Joint Trust Form

What is the Joint Trust

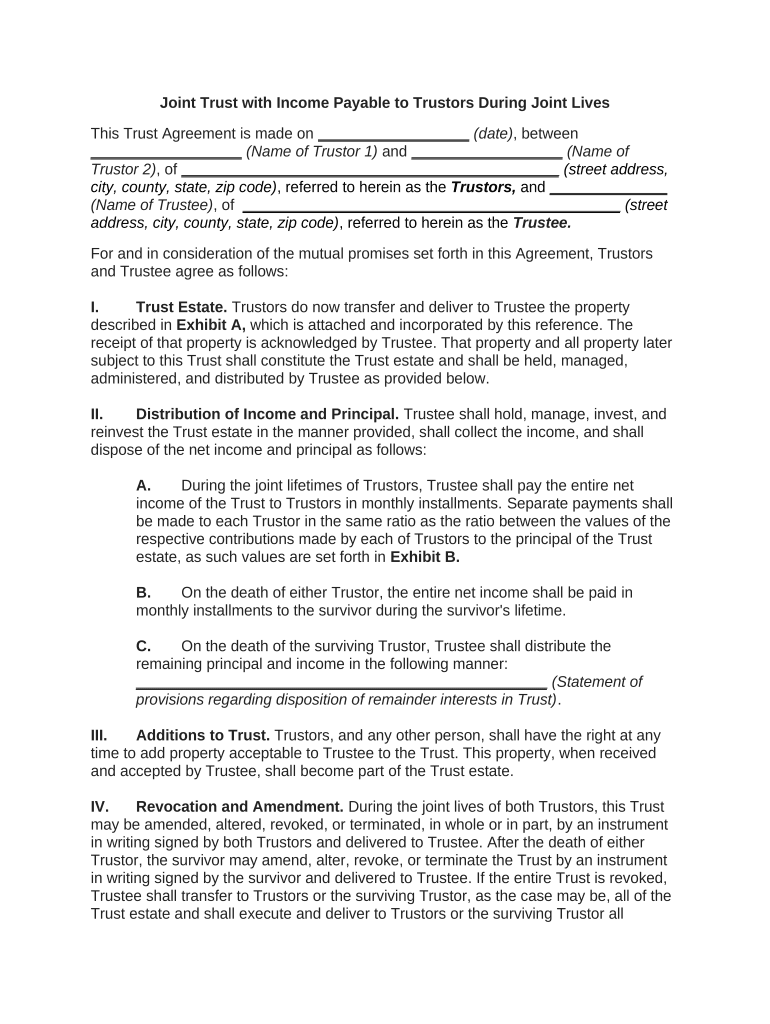

A joint trust is a legal arrangement created by two or more individuals to manage and protect their assets. It allows the trustors, often spouses or partners, to combine their resources into a single entity, simplifying asset management and distribution upon death or incapacitation. This type of trust can help avoid probate, ensuring that assets are transferred directly to beneficiaries without court intervention. Joint trusts can also provide tax benefits and facilitate financial planning, making them a popular choice for couples and families.

Steps to Complete the Joint Trust

Completing a joint trust involves several key steps to ensure that it is legally binding and meets the needs of all parties involved. Here are the essential steps:

- Consult with a legal professional: Engaging an attorney who specializes in estate planning can provide valuable guidance tailored to your situation.

- Gather necessary information: Compile details about assets, liabilities, and beneficiaries to accurately reflect your intentions in the trust.

- Draft the trust document: Work with your attorney to create a comprehensive document that outlines the terms, conditions, and management of the trust.

- Review and finalize: Carefully review the draft with all parties involved to ensure clarity and agreement on the terms.

- Sign and notarize: Execute the trust document in the presence of a notary public to enhance its legal validity.

- Fund the trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Joint Trust

The legal use of a joint trust is governed by state laws, which can vary significantly. Generally, a joint trust is recognized as a valid legal entity that can hold and manage assets. To ensure legal compliance, it is crucial to adhere to specific requirements, such as proper execution and funding of the trust. Additionally, the trust must be structured to meet the needs of the trustors and beneficiaries, including provisions for asset distribution and management during the trustors' lifetimes and after their passing.

Key Elements of the Joint Trust

A well-structured joint trust includes several key elements that define its operation and effectiveness:

- Trustors: The individuals who create the trust and contribute assets to it.

- Trustee: The person or entity responsible for managing the trust's assets and ensuring compliance with its terms.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust, such as income or assets.

- Terms of the trust: Specific instructions regarding how the assets should be managed and distributed, including any conditions or restrictions.

- Revocability: Whether the trust can be altered or revoked by the trustors during their lifetimes.

How to Obtain the Joint Trust

Obtaining a joint trust typically involves consulting with an estate planning attorney who can help you navigate the process. The attorney will assist in drafting the trust document, ensuring it complies with state laws and reflects the intentions of the trustors. Once the trust is created, it is essential to fund it by transferring assets into the trust's name. This step is crucial for the trust to function as intended and provide the desired legal protections and benefits.

Examples of Using the Joint Trust

Joint trusts can be used in various scenarios to achieve specific financial and estate planning goals. For instance:

- Married couples: They may create a joint trust to manage shared assets, ensuring a smooth transition of property to heirs.

- Blended families: A joint trust can help address complex family dynamics by clearly outlining asset distribution among children from previous relationships.

- Tax planning: Joint trusts can be structured to minimize estate taxes, allowing more wealth to be passed on to beneficiaries.

Quick guide on how to complete joint trust

Complete Joint Trust effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Joint Trust on any platform using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign Joint Trust without hassle

- Obtain Joint Trust and select Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Joint Trust to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a joint trust with airSlate SignNow?

A joint trust with airSlate SignNow allows two or more individuals to manage shared assets collaboratively. This setup ensures that all parties have equal access to the trust documents, making it easier to coordinate decisions. Additionally, airSlate SignNow provides a secure platform for eSigning and sharing necessary documents.

-

How does airSlate SignNow facilitate a joint trust with multiple signers?

With airSlate SignNow, creating a joint trust with multiple signers is seamless. The platform allows you to add co-signers easily, ensuring that everyone involved can review and eSign the documents. This streamlined process enhances collaboration, allowing for faster decision-making.

-

What are the pricing options for creating a joint trust with airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different needs when setting up a joint trust with our platform. Plans range from basic individual accounts to more comprehensive business solutions, all offering features suitable for creating and managing trusts. Potential users can explore our pricing page for detailed information and a plan that best suits their requirements.

-

Are there any features specifically designed for a joint trust with airSlate SignNow?

Yes, airSlate SignNow includes several features tailored for managing a joint trust with ease. These features include customizable templates, document sharing, and secure eSigning capabilities. Additionally, you can track the status of documents and receive notifications, ensuring everyone is up to date.

-

What are the benefits of using airSlate SignNow for creating a joint trust?

Using airSlate SignNow for a joint trust streamlines the entire process, making it more efficient and cost-effective. Users benefit from secure electronic signatures, reducing paperwork and ensuring cloud accessibility. This flexibility allows parties to manage their joint trust documents from anywhere, increasing collaboration and reducing time constraints.

-

Can I integrate airSlate SignNow with other platforms for my joint trust workflow?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to enhance your joint trust workflow. Popular tools like Google Drive, Dropbox, and various CRM systems can be integrated, helping to centralize your document management and improve overall efficiency.

-

What security measures does airSlate SignNow implement for joint trusts?

When dealing with sensitive documents like a joint trust with airSlate SignNow, security is paramount. Our platform features advanced encryption protocols and secure cloud storage to protect your data. Additionally, we ensure compliance with regulatory standards, giving you peace of mind that your joint trust documents are safe and secure.

Get more for Joint Trust

Find out other Joint Trust

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast