1100 Form

What is the 1100?

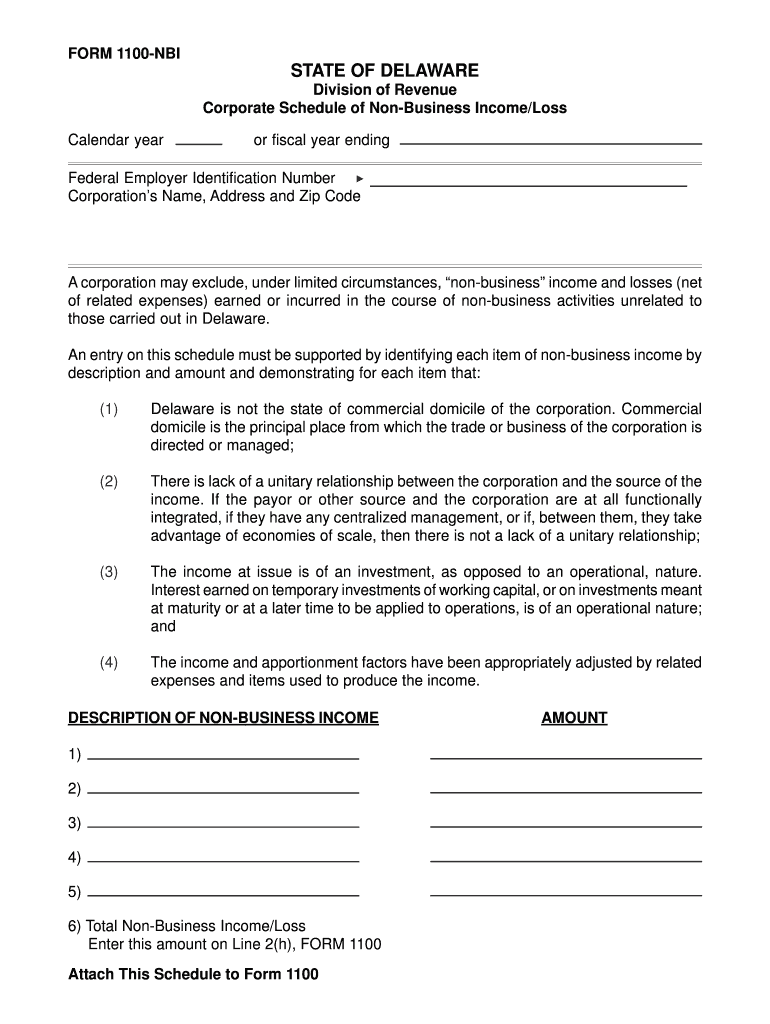

The Delaware 1100 NBI corporate non-business income loss form is a tax document used by corporations to report non-business income losses. This form is essential for entities that have incurred losses that are not related to their primary business activities. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to complete the 1100

Completing the Delaware 1100 NBI corporate non-business income loss form involves several key steps:

- Gather necessary financial documents, including income statements and loss records.

- Fill in the corporate information section, ensuring accuracy in the name and address of the entity.

- Detail the non-business income losses in the designated sections, providing clear and concise descriptions.

- Review all entries for accuracy and completeness before submission.

- Sign and date the form, ensuring that it is properly authenticated.

Legal use of the 1100

The legal use of the Delaware 1100 NBI corporate non-business income loss form is governed by state tax laws. Corporations must ensure that the information provided is truthful and complete to avoid penalties. The form serves as an official record of non-business income losses, which can be used in tax calculations and audits. Compliance with legal requirements is essential for maintaining the entity's standing with the Delaware Division of Revenue.

Required Documents

To successfully complete the Delaware 1100 NBI corporate non-business income loss form, several documents are required:

- Previous tax returns, if applicable.

- Financial statements that detail income and losses.

- Documentation supporting the claims of non-business income losses.

- Any relevant correspondence with the Delaware Division of Revenue.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Delaware 1100 NBI corporate non-business income loss form. Typically, the form must be submitted by the due date for the corporation's annual tax return. Late submissions may incur penalties, so timely filing is crucial. Corporations should also check for any updates or changes to deadlines from the Delaware Division of Revenue.

Form Submission Methods

The Delaware 1100 NBI corporate non-business income loss form can be submitted through various methods:

- Online submission via the Delaware Division of Revenue's e-filing system.

- Mailing a physical copy of the form to the appropriate state office.

- In-person submission at designated state offices, if required.

Who Issues the Form

The Delaware 1100 NBI corporate non-business income loss form is issued by the Delaware Division of Revenue. This state agency is responsible for tax administration and compliance in Delaware. Corporations must ensure they are using the most current version of the form, as updates may occur periodically to reflect changes in tax law or policy.

Quick guide on how to complete 1100

Easily Prepare 1100 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without complications. Manage 1100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Edit and Electronically Sign 1100 with Ease

- Acquire 1100 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how to submit your form, via email, SMS, invite link, or download it to your computer.

Lose the worries about lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign 1100 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1100

Create this form in 5 minutes!

How to create an eSignature for the 1100

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Delaware 1100 NBI Corporate Non Business Income Loss form?

The Delaware 1100 NBI Corporate Non Business Income Loss form is used by corporations to declare non-business income losses. This form helps businesses in Delaware accurately report their financial standing, especially when it comes to income that is not derived from regular business activities.

-

How does airSlate SignNow assist with the Delaware 1100 NBI Corporate Non Business Income Loss process?

airSlate SignNow streamlines the preparation and submission of the Delaware 1100 NBI Corporate Non Business Income Loss form by allowing users to easily create, send, and eSign documents. This eliminates the hassles of physical paperwork and ensures that your submissions are timely and compliant with Delaware regulations.

-

What are the key features of airSlate SignNow for managing the Delaware 1100 NBI Corporate Non Business Income Loss?

airSlate SignNow offers features like customizable templates, secure cloud storage, and real-time tracking for document status. These features signNowly enhance the efficiency of managing the Delaware 1100 NBI Corporate Non Business Income Loss form, ensuring you have everything you need at your fingertips.

-

What pricing options are available for using airSlate SignNow for Delaware 1100 NBI corporate non business income loss?

airSlate SignNow offers flexible pricing plans catering to various business sizes. This allows companies dealing with the Delaware 1100 NBI corporate non business income loss to select a plan that aligns with their needs and budget, making it an affordable solution.

-

Can airSlate SignNow integrate with other software for Delaware corporate tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, simplifying the management of your Delaware corporate tax submissions. This integration ensures that you have a cohesive workflow while handling the Delaware 1100 NBI corporate non business income loss.

-

What benefits does eSigning provide for the Delaware 1100 NBI Corporate Non Business Income Loss form?

eSigning the Delaware 1100 NBI Corporate Non Business Income Loss form saves time and reduces the risk of errors associated with traditional signing methods. With airSlate SignNow, you ensure that your documents are signed quickly and securely, facilitating a smoother submission process.

-

How secure is the information when using airSlate SignNow for tax forms?

Security is a top priority at airSlate SignNow. When handling the Delaware 1100 NBI Corporate Non Business Income Loss or any other sensitive forms, your data is encrypted and stored securely to ensure confidentiality and compliance with regulatory standards.

Get more for 1100

- School transportation vehicle accident report form cde state co

- Mvd 10284 rev 0795 change of address request the form

- Application for disabled license plate or parking placard form

- Fidelity vehicle service contract cancellation request form

- Request for immediate threat form

- Application for lottery plate reassignment see re form

- Ais 099 approval of vehicles with regards to the protection form

- Da form 1058 r

Find out other 1100

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo