Letter Requesting Credit Report Form

What is the letter requesting credit report?

A letter requesting a credit report is a formal document that individuals or businesses use to obtain their credit history from credit reporting agencies. This report contains detailed information about credit accounts, payment history, and any public records related to creditworthiness. Understanding your credit report is essential for managing finances, applying for loans, or verifying the accuracy of your credit history. It serves as a vital tool for consumers to monitor their credit status and ensure that all information is accurate and up-to-date.

How to obtain the letter requesting credit report

To obtain a letter requesting a credit report, you should follow these steps:

- Identify the credit reporting agency you wish to contact, such as Experian, TransUnion, or Equifax.

- Gather necessary personal information, including your full name, address, Social Security number, and any previous addresses if you have moved recently.

- Draft your letter, clearly stating your request for a copy of your credit report. Include your personal information and any specific details required by the agency.

- Send the letter via certified mail to ensure it is received and to have a record of your request.

Steps to complete the letter requesting credit report

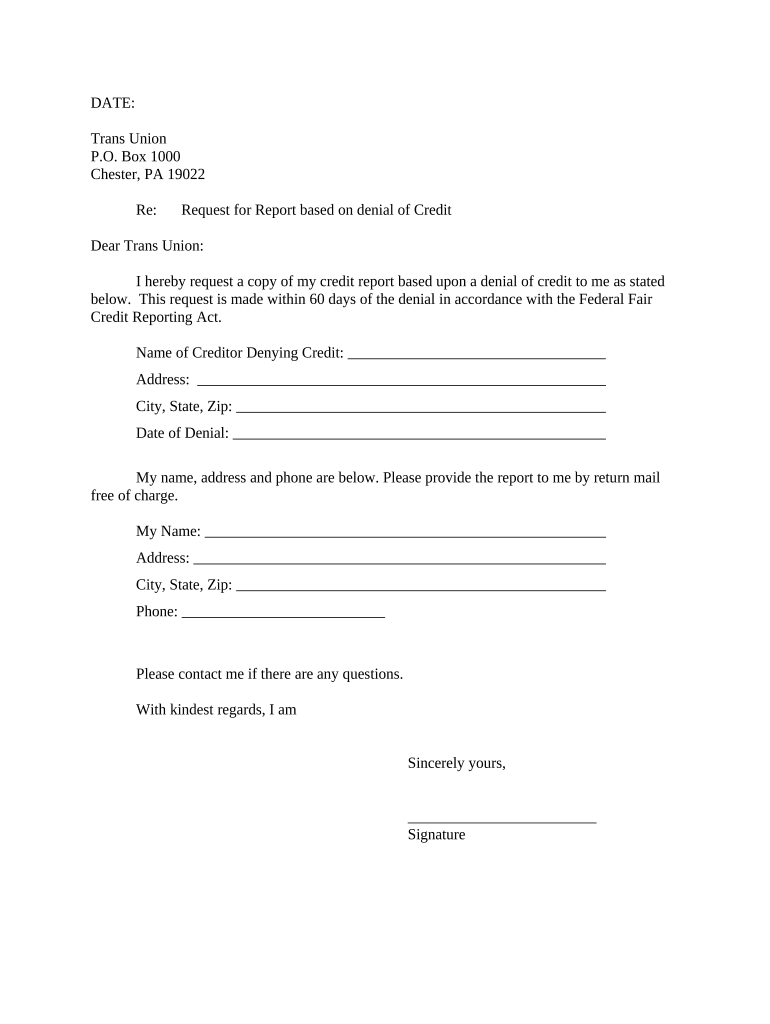

Completing a letter requesting a credit report involves several key steps to ensure it is effective:

- Begin with your contact information at the top of the letter, followed by the date.

- Address the letter to the appropriate department of the credit reporting agency.

- Clearly state your request for a copy of your credit report, mentioning any relevant details such as the reason for your request.

- Include a statement affirming your identity, such as a request for verification of your Social Security number.

- Conclude the letter with a polite closing and your signature.

Legal use of the letter requesting credit report

The letter requesting a credit report must comply with legal standards to be considered valid. Under the Fair Credit Reporting Act (FCRA), consumers are entitled to request a free credit report annually from each of the major credit bureaus. This right ensures that individuals can access their credit information without incurring costs, allowing them to check for inaccuracies or fraudulent activity. It is important to follow the guidelines set forth by the FCRA to ensure the letter is legally recognized and processed by the credit reporting agency.

Key elements of the letter requesting credit report

When drafting a letter requesting a credit report, certain key elements should be included to ensure clarity and effectiveness:

- Your full name and current address.

- Your Social Security number, or the last four digits, for identification purposes.

- Specific request for the credit report, including any relevant details.

- A statement affirming your identity and any previous addresses if applicable.

- A polite closing and your signature.

Examples of using the letter requesting credit report

Examples of situations where a letter requesting a credit report may be used include:

- Before applying for a mortgage or car loan to ensure your credit report is accurate.

- When reviewing your financial health after a period of credit issues.

- To verify the accuracy of information reported by creditors, especially if you suspect identity theft.

Quick guide on how to complete letter requesting credit report

Prepare Letter Requesting Credit Report effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage Letter Requesting Credit Report on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign Letter Requesting Credit Report without hassle

- Obtain Letter Requesting Credit Report and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Letter Requesting Credit Report and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter requesting credit report?

A letter requesting credit report is a formal document sent to credit reporting agencies to obtain a copy of your credit history. This letter is essential for individuals looking to review their credit status and ensure accuracy. By using airSlate SignNow, you can easily create and eSign this letter efficiently.

-

How can I use airSlate SignNow to create a letter requesting credit report?

With airSlate SignNow, you can quickly draft a letter requesting credit report using customizable templates. Our platform allows you to edit the content, add your personal information, and then eSign it securely. This process simplifies the creation and submission of your request.

-

Is there a cost associated with using airSlate SignNow for my letter requesting credit report?

Yes, airSlate SignNow offers various pricing plans to suit your needs for sending and eSigning documents, including your letter requesting credit report. We aim to provide a cost-effective solution while ensuring you have access to all necessary features for document management.

-

What features does airSlate SignNow offer for document signing?

AirSlate SignNow provides a range of features for document signing, such as templates, eSignature capabilities, cloud storage, and team collaboration tools. When you're sending a letter requesting credit report, these features ensure a smooth and professional experience. You can track the status of your document and receive notifications once it has been signed.

-

Can I track the status of my letter requesting credit report sent via airSlate SignNow?

Absolutely! AirSlate SignNow includes document tracking features that keep you informed about the status of your letter requesting credit report. You will know when the document is sent, viewed, and signed, which adds transparency and peace of mind to your communication process.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various third-party applications like Google Drive, Microsoft Office, and Salesforce. This flexibility allows you to create, manage, and send your letter requesting credit report directly from the applications you use daily, streamlining your workflow effectively.

-

What are the advantages of using airSlate SignNow over traditional methods for my letter requesting credit report?

Using airSlate SignNow for your letter requesting credit report offers numerous advantages, including quicker processing times, enhanced security, and a more environmentally friendly approach without the need for paper. The digital platform also minimizes the need for physical storage, making it easier to organize your documents.

Get more for Letter Requesting Credit Report

Find out other Letter Requesting Credit Report

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free