Chapter 13 Bankruptcy Form

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is a legal process that allows individuals with a regular income to reorganize their debts. This type of bankruptcy is designed for those who wish to keep their property while repaying their debts over a period of time, typically three to five years. The process involves creating a repayment plan that outlines how debts will be paid back, which must be approved by the court. Unlike Chapter 7 bankruptcy, which liquidates assets to pay creditors, Chapter 13 allows individuals to retain their assets while making manageable payments.

Steps to Complete the Chapter 13 Bankruptcy

Completing a Chapter 13 bankruptcy involves several key steps:

- Credit Counseling: Before filing, individuals must complete a credit counseling session with an approved agency.

- Filing the Petition: The bankruptcy petition and accompanying schedules must be filed in the appropriate bankruptcy court.

- Repayment Plan Proposal: A repayment plan must be proposed, detailing how debts will be repaid over the designated period.

- Court Approval: The proposed plan must be confirmed by the bankruptcy court, which may require modifications.

- Making Payments: Once approved, the individual must make regular payments to the bankruptcy trustee, who distributes the funds to creditors.

Eligibility Criteria for Chapter 13 Bankruptcy

To qualify for Chapter 13 bankruptcy, individuals must meet certain eligibility criteria:

- Regular Income: The individual must have a regular source of income, which can include wages, self-employment income, or other steady income streams.

- Debt Limits: There are limits on the amount of unsecured and secured debt an individual can have to qualify for Chapter 13.

- Credit Counseling: Completion of a credit counseling course is mandatory before filing.

Required Documents for Chapter 13 Bankruptcy

Filing for Chapter 13 bankruptcy requires several important documents, including:

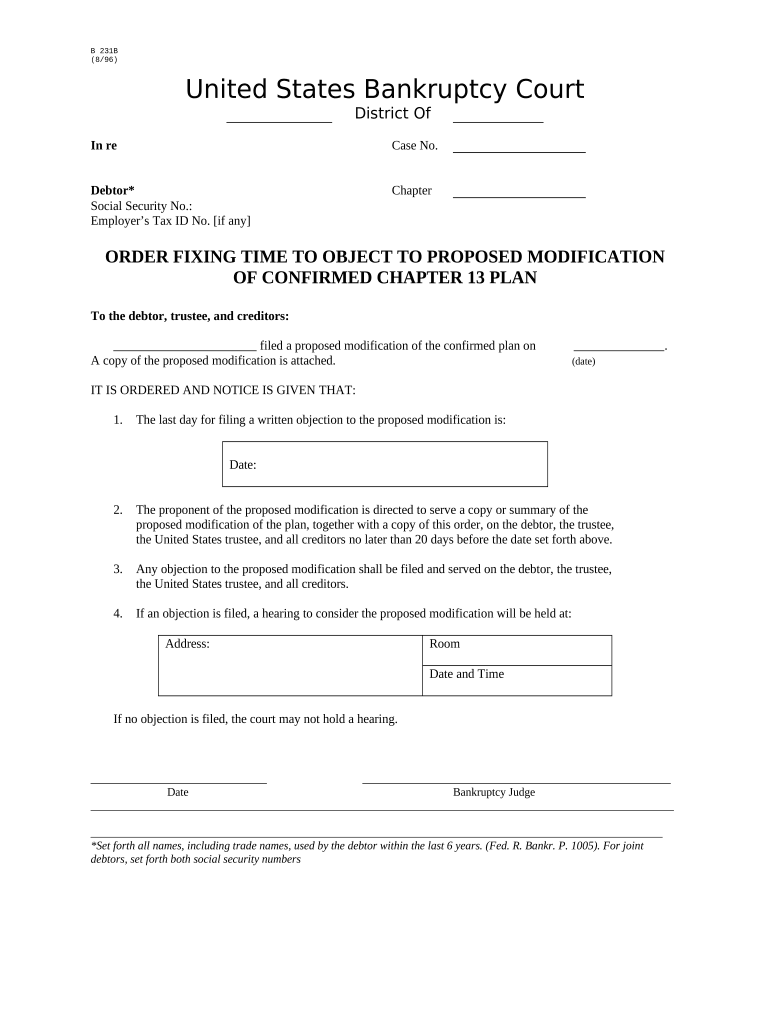

- Bankruptcy Petition: The official petition form that initiates the bankruptcy process.

- Schedules of Assets and Liabilities: Detailed lists of all assets, liabilities, income, and expenses.

- Repayment Plan: A proposed plan outlining how debts will be repaid over the bankruptcy period.

- Tax Returns: Recent tax returns may be required to demonstrate income levels.

Legal Use of Chapter 13 Bankruptcy

Chapter 13 bankruptcy is legally recognized as a means for individuals to reorganize their debts and avoid foreclosure or repossession of assets. It provides a structured approach to debt repayment while allowing individuals to maintain ownership of their property. Compliance with all legal requirements, including timely payments and adherence to the approved repayment plan, is essential for successfully completing the bankruptcy process.

Examples of Using Chapter 13 Bankruptcy

Individuals may utilize Chapter 13 bankruptcy in various scenarios, such as:

- Preventing Foreclosure: Homeowners facing foreclosure can use Chapter 13 to catch up on missed mortgage payments while keeping their home.

- Managing Medical Debt: Individuals with significant medical expenses can reorganize their debts through a repayment plan.

- Consolidating Payments: Chapter 13 allows individuals to consolidate multiple debts into a single monthly payment, making it easier to manage finances.

Quick guide on how to complete chapter 13 bankruptcy

Complete Chapter 13 Bankruptcy effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Chapter 13 Bankruptcy on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Chapter 13 Bankruptcy without hassle

- Obtain Chapter 13 Bankruptcy and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Chapter 13 Bankruptcy and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a modification chapter 13?

A modification chapter 13 refers to a court-approved change to an existing chapter 13 repayment plan. This can be necessary if a debtor's financial situation has changed, allowing them to adjust their payments. Understanding how to implement a modification chapter 13 can be crucial for maintaining compliance with court requirements.

-

How can airSlate SignNow assist with modification chapter 13 documents?

airSlate SignNow provides businesses with tools to create, send, and eSign modification chapter 13 documents easily. Users can streamline their documentation process, ensuring that all necessary forms are completed and signed quickly. Our platform offers templates and secure storage for your important files.

-

Are there costs associated with using airSlate SignNow for modification chapter 13?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. The costs are relatively low compared to traditional document processing methods, maximizing your budget while dealing with modification chapter 13. You can choose a plan that best fits your needs without compromising on features.

-

What features does airSlate SignNow offer for modification chapter 13?

airSlate SignNow includes several features crucial for handling modification chapter 13 effectively. These features include eSignature capabilities, real-time tracking of document status, and easy document sharing. Our user-friendly platform ensures that you can manage your modification chapter 13 processes efficiently.

-

Can I integrate airSlate SignNow with other software for modification chapter 13?

Yes, airSlate SignNow offers seamless integration with various software applications, enhancing your ability to manage modification chapter 13 documents. These integrations allow for automated workflows and easy data transfer between systems. This ensures a smooth experience as you handle your legal documentation.

-

How can modification chapter 13 benefit my business?

Understanding and managing a modification chapter 13 can signNowly benefit your business by providing you with a structured repayment plan. This can alleviate financial pressures and allow for better cash flow management. With airSlate SignNow, you can simplify the documentation process, thus saving time and reducing stress.

-

Is airSlate SignNow secure for handling modification chapter 13 documents?

Absolutely, airSlate SignNow prioritizes security for all documents, including those related to modification chapter 13. Our platform utilizes advanced encryption and secure data storage methods to protect sensitive information. You can have peace of mind knowing your documents are safe while you focus on your financial strategies.

Get more for Chapter 13 Bankruptcy

Find out other Chapter 13 Bankruptcy

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form