5200, Annual Return for HMO Use Tax 5200, Annual Return for HMO Use Tax Michigan Form

Understanding the 5200 Annual Return for HMO Use Tax in Michigan

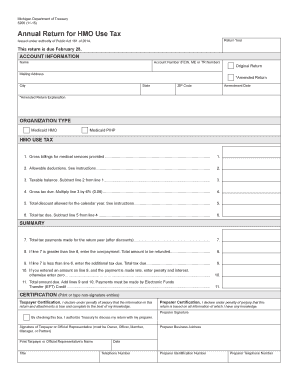

The 5200 Annual Return for HMO Use Tax is a specific tax form required by the state of Michigan. This form is used by businesses that operate as Health Maintenance Organizations (HMOs) to report and remit the use tax on their purchases. The use tax is applied to tangible personal property and certain services that are used, consumed, or stored in Michigan. It is essential for organizations to accurately complete this form to ensure compliance with state tax regulations.

Steps to Complete the 5200 Annual Return for HMO Use Tax

Completing the 5200 Annual Return involves several key steps:

- Gather necessary financial records, including purchase invoices and receipts.

- Calculate the total use tax owed based on applicable rates and the value of taxable purchases.

- Fill out the 5200 form with accurate information, including business details and tax calculations.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state tax authority by the designated deadline.

Obtaining the 5200 Annual Return for HMO Use Tax

The 5200 Annual Return can be obtained through the Michigan Department of Treasury's website or by contacting their office directly. It is crucial to ensure that you are using the most current version of the form, as updates may occur. Additionally, businesses can access the form through various tax preparation software that supports Michigan tax filings.

Legal Use of the 5200 Annual Return for HMO Use Tax

The 5200 form is legally binding when completed correctly and submitted on time. To ensure that the form is recognized as valid, it must be signed by an authorized representative of the organization. The use of electronic signatures is acceptable, provided that the signing process complies with the relevant eSignature laws and regulations.

Filing Deadlines for the 5200 Annual Return

Businesses must be aware of the filing deadlines associated with the 5200 Annual Return. Typically, the form is due annually on a specific date set by the Michigan Department of Treasury. Late submissions may incur penalties, so it is advisable to keep track of these important dates to maintain compliance.

Key Elements of the 5200 Annual Return for HMO Use Tax

When completing the 5200 form, several key elements must be included:

- Business name and address

- Tax identification number

- Total taxable purchases for the year

- Calculated use tax amount

- Signature of an authorized representative

Penalties for Non-Compliance with the 5200 Annual Return

Failure to file the 5200 Annual Return on time or inaccuracies in reporting can lead to penalties imposed by the state. These penalties may include fines or interest on unpaid taxes. It is important for businesses to understand the consequences of non-compliance and to take the necessary steps to file accurately and on time.

Quick guide on how to complete 5200 annual return for hmo use tax 5200 annual return for hmo use tax michigan

Prepare 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan with ease

- Locate 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

The 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan, is a mandatory document required for health maintenance organizations operating in Michigan. It ensures compliance with state tax regulations. Completing this form accurately is crucial to avoid penalties.

-

How can airSlate SignNow help with the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

airSlate SignNow provides a seamless way to eSign and send documents, including the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan. Our platform simplifies the process, making it easy to gather signatures and ensure timely submission. This reduces errors and speeds up compliance efforts.

-

Is airSlate SignNow affordable for small businesses needing to file the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our flexible pricing plans allow small businesses to efficiently manage their documentation needs without breaking the bank, especially when handling essential forms like the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan.

-

What features does airSlate SignNow offer for processing the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking, which are ideal for processing the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan. These capabilities streamline the filing process, ensuring accuracy and compliance. You can easily manage and store your documents securely within the platform.

-

How does airSlate SignNow ensure the security of the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your data, including the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan. Our compliance with industry standards ensures that your sensitive information remains confidential and safe.

-

Can airSlate SignNow integrate with other software for managing the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan. This allows you to pull data from your existing systems and streamline the documentation process, making it more efficient.

-

What are the benefits of using airSlate SignNow for the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan?

By using airSlate SignNow, you benefit from a user-friendly interface, quick document turnaround, and enhanced collaboration capabilities for the 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan. These advantages help ensure timely compliance while minimizing frustration and delays during the submission process.

Get more for 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan

- Ie nfs 1 2018 2021 fill and sign printable template form

- Claim by unregistered farmer for refund of value added tax form

- Asn4 asbestos waste shipment reporting form oregon

- Oregon department of education school bus forms pupil

- Use this form to provide personal history information for each individual who qualifies as an applicant for a

- Claim against the city of san jose ca form

- Affidavit of net worth child support forms archive

- Get the free pdf fire department nycgov pdffiller form

Find out other 5200, Annual Return For HMO Use Tax 5200, Annual Return For HMO Use Tax Michigan

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent