves its intended purpose effectively. These elements typically include:

- Full name and contact information of the individual earning the commission.

- Details of the sales transactions, including dates and amounts.

- Commission rates applied to each sale.

- Total commissions earned during the reporting period.

- Any deductions or adjustments that may apply.

Examples of using the Commission Summary

The Commission Summary can be utilized in various scenarios. For instance, a real estate agent may use it to report commissions earned from property sales to their brokerage. Similarly, sales representatives in retail may need to submit this form to their employer for payroll processing. In both cases, the Commission Summary provides a clear and concise record of earnings, facilitating accurate accounting and compliance with tax obligations.

Quick guide on how to complete commission summary

Complete Commission Summary effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly and without delays. Manage Commission Summary on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Commission Summary without hassle

- Find Commission Summary and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Commission Summary and ensure top-notch communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Commission Summary in airSlate SignNow?

A Commission Summary in airSlate SignNow provides a detailed overview of commissions related to your transactions. It enables businesses to track earnings, manage commissions effectively, and ensure accurate reporting. This feature helps streamline processes and enhances transparency in financial dealings.

-

How can I create a Commission Summary using airSlate SignNow?

Creating a Commission Summary in airSlate SignNow is simple. You can generate summaries directly from your transactions by selecting the relevant documents. The system compiles the necessary data, allowing you to review and export the summary for your records.

-

Is there a cost associated with accessing the Commission Summary feature?

The cost of accessing the Commission Summary feature varies based on your subscription plan with airSlate SignNow. Basic plans may include limited access, while premium plans offer comprehensive features including advanced reporting. It's best to check our pricing page for detailed information on what each plan offers.

-

What are the benefits of using airSlate SignNow for Commission Summaries?

Using airSlate SignNow for your Commission Summaries streamlines your documentation process and improves accuracy. You’ll save time with automated data compilation and ensure compliance. Plus, the easy-to-navigate interface enhances user experience, making it accessible even for those with minimal technical expertise.

-

Can I integrate Commission Summary features with other tools?

Yes, airSlate SignNow allows you to integrate Commission Summary features with various applications. You can connect it to CRM systems and financial software, enhancing your workflow and data management. The seamless integration ensures that your commission data is always synced and accessible across platforms.

-

What types of documents work with Commission Summary in airSlate SignNow?

The Commission Summary feature in airSlate SignNow can analyze various document types related to transactions, including sales agreements, payment records, and invoices. You can easily upload relevant documents, and the system will extract and summarize the pertinent commission information. This flexibility helps in maintaining detailed records.

-

How does airSlate SignNow ensure the accuracy of Commission Summaries?

AirSlate SignNow employs advanced algorithms to ensure the accuracy of your Commission Summaries. Data is cross-verified with transaction details and real-time updates are provided whenever changes occur. This commitment to accuracy reduces errors and enhances trust in your financial reports.

Get more for Commission Summary

Find out other Commission Summary

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms