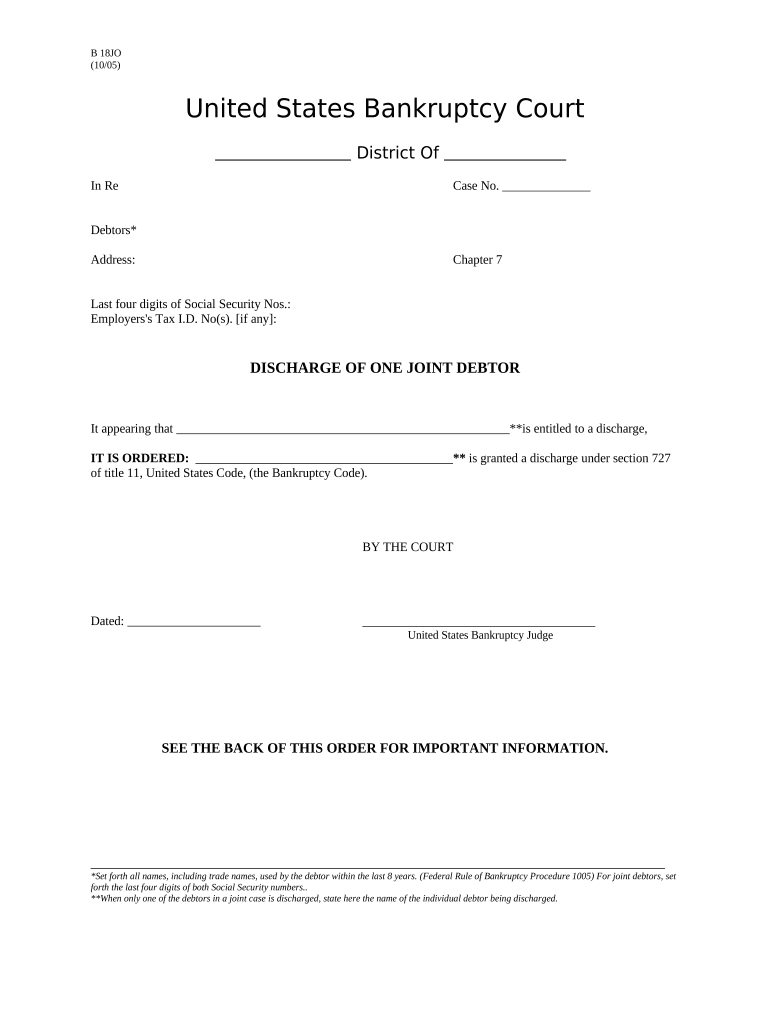

Joint Debtor Form

Understanding the Joint Debtor

The term "joint debtor" refers to individuals who are collectively responsible for a debt or obligation. In the context of Chapter 7 bankruptcy, a joint debtor may include spouses or partners who file together. This shared responsibility can simplify the process of discharging debts, as both parties’ financial situations are considered in the bankruptcy proceedings. It is important for joint debtors to understand their rights and obligations under the law, as well as the implications for their credit and future financial decisions.

Steps to Complete the Joint Debtor Form

Completing the Joint Debtor form requires careful attention to detail to ensure accuracy and compliance with legal standards. Here are the key steps involved:

- Gather necessary financial documents, including income statements, tax returns, and a list of debts.

- Fill out the form with accurate personal information for both debtors, including full names, addresses, and Social Security numbers.

- Detail all debts and assets, ensuring that all information is current and reflects the financial situation accurately.

- Review the form for completeness and accuracy before submission.

- Sign and date the form, ensuring that both debtors provide their signatures.

Legal Use of the Joint Debtor Form

The Joint Debtor form must be used in accordance with relevant laws to ensure its validity. Under U.S. bankruptcy law, both parties must meet specific eligibility criteria, including income limits and types of debts. The form must be filed with the appropriate bankruptcy court, and it is essential to comply with all procedural requirements to avoid delays or rejections. Understanding these legal frameworks helps joint debtors navigate the process effectively and ensures that their rights are protected throughout the bankruptcy proceedings.

Required Documents for Joint Debtors

When filing as joint debtors, specific documentation is required to support the application. These documents typically include:

- Proof of income for both debtors, such as pay stubs or tax returns.

- A complete list of debts, including credit cards, loans, and any other financial obligations.

- A list of all assets owned, including real estate, vehicles, and bank accounts.

- Identification documents, such as driver's licenses or Social Security cards.

Having these documents ready can facilitate a smoother filing process and help ensure compliance with legal requirements.

Examples of Using the Joint Debtor Form

Joint debtors may find themselves in various scenarios where filing together is beneficial. Common examples include:

- Married couples seeking to eliminate shared debts from credit cards or personal loans.

- Partners in a business who have personal guarantees on business loans.

- Individuals co-signing for loans who wish to discharge their liability together.

These examples illustrate how joint debtors can approach their financial challenges collaboratively, potentially achieving a more favorable outcome in bankruptcy proceedings.

Filing Deadlines and Important Dates

Timeliness is crucial when filing the Joint Debtor form. Important deadlines include:

- The date by which the form must be submitted to the bankruptcy court.

- Deadlines for providing additional documentation if requested by the court.

- Notification periods for creditors regarding the bankruptcy filing.

Staying aware of these dates helps ensure that the filing process proceeds without unnecessary complications.

Quick guide on how to complete joint debtor

Complete Joint Debtor seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Joint Debtor on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Joint Debtor effortlessly

- Find Joint Debtor and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Joint Debtor and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is debtor 7 and how does it work with airSlate SignNow?

Debtor 7 refers to a type of bankruptcy filing where individuals can reorganize their debts. airSlate SignNow simplifies the eSigning process for debtor 7 documents, making it easier for users to manage their paperwork efficiently and securely.

-

What features does airSlate SignNow offer for debtor 7 filings?

airSlate SignNow offers features tailored for debtor 7 filings, such as customizable templates, secure document storage, and the ability to track the status of your signed documents. These features help streamline the process, ensuring that all necessary forms are completed accurately.

-

How much does airSlate SignNow cost for debtor 7 document management?

The pricing for airSlate SignNow is competitive and designed to fit various budgets. For debtor 7 document management, users can choose from flexible plans that offer essential features needed for effective eSigning and document collaboration without breaking the bank.

-

Can I integrate airSlate SignNow with other platforms for debtor 7 processing?

Yes, airSlate SignNow integrates seamlessly with various platforms, making it an ideal solution for debtor 7 processing. Users can connect it with their existing applications to streamline workflows and ensure all necessary financial documents are efficiently handled.

-

What are the benefits of using airSlate SignNow for debtor 7 paperwork?

Using airSlate SignNow for debtor 7 paperwork offers numerous benefits, including enhanced security, faster turnaround times for document signing, and easier access to files from any device. This ensures that users can manage their debtor 7 processes without the hassle of traditional paperwork.

-

Is airSlate SignNow user-friendly for individuals dealing with debtor 7?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals navigating the debtor 7 process. The intuitive interface ensures that users can easily create, send, and sign documents with minimal stress.

-

How secure is airSlate SignNow for debtor 7 transactions?

airSlate SignNow prioritizes security, employing top-notch encryption to protect all documents related to debtor 7 transactions. This commitment to security ensures that your sensitive financial information remains confidential and safe from unauthorized access.

Get more for Joint Debtor

- Hmo premium taxminnesota department of revenue form

- Minnesota form m1r age 65 or olderdisabled subtraction printable 2020 minnesota form m1r age 65 or older minnesota form m1r age

- Printable 2020 minnesota form m1mt alternative minimum tax

- Fedach services return item exception fax form instructions

- Missouri form mo 1040v individual income tax payment voucher

- Reactjs formik how to reset form after confirmation stack overflowreactjs formik how to reset form after confirmation stack

- Reactjs formik how to reset form after confirmation

- Printable 2020 missouri form mo 2210 underpayment of estimated tax

Find out other Joint Debtor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors