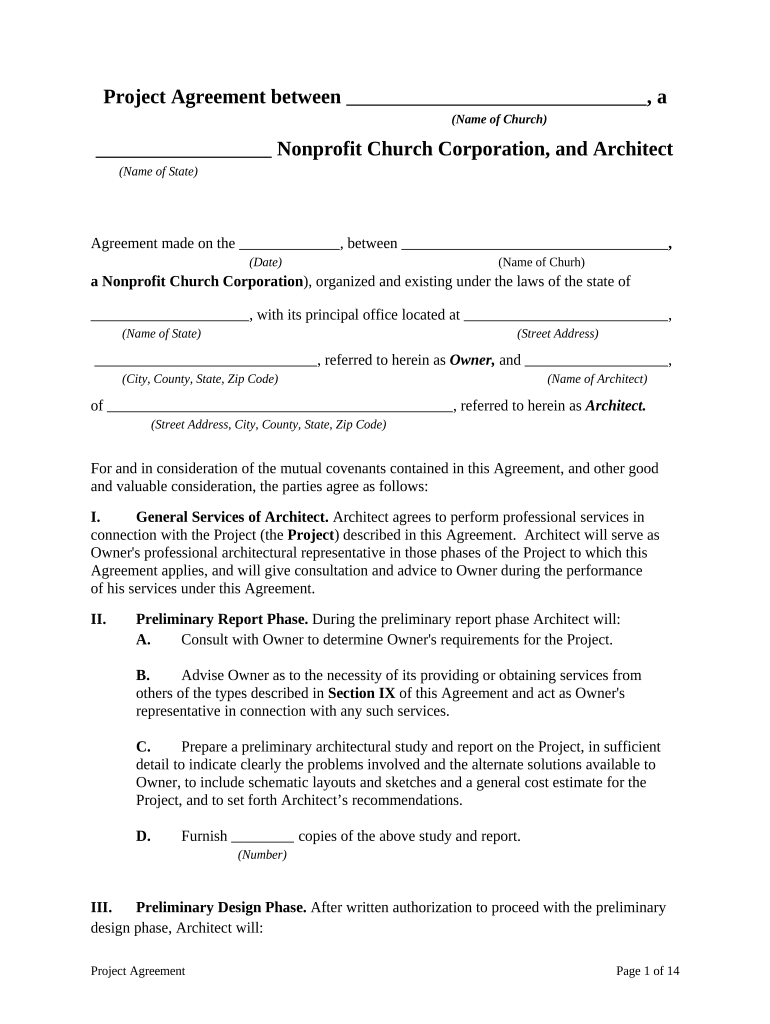

Non Profit Corporation Form

What is the non profit corporation?

A non profit corporation is an organization formed primarily for purposes other than making a profit. These entities often focus on charitable, educational, religious, or social missions. In the United States, non profit corporations can apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, allowing them to receive tax-deductible contributions. This status can enhance credibility and attract donations, which are crucial for their operations.

Key elements of the non profit corporation

Several key elements define a non profit corporation. These include:

- Mission Statement: A clear and concise statement outlining the organization's purpose and goals.

- Board of Directors: A group of individuals responsible for overseeing the organization's activities and ensuring it adheres to its mission.

- Bylaws: Rules governing the internal management of the organization, including the election of board members and meeting procedures.

- Tax-Exempt Status: Eligibility for federal and state tax exemptions, which requires adherence to specific regulations.

Steps to complete the non profit corporation

To establish a non profit corporation, follow these essential steps:

- Choose a Name: Select a unique name that reflects the organization's mission and complies with state regulations.

- Draft Bylaws: Create bylaws that outline the governance structure and operational procedures.

- File Articles of Incorporation: Submit the necessary documents to the state, including the articles of incorporation, which formally establish the organization.

- Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS, which is necessary for tax purposes.

- Apply for Tax-Exempt Status: Complete IRS Form 1023 or 1023-EZ to apply for federal tax exemption.

Legal use of the non profit corporation

The legal framework governing non profit corporations is essential for their operation. Compliance with federal and state laws ensures the organization can maintain its tax-exempt status and operate legally. Non profits must adhere to regulations regarding fundraising, reporting, and governance. This includes filing annual reports and maintaining transparency with financial records to uphold public trust.

Required documents

Establishing a non profit corporation requires several key documents:

- Articles of Incorporation: This document outlines the organization's purpose and structure.

- Bylaws: A comprehensive set of rules for governance.

- Employer Identification Number (EIN): Required for tax purposes.

- IRS Form 1023 or 1023-EZ: Application for tax-exempt status.

Filing deadlines / Important dates

Timely filing is crucial for non profit corporations. Key deadlines include:

- Articles of Incorporation: Must be filed with the state, typically within a few months of formation.

- IRS Form 1023: Should be submitted within 27 months of incorporation to receive retroactive tax-exempt status.

- Annual Reports: Many states require annual filings to maintain good standing.

Quick guide on how to complete non profit corporation

Effortlessly Prepare Non Profit Corporation on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Non Profit Corporation on any device using airSlate SignNow's Android or iOS applications and streamline your document-based tasks today.

The easiest way to modify and electronically sign Non Profit Corporation without hassle

- Obtain Non Profit Corporation and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), an invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Non Profit Corporation while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for non profit churches?

airSlate SignNow provides a variety of features that are ideal for non profit churches, including eSignature management, document templates, and secure cloud storage. These tools help streamline the signing process for important documents like donation forms and membership applications, enhancing efficiency without sacrificing security.

-

How does airSlate SignNow support the needs of non profit churches?

AirSlate SignNow is specifically designed to meet the needs of non profit churches by offering a user-friendly interface and customizable templates. This makes it easy for church administrators to collect signatures and manage documentation without the complexity often associated with traditional methods.

-

Is airSlate SignNow affordable for non profit churches?

Yes, airSlate SignNow offers flexible pricing plans that cater specifically to non profit churches. With discounted rates and features that are tailored to the budget constraints of charitable organizations, it provides a cost-effective solution for document management.

-

Can airSlate SignNow integrate with other tools commonly used by non profit churches?

Absolutely! airSlate SignNow seamlessly integrates with various software programs that non profit churches frequently use, such as CRM systems and accounting software. This integration ensures that all your church's data remains connected, improving workflow and collaboration.

-

What are the benefits of using airSlate SignNow for non profit churches?

By using airSlate SignNow, non profit churches can enhance their operational efficiency, reduce paper usage, and accelerate document turnaround times. These benefits not only save time and resources but also help ensure that church operations run smoothly, allowing leaders to focus more on their mission.

-

How secure is airSlate SignNow for non profit churches?

Security is a top priority for airSlate SignNow, especially for non profit churches handling sensitive information. The platform employs advanced encryption, secure access controls, and compliance with industry standards to protect your documents and data.

-

Can non profit churches customize templates on airSlate SignNow?

Yes, non profit churches can easily customize document templates on airSlate SignNow to fit their specific needs. This feature allows you to create forms for various purposes, from fundraising initiatives to volunteer applications, ensuring that all communications represent your church accurately.

Get more for Non Profit Corporation

- Form 16b affidavit of service

- Dmv ca gov forms search medical evaluation form

- Police check nsw form pdf

- Bureau of medical services us department of state form

- Medical clearances united states department of state form

- 2019 form pd f 1455 e fill online printable fillable blank

- Solicitud de informacin sobre el empleo formulario cms l564r297

- Department of labor family medical leave form about dol

Find out other Non Profit Corporation

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document