Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws Form

What is the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

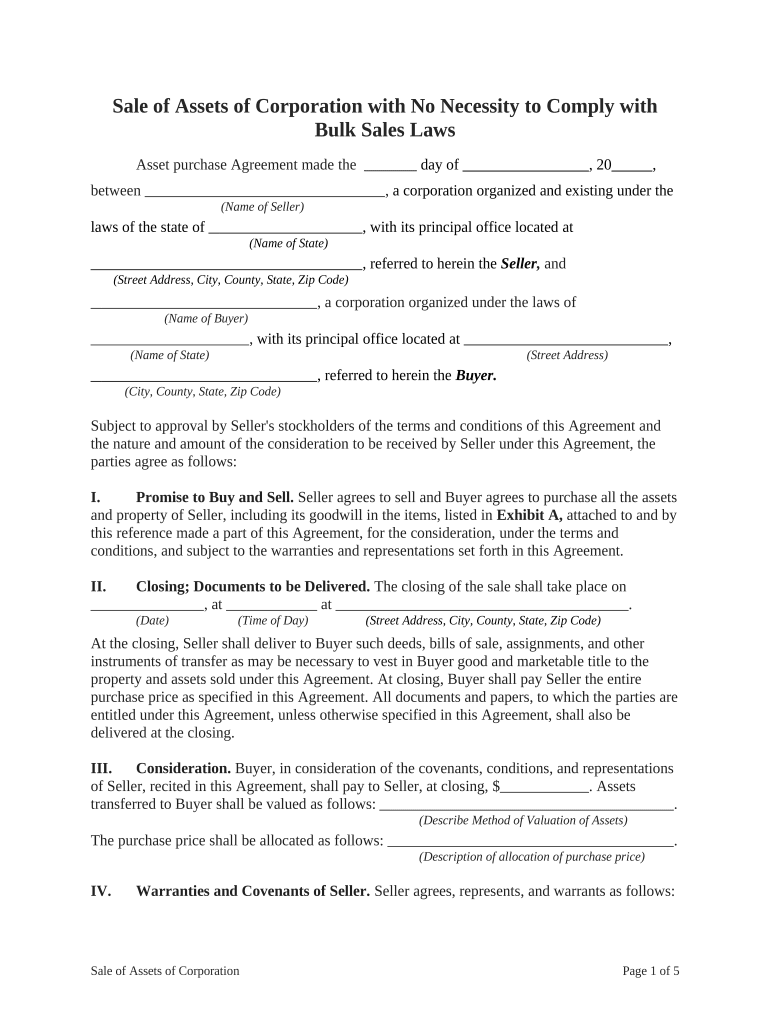

The sale of assets of a corporation with no necessity to comply with bulk sales laws refers to a transaction where a corporation can sell its assets without adhering to specific regulations that typically govern bulk sales. Bulk sales laws are designed to protect creditors by requiring sellers to notify them of significant asset sales. When a corporation qualifies for this exemption, it can streamline the process of asset liquidation, making it easier to conduct business transactions efficiently. Understanding this exemption is crucial for corporations looking to manage their assets effectively while minimizing legal complications.

Steps to Complete the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

Completing the sale of assets under this exemption involves several important steps:

- Identify the assets to be sold and ensure they are eligible for sale without bulk sales compliance.

- Gather all necessary documentation, including ownership records and valuation reports.

- Draft a sales agreement that outlines the terms of the sale, including price, payment terms, and any warranties.

- Ensure all parties involved in the transaction understand and agree to the terms outlined in the sales agreement.

- Execute the agreement, ensuring all required signatures are obtained.

- Maintain copies of all documents for record-keeping and future reference.

Legal Use of the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

Legally utilizing the sale of assets exemption requires adherence to specific guidelines. Corporations must ensure that the sale does not adversely affect creditors or violate any existing agreements. The transaction should be conducted transparently, with all relevant parties informed. Additionally, it is advisable to consult legal counsel to confirm compliance with state laws and regulations, as these can vary significantly. Proper legal use of this exemption helps protect the corporation from potential disputes or claims from creditors after the sale.

Key Elements of the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

Several key elements define the sale of assets under this exemption:

- Eligibility: The corporation must meet specific criteria to qualify for the exemption.

- Documentation: Proper documentation is essential to support the legitimacy of the sale.

- Agreement Terms: The sales agreement must clearly outline the terms and conditions of the transaction.

- Transparency: All parties involved should be fully informed about the transaction to avoid disputes.

Examples of Using the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

Examples of situations where a corporation might utilize this exemption include:

- A corporation selling off excess inventory to streamline operations without notifying creditors.

- A business liquidating non-essential assets to raise funds for new projects.

- A company restructuring its operations and selling assets to a third party without the bulk sales process.

State-Specific Rules for the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

State regulations can significantly impact how the sale of assets is conducted. Each state may have different rules regarding the exemption from bulk sales laws. Corporations should familiarize themselves with their state’s specific regulations, including any necessary filings or notifications. Consulting with a legal professional familiar with local laws can provide valuable guidance and ensure compliance.

Quick guide on how to complete sale of assets of corporation with no necessity to comply with bulk sales laws

Complete Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Handle Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws effortlessly

- Locate Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws and ensure stellar communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

The Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws refers to the ability of a corporation to sell its assets without adhering to complex legal requirements typically imposed by bulk sales laws. This simplifies the process, allowing businesses to operate more flexibly and efficiently while managing their asset sales.

-

How can airSlate SignNow facilitate the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

airSlate SignNow provides a seamless platform for businesses to create, send, and eSign documents related to the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws. Our easy-to-use interface ensures that all necessary documentation can be handled quickly and efficiently, minimizing legal risks and streamlining the sale process.

-

What pricing plans does airSlate SignNow offer for businesses involved in the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

airSlate SignNow offers various pricing plans tailored to fit the needs of businesses looking to manage the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws. Our competitive pricing ensures that you receive cost-effective solutions without sacrificing quality, allowing companies of all sizes to benefit from our services.

-

What features does airSlate SignNow provide for asset sales transactions?

Our platform includes features such as customizable templates, real-time tracking of document status, and secure eSigning, which are crucial for facilitating the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws. These features provide clarity and assurance throughout the transaction process, leading to smoother operations.

-

Are there any benefits to using airSlate SignNow for asset sales?

Yes, using airSlate SignNow for the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws offers numerous benefits, including increased efficiency, reduced transaction times, and lower administrative costs. Our platform empowers businesses to finalize deals faster and with greater confidence, ultimately enhancing their operational effectiveness.

-

Can airSlate SignNow integrate with other business applications for asset sales?

Absolutely! airSlate SignNow seamlessly integrates with various CRM, document management, and financial applications that support the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws. This ensures that your team can collaborate effectively and manage asset sales without switching between multiple platforms.

-

How does airSlate SignNow ensure the security of documents during asset sales?

airSlate SignNow prioritizes security while facilitating the Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws. Our platform employs advanced encryption protocols, secure data storage, and compliance with industry standards to protect your sensitive documents and transactions at all times.

Get more for Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

Find out other Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online