Credit Application Form

What is the Credit Application

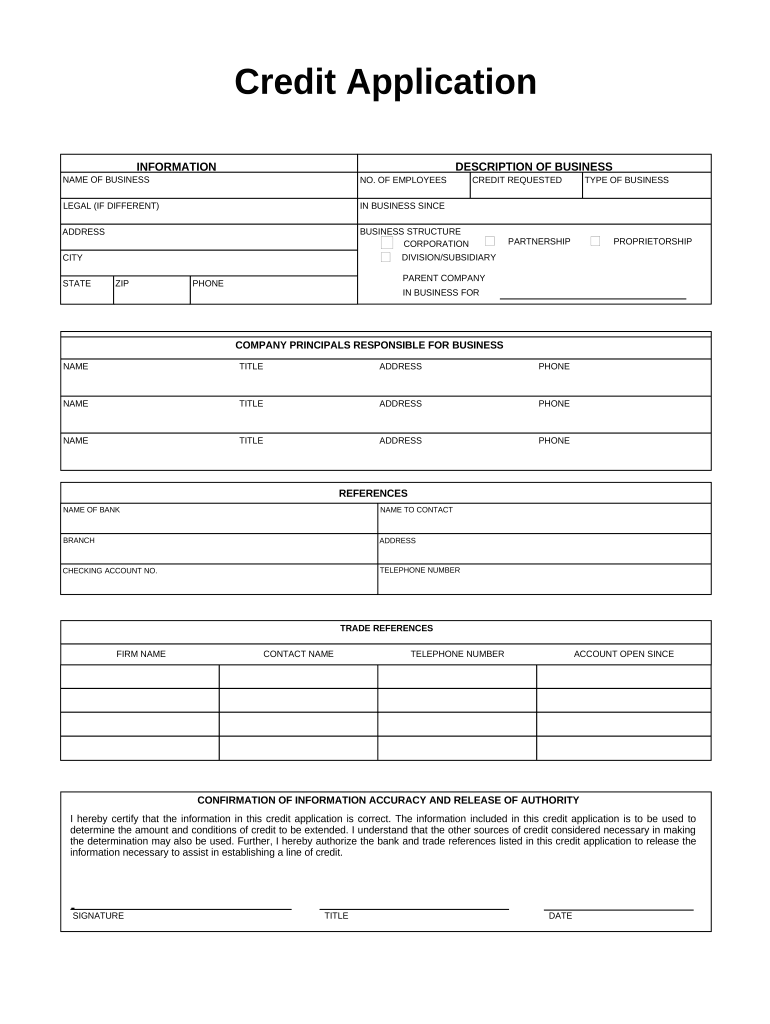

The credit application is a formal document that individuals or businesses submit to lenders to request credit or loans. This form collects essential information about the applicant's financial history, income, and other relevant details that help the lender assess creditworthiness. It serves as a critical tool in the lending process, enabling institutions to make informed decisions about extending credit. The credit application typically includes sections for personal identification, employment information, and financial obligations.

Steps to complete the Credit Application

Completing a credit application involves several straightforward steps to ensure accuracy and compliance. First, gather necessary documents, such as identification, income statements, and any existing debt information. Next, fill out the application form with precise details, ensuring all sections are completed. Review the information for any errors or omissions, as inaccuracies can delay processing or lead to denial. Finally, sign and submit the application electronically or via traditional methods, depending on the lender's requirements.

Key elements of the Credit Application

Several key elements are essential for a comprehensive credit application. These include:

- Personal Information: Name, address, Social Security number, and date of birth.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Monthly income, existing debts, and assets.

- Credit History: Previous loans, credit cards, and payment history.

Providing accurate and complete information in these sections is crucial for a successful application process.

Legal use of the Credit Application

The legal use of a credit application is governed by various regulations that ensure fairness and transparency in lending practices. Lenders must comply with the Fair Credit Reporting Act (FCRA), which mandates that they inform applicants of their rights regarding credit reporting. Additionally, the Equal Credit Opportunity Act (ECOA) prohibits discrimination based on race, gender, or other protected characteristics. Understanding these legal frameworks is vital for both lenders and applicants to ensure the application process is conducted ethically and lawfully.

Who Issues the Form

The credit application form is typically issued by financial institutions, including banks, credit unions, and other lending organizations. Each lender may have its own version of the form, tailored to its specific requirements and policies. It is important for applicants to use the correct form provided by the institution they are applying to, as this ensures that all necessary information is collected for evaluation.

Application Process & Approval Time

The application process for a credit application generally involves several stages. After submission, the lender reviews the information provided, which may include conducting a credit check and verifying employment and income details. The approval time can vary significantly based on the lender's policies and the complexity of the application. Typically, applicants can expect a decision within a few days to a couple of weeks. Factors such as the lender's workload and the applicant's financial situation can influence this timeline.

Quick guide on how to complete credit application

Effortlessly Prepare Credit Application on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Credit Application on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-related tasks today.

Edit and eSign Credit Application with Ease

- Locate Credit Application and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Credit Application to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Credit Application, and how does airSlate SignNow facilitate it?

A Credit Application is a document used by businesses to assess the creditworthiness of prospective clients. airSlate SignNow streamlines this process by allowing users to create, send, and eSign Credit Applications quickly and efficiently, ensuring a smooth and secure transaction.

-

What are the key features of airSlate SignNow for managing Credit Applications?

airSlate SignNow offers essential features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of your Credit Application workflow, enabling businesses to collect signed documents effortlessly.

-

How much does it cost to use airSlate SignNow for Credit Applications?

airSlate SignNow provides cost-effective pricing plans that cater to various business sizes. Users can choose from monthly or annual subscriptions that scale according to the number of Credit Applications processed, making it affordable for any budget.

-

Is it easy to integrate airSlate SignNow with other tools for Credit Applications?

Yes, airSlate SignNow integrates seamlessly with various business tools and software, including CRM systems and financial platforms. This ensures that your Credit Applications can flow smoothly between applications, saving time and reducing manual entry.

-

What security measures does airSlate SignNow use for Credit Applications?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Credit Applications. The platform uses advanced encryption, two-factor authentication, and complies with industry standards to protect your data and ensure information integrity.

-

Can I customize the Credit Application templates in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable Credit Application templates that allow businesses to tailor their documents according to their specific needs. You can easily add logos, modify fields, and adjust the layout to match your branding.

-

How does airSlate SignNow improve the turnaround time for Credit Applications?

By digitizing and automating the Credit Application process, airSlate SignNow signNowly reduces the time needed for document completion. Features like eSigning eliminate the need for printing and mailing, allowing for faster approvals and improved cash flow.

Get more for Credit Application

Find out other Credit Application

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast