Review Loan Application Form

What is the review loan application?

The review loan application is a formal document used by individuals or businesses to request a loan from a financial institution. This application typically includes personal and financial information, such as income, credit history, and the purpose of the loan. The review process allows lenders to assess the applicant's creditworthiness and determine the terms of the loan. Understanding the components of the application is crucial for ensuring that all necessary information is provided accurately, which can significantly impact the approval process.

Steps to complete the review loan application

Completing a review loan application involves several key steps to ensure accuracy and compliance with lender requirements. Here’s a straightforward approach:

- Gather necessary documents: Collect financial statements, proof of income, and identification.

- Fill out personal information: Provide your name, address, Social Security number, and contact details.

- Detail your financial situation: Include information about your employment, income, debts, and assets.

- Specify loan details: Indicate the amount you wish to borrow and the purpose of the loan.

- Review and sign: Carefully check all entries for accuracy before signing the application.

Legal use of the review loan application

The review loan application must comply with various legal standards to be considered valid. In the United States, eSignature laws, such as the ESIGN Act and UETA, govern the electronic signing of documents. These laws ensure that electronic signatures are legally binding and enforceable. Additionally, lenders must adhere to regulations regarding the collection and handling of personal information, ensuring that applicants' data is protected throughout the process.

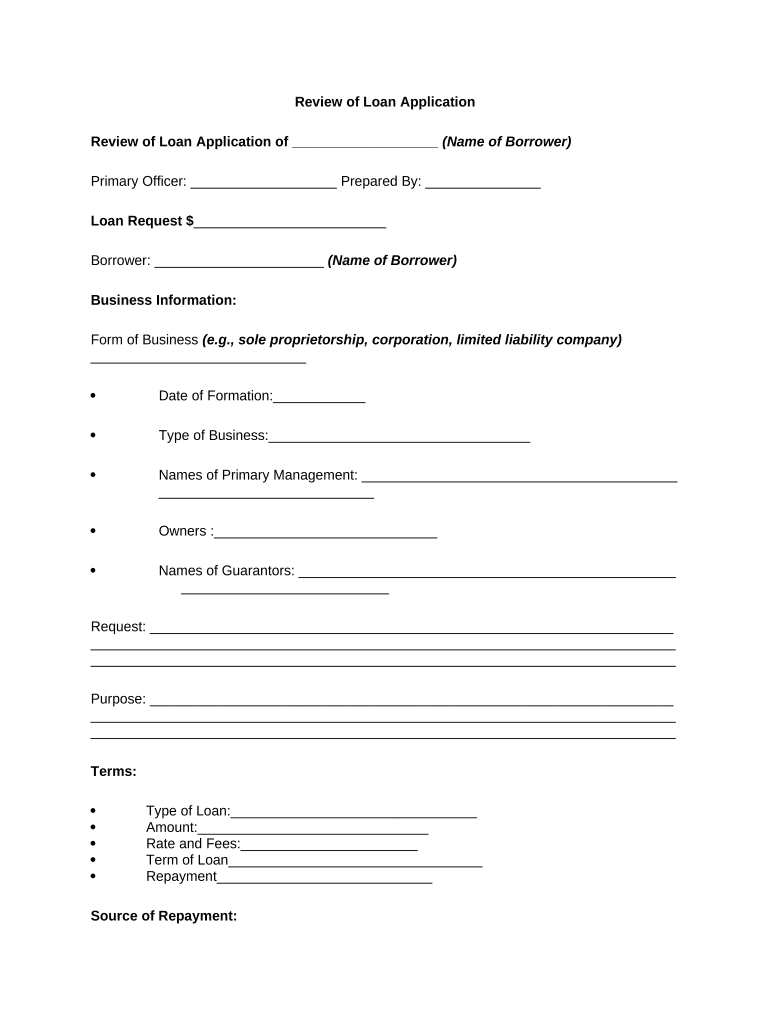

Key elements of the review loan application

Several essential components make up a complete review loan application. These include:

- Personal information: Name, address, and Social Security number.

- Employment details: Current employer, job title, and length of employment.

- Financial information: Monthly income, existing debts, and assets.

- Loan specifics: Desired loan amount, purpose, and repayment terms.

Providing accurate and comprehensive information in these sections helps facilitate a smoother review process.

How to use the review loan application

Using the review loan application effectively involves understanding its purpose and the information required. Applicants should fill out the form with precise details, ensuring that all sections are completed. After submission, it is advisable to keep a copy of the application for personal records. This can help in tracking the application status and addressing any follow-up questions from the lender. Additionally, being prepared to provide further documentation or clarification may expedite the review process.

Required documents

When submitting a review loan application, certain documents are typically required to support the information provided. Commonly needed documents include:

- Proof of identity: A government-issued ID or passport.

- Income verification: Recent pay stubs, tax returns, or bank statements.

- Credit history: A credit report may be requested to assess creditworthiness.

- Asset documentation: Records of any significant assets, such as property or investments.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Quick guide on how to complete review loan application

Complete Review Loan Application effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly without hold-ups. Handle Review Loan Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Review Loan Application without any hassle

- Locate Review Loan Application and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Review Loan Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How does airSlate SignNow help in reviewing loan applications?

airSlate SignNow streamlines the process to review loan applications by allowing users to send, sign, and manage documents digitally. This simplifies communication among all parties involved and ensures that all necessary paperwork is easily accessible. Moreover, the ability to track the status of each document helps businesses stay organized and efficient during the review process.

-

What features do I get with airSlate SignNow for loan application reviews?

With airSlate SignNow, you gain access to features like customizable templates, real-time document tracking, and automated reminders, which enhance the loan application review process. These features allow businesses to quickly request signatures and gather necessary information, ensuring a smooth review experience. Additionally, the platform supports multiple file formats and integrates seamlessly with other applications.

-

Is airSlate SignNow cost-effective for reviewing loan applications?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses looking to review loan applications efficiently. Competitive pricing plans cater to organizations of all sizes, and the time saved through electronic reviews signNowly reduces overall operational costs. This makes airSlate SignNow an ideal choice for companies wanting to streamline their loan application processes.

-

Can I integrate airSlate SignNow with my existing loan management system?

Absolutely! airSlate SignNow offers integrations with various loan management systems and other essential software. This flexibility allows you to enhance your current workflow when reviewing loan applications without disrupting your existing setup. Integrating these systems fosters a seamless experience for users managing documents.

-

How secure is the document handling with airSlate SignNow during loan application reviews?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication methods to protect your documents throughout the loan application review process. This ensures that sensitive information related to loan applications remains confidential and secure. Additionally, the platform complies with industry standards, giving you peace of mind.

-

What are the benefits of using airSlate SignNow for small businesses reviewing loan applications?

For small businesses, airSlate SignNow offers an easy-to-use platform that simplifies the loan application review process, allowing you to focus on core operations. The cost-effective solution enables quicker document turnaround, which can enhance customer satisfaction. Ultimately, leveraging this tool can help you compete more effectively in the market.

-

How can I track the status of my loan applications in airSlate SignNow?

In airSlate SignNow, tracking the status of loan applications is straightforward with real-time notifications and updates. You can monitor when documents are sent, signed, or viewed, which gives you better control over the review process. This transparency helps you stay informed and enhances your ability to manage loan applications efficiently.

Get more for Review Loan Application

Find out other Review Loan Application

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple