Definition of Adjusted Gross Income Internal Revenue Service Form

Understanding the 5200 Tax Form

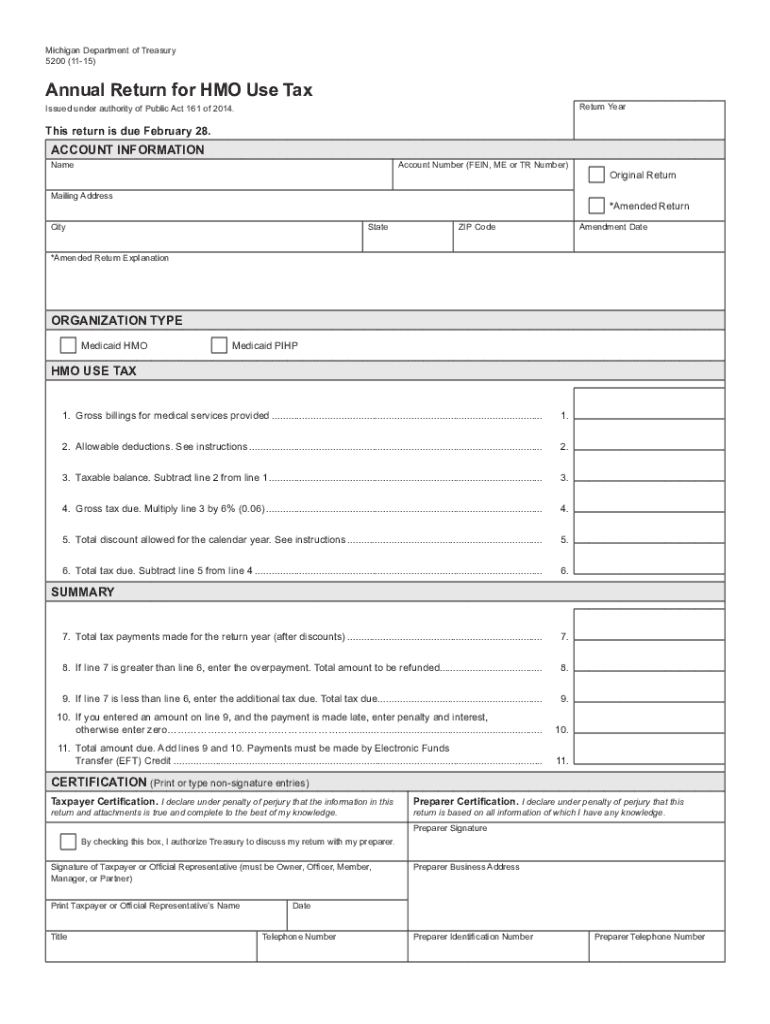

The 5200 tax form is essential for taxpayers who need to report specific financial information to the Internal Revenue Service (IRS). This form helps in determining the adjusted gross income, which is a crucial component in calculating overall tax liability. Understanding the nuances of this form is vital for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the 5200 Tax Form

Completing the 5200 tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as W-2s, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay close attention to calculations, as errors can lead to penalties. Once completed, review the form for any discrepancies before submission.

Required Documents for the 5200 Tax Form

To successfully complete the 5200 tax form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of other income sources, such as interest or dividends

- Receipts for deductible expenses, if applicable

Having these documents organized will facilitate a smoother filing process and ensure all necessary information is reported.

Filing Deadlines for the 5200 Tax Form

Filing deadlines for the 5200 tax form are crucial to avoid penalties. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Legal Use of the 5200 Tax Form

The 5200 tax form holds legal significance as it is used to report income and calculate tax obligations. When filled out correctly, it serves as a legal document that can be used in case of audits or disputes with the IRS. Ensuring compliance with all IRS guidelines when completing this form is essential to maintain its legal validity.

IRS Guidelines for the 5200 Tax Form

The IRS provides specific guidelines for completing the 5200 tax form. These guidelines include instructions on how to report various types of income, allowable deductions, and credits. It is important to consult the IRS website or official publications for the most current information and to ensure all requirements are met when filing.

Quick guide on how to complete definition of adjusted gross income internal revenue service

Complete Definition Of Adjusted Gross Income Internal Revenue Service effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Definition Of Adjusted Gross Income Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Definition Of Adjusted Gross Income Internal Revenue Service with ease

- Find Definition Of Adjusted Gross Income Internal Revenue Service and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Definition Of Adjusted Gross Income Internal Revenue Service and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 5200 tax form and who needs to use it?

The 5200 tax form is a specific tax document required for certain business transactions and reporting to the IRS. Businesses that engage in activities related to the 5200 tax must complete this form to ensure compliance with tax regulations. Using airSlate SignNow simplifies the signing process for such documents, streamlining your workflow.

-

How can airSlate SignNow help with 5200 tax document signing?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing 5200 tax documents. By enabling secure eSignature options, businesses can efficiently complete their tax documentation without the hassle of printing and mailing. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for 5200 tax documents?

Yes, there are pricing plans available for airSlate SignNow, tailored to fit different business needs. The cost depends on the chosen features and the number of users. Investing in this platform can ultimately enhance your productivity, especially when dealing with important forms like the 5200 tax.

-

What features does airSlate SignNow offer for 5200 tax management?

airSlate SignNow offers a range of features, including customizable document templates, automated workflows, and real-time tracking. These tools can signNowly aid in managing your 5200 tax documents and ensure that they are accurately completed and filed on time. Enhanced security measures further protect sensitive information.

-

Can I integrate airSlate SignNow with other applications for 5200 tax processing?

Yes, airSlate SignNow offers integrations with various business applications, such as CRM systems and cloud storage services. This seamless integration helps streamline the entire process of preparing and signing 5200 tax documents. Effortlessly connect your existing tools for an improved workflow.

-

What are the benefits of using airSlate SignNow for my 5200 tax needs?

The primary benefit of using airSlate SignNow for your 5200 tax needs is the ability to save time and reduce paper waste. The platform allows for quick electronic signing and enhances document management efficiency. Additionally, it helps ensure that you meet tax deadlines with confidence.

-

How secure is airSlate SignNow when handling 5200 tax documents?

airSlate SignNow prioritizes security, utilizing encryption and authentication protocols to safeguard your 5200 tax documents. This ensures that only authorized users can access sensitive information. By choosing SignNow, you can trust that your tax documents are handled with the utmost protection.

Get more for Definition Of Adjusted Gross Income Internal Revenue Service

- Use this form to request a rollover from another 529 plan a coverdell education savings account or a qualified u

- Your health you can ask for an expedited faster appeal review form

- Fillable online www5 esc13 speaker proposal form www5

- Fillable online individual flexible purchase payment variable form

- Dmv use out of state change endorsement only new transfer form

- Read application in full form

- Form p11d for the period 1 jan 2020 to 31 dec 2020 return by employer for benefits non cash emoluments

- Calendar of key dates revenue form

Find out other Definition Of Adjusted Gross Income Internal Revenue Service

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template