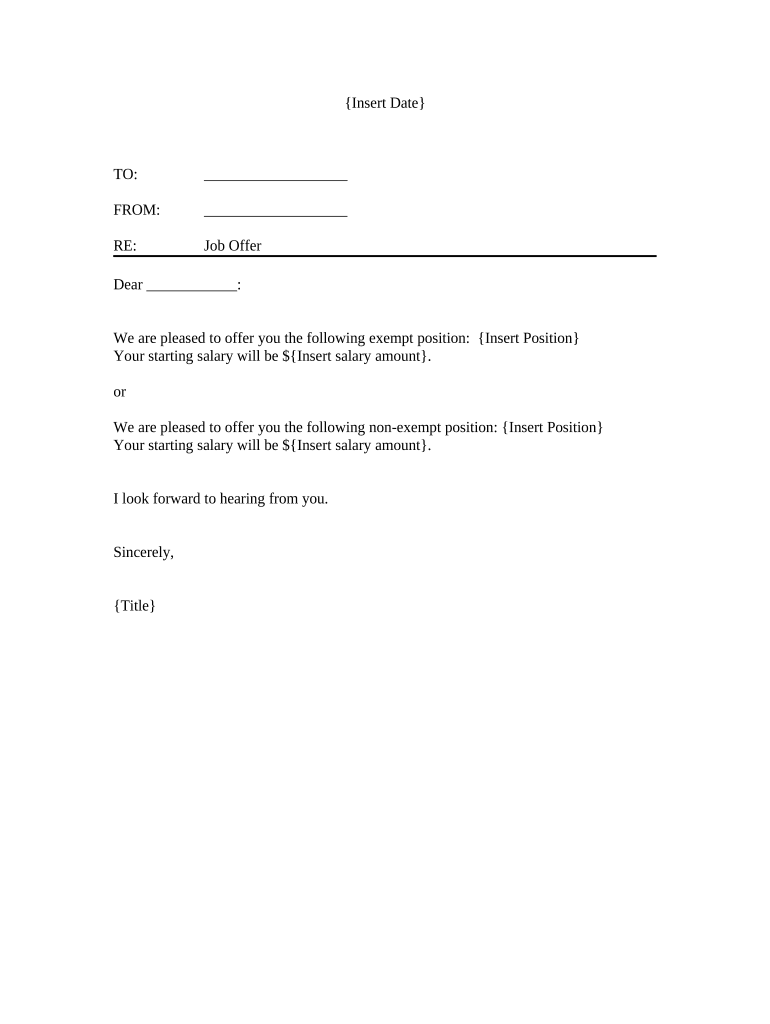

Exempt Form

What is the purchase exemption certificate?

The purchase exemption certificate is a legal document that allows buyers to make tax-exempt purchases for specific goods or services. This certificate is primarily used by organizations that qualify for tax exemptions, such as non-profits, government entities, and certain educational institutions. By presenting this certificate at the time of purchase, the buyer can avoid paying sales tax, which can lead to significant savings, especially for bulk purchases.

How to obtain the purchase exemption certificate

To obtain a purchase exemption certificate, eligible entities must apply through their state's taxation department. The process typically involves filling out an application form that provides details about the organization, such as its legal name, address, and tax identification number. Some states may require additional documentation to verify the entity's tax-exempt status. Once the application is approved, the organization will receive the exemption certificate, which can then be used for tax-exempt purchases.

Steps to complete the purchase exemption certificate

Completing a purchase exemption certificate involves several key steps:

- Gather necessary information, including the buyer's name, address, and tax identification number.

- Specify the type of exemption being claimed, such as non-profit status or government entity.

- Provide details about the purchase, including the items being bought and the seller's information.

- Sign and date the certificate to validate the claim.

It is important to ensure that all information is accurate and complete to avoid issues during the transaction.

Legal use of the purchase exemption certificate

The legal use of a purchase exemption certificate is governed by state laws. Each state has specific regulations regarding who can use the certificate and for what types of purchases. Misuse of the certificate, such as using it for personal purchases or for items not covered under the exemption, can result in penalties, including fines and back taxes. It is crucial for organizations to understand their state's rules to ensure compliance.

Key elements of the purchase exemption certificate

A purchase exemption certificate typically includes several key elements:

- The name and address of the buyer.

- The tax identification number of the buyer.

- The name and address of the seller.

- A description of the items being purchased.

- The reason for the tax exemption.

- The signature of an authorized representative of the buyer.

These elements help establish the legitimacy of the exemption claim and provide necessary information for both the buyer and seller.

State-specific rules for the purchase exemption certificate

State-specific rules for purchase exemption certificates can vary significantly. Some states may have specific forms that must be used, while others allow for a general certificate. Additionally, the types of purchases that qualify for exemption can differ. For instance, certain states may exempt only specific goods, such as machinery or educational materials, while others may have broader exemptions. It is essential for buyers to familiarize themselves with their state's regulations to ensure compliance and maximize the benefits of the exemption.

Quick guide on how to complete exempt 497334749

Complete Exempt effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Exempt on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Exempt with ease

- Locate Exempt and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your revisions.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Exempt and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an exempt draft in airSlate SignNow?

An exempt draft in airSlate SignNow refers to a type of draft document that can be signed electronically without the need for physical signatures. This feature simplifies document management, making it easier for businesses to streamline their processes and improve efficiency.

-

How does airSlate SignNow ensure the security of exempt drafts?

airSlate SignNow employs advanced encryption and secure storage solutions to protect all exempt drafts. This ensures that sensitive information remains confidential while allowing for quick and easy electronic signatures.

-

What pricing plans are available for using exempt draft features in airSlate SignNow?

airSlate SignNow offers several pricing plans that include access to exempt draft features. These plans are designed to cater to businesses of all sizes, providing flexibility and scalability to meet your specific needs.

-

Can I integrate airSlate SignNow with my existing software for exempt drafts?

Yes, airSlate SignNow offers a range of integrations with popular software applications. This allows users to seamlessly manage exempt drafts alongside their existing tools, enhancing overall productivity and efficiency.

-

What are the benefits of using an exempt draft in business transactions?

Using exempt drafts can signNowly reduce the time it takes to finalize documents, accelerating business transactions. Additionally, they eliminate the need for physical paperwork, leading to cost savings and a more eco-friendly approach.

-

Is there a mobile app available for managing exempt drafts on the go?

Yes, airSlate SignNow offers a mobile app that allows users to manage exempt drafts from anywhere. This is particularly beneficial for businesses with remote teams or those who frequently need to sign documents while traveling.

-

How does airSlate SignNow improve collaboration on exempt drafts?

airSlate SignNow enhances collaboration by allowing multiple users to review and sign exempt drafts simultaneously. This feature facilitates faster decision-making and ensures that all parties are engaged in the document process.

Get more for Exempt

- Civ 535 creditors affidavit and request 1112 civil forms

- Request for approval of supersedeas bond in an administrative appeal 2 12 appeal forms

- Small claims satisfaction of judgement form

- Adm 124 screeing investigation billing forms 6 11

- Civ 715 affidavit in support of petition for order authorizing form

- Adm 122 juror counseling billing forms

- Mc 412 notice of release of respondent and request for dismissal of petition form

- Dr 800 and dr 805 divorce ffcl and decree 10 15 domestic relations form

Find out other Exempt

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online