Letter Informing Debt Collector of Unfair Practices in Collection Activities Communicating with a Consumer Regarding a Debt by P

Understanding the Letter Informing Debt Collector of Unfair Practices

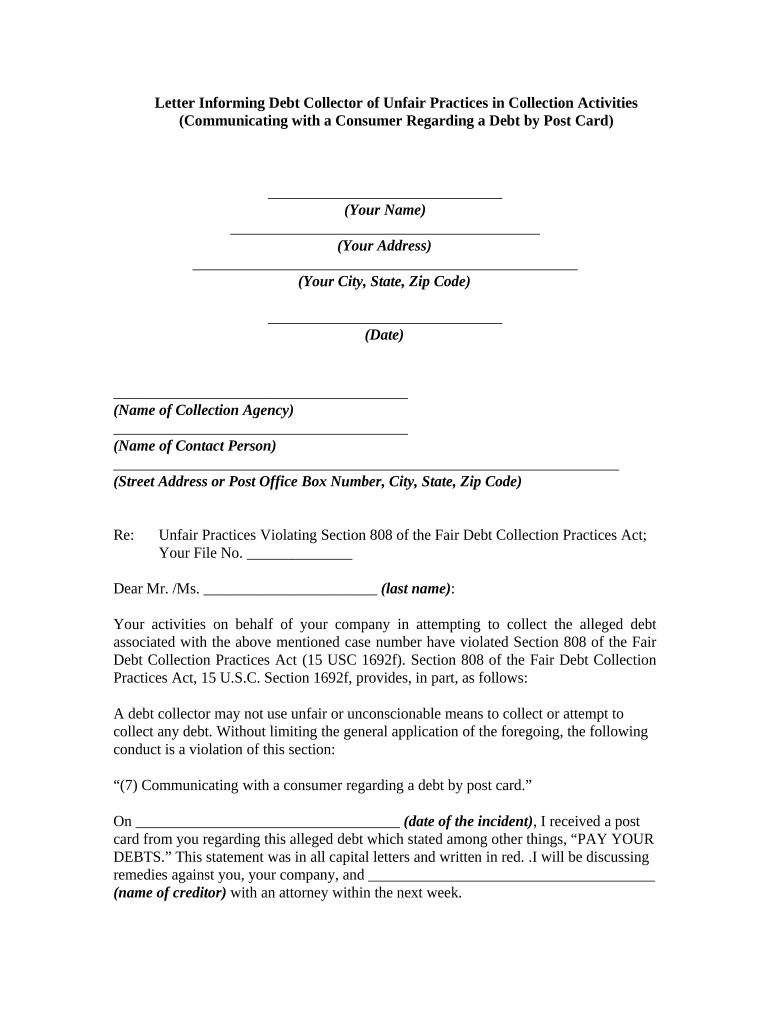

The Letter Informing Debt Collector of Unfair Practices in Collection Activities communicating with a consumer regarding a debt by postcard serves as a formal notification to debt collectors about their inappropriate or illegal collection practices. This letter is critical for consumers who wish to assert their rights under the Fair Debt Collection Practices Act (FDCPA). It outlines specific unfair practices, such as harassment, false statements, or improper communication methods, and demands that these practices cease. By documenting these issues, consumers can protect themselves and potentially strengthen their position in any future disputes.

Steps to Complete the Letter Informing Debt Collector of Unfair Practices

Completing the letter requires careful attention to detail to ensure it is effective. Start by clearly identifying the debt collector and including your personal information. Specify the unfair practices you have experienced, providing examples where possible. It is essential to state your expectations for resolution, such as ceasing all communication or correcting inaccuracies. Finally, sign the letter and keep a copy for your records. Utilizing a digital signature can enhance the legitimacy of your letter, ensuring that it meets legal standards.

Legal Use of the Letter Informing Debt Collector of Unfair Practices

This letter is not just a formality; it can have significant legal implications. Under the FDCPA, consumers have the right to dispute debts and request verification. Sending this letter formally notifies the debt collector of your position and can serve as evidence should the situation escalate to legal proceedings. It is advisable to send the letter via certified mail to maintain a record of delivery, which can be crucial if legal action becomes necessary.

Key Elements of the Letter Informing Debt Collector of Unfair Practices

To ensure the letter is effective, it should include several key elements. These include your name and address, the debt collector's name and address, a clear statement of the unfair practices, and a request for action. Additionally, include a date and a clear subject line, such as "Notice of Unfair Debt Collection Practices." Including a request for written confirmation that the practices will cease can also be beneficial.

Examples of Using the Letter Informing Debt Collector of Unfair Practices

Examples of situations where this letter may be used include instances where a debt collector has contacted you at inappropriate times, used threatening language, or failed to provide proper verification of the debt. Each example should be detailed in the letter to provide a clear picture of the issues faced. By documenting these instances, you can create a comprehensive record that supports your claims and helps protect your rights as a consumer.

State-Specific Rules for the Letter Informing Debt Collector of Unfair Practices

Different states may have additional laws governing debt collection practices. It is essential to research your state’s specific regulations to ensure that your letter complies with local laws. Some states may have stricter rules regarding communication methods or additional consumer protections. Understanding these nuances can help strengthen your case and ensure that your rights are fully protected.

Quick guide on how to complete letter informing debt collector of unfair practices in collection activities communicating with a consumer regarding a debt by

Complete Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P effortlessly on any platform

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, alter, and eSign your documents swiftly without delays. Handle Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P with ease

- Find Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P and click Get Form to initiate.

- Make use of the available tools to submit your document.

- Emphasize critical sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P and ensure exemplary communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card?

A Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card is a formal document that consumers can use to notify debt collectors of their illegal or unethical practices. This letter serves as a crucial tool to address unfair tactics employed in the collection process and helps protect consumer rights.

-

How can airSlate SignNow help me create a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card?

airSlate SignNow provides an intuitive platform that allows you to easily draft, customize, and send your Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card. With user-friendly templates and eSignature options, you can streamline the process and ensure your document is legally binding.

-

Is there a cost associated with using airSlate SignNow to send a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card?

Yes, using airSlate SignNow does involve a subscription fee, depending on the features you choose. However, the platform offers cost-effective plans that ensure you can send your Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card without breaking the bank.

-

What features does airSlate SignNow offer for preparing a debt collection letter?

airSlate SignNow offers several features for preparing a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card, including customizable templates, drag-and-drop fields, and secure eSigning options. These features enhance your document management experience and ensure your letter is professional.

-

Can airSlate SignNow integrate with other tools I use for managing debt collection processes?

Absolutely! airSlate SignNow offers seamless integrations with various popular business applications and tools that can help you manage your debt collection processes, making it easier to send your Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card within your existing workflow.

-

How quickly can I send my Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card using airSlate SignNow?

With airSlate SignNow, you can send your Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card almost instantly. The platform’s streamlined interface and eSignature feature allow for quick drafting and sending, helping you respond to unfair practices promptly.

-

What are the benefits of sending a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card?

Sending a Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By Post Card can help assert your rights, deter further harassment, and provide a record of your communication. It's a proactive step in managing your debt obligations while upholding your consumer rights.

Get more for Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P

- Ba admission form

- Rssmv form

- Customer information file cif individual registration form

- Cif number rbl bank form

- Surrender request form super suraksha dhanaraksha rinnraksha

- Gift aid declaration multiple donation friends of tread form

- Corporate internet banking non individual customer existing form

- Pnb metlife claim form

Find out other Letter Informing Debt Collector Of Unfair Practices In Collection Activities Communicating With A Consumer Regarding A Debt By P

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now