Debt Validation Letter Form

What is the Debt Validation Letter

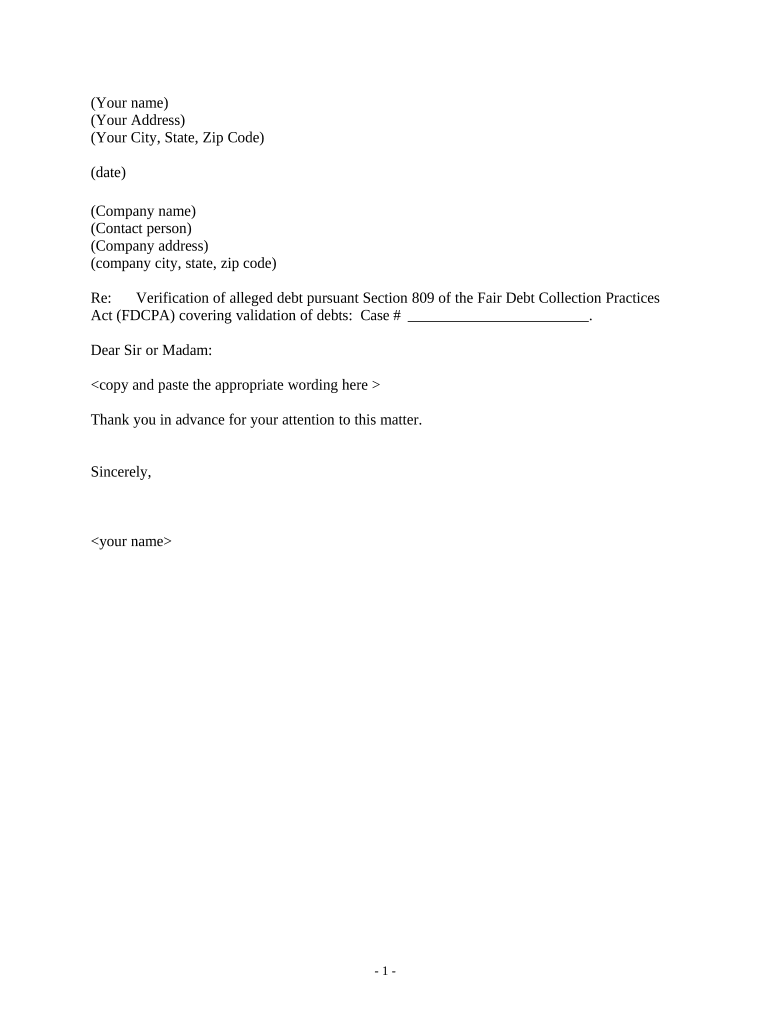

The debt validation letter is a formal document that a consumer can send to a debt collector to request verification of a debt. This letter serves to ensure that the consumer is informed about the details of the debt, including the amount owed and the original creditor. Under the Fair Debt Collection Practices Act (FDCPA), consumers have the right to request this validation within thirty days of being contacted by a debt collector. The purpose of the letter is to protect consumers from unfair collection practices and to give them an opportunity to dispute the debt if necessary.

How to Use the Debt Validation Letter

Using a debt validation letter involves several steps. First, the consumer should draft the letter, including essential information such as their name, address, and account number. It is crucial to clearly state the request for validation and to specify that the debt collector must provide proof of the debt. After drafting the letter, the consumer should send it via certified mail to ensure there is a record of the request. This method also provides proof of delivery, which can be important if disputes arise later. Once the debt collector receives the letter, they are required to cease collection activities until they provide the requested validation.

Key Elements of the Debt Validation Letter

A well-structured debt validation letter should include several key elements to be effective. These elements include:

- Consumer's Information: Full name, address, and contact information.

- Debt Collector's Information: Name and address of the debt collection agency.

- Account Details: Reference number or account number associated with the debt.

- Request for Validation: A clear statement requesting verification of the debt.

- Dispute Statement: A note indicating that the consumer disputes the debt until validated.

- Signature: The consumer's signature to authenticate the letter.

Steps to Complete the Debt Validation Letter

Completing a debt validation letter involves a systematic approach to ensure all necessary information is included. Here are the steps to follow:

- Gather your personal information and details about the debt.

- Draft the letter, including all key elements mentioned above.

- Review the letter for accuracy and clarity.

- Print the letter and sign it.

- Send the letter via certified mail to the debt collector.

- Keep a copy of the letter and the mailing receipt for your records.

Legal Use of the Debt Validation Letter

The legal use of the debt validation letter is grounded in consumer protection laws, particularly the FDCPA. This law gives consumers the right to challenge debts and request validation. When a consumer sends a debt validation letter, the debt collector must respond with proof of the debt, which may include documentation from the original creditor. If the collector fails to provide this validation, they cannot legally continue collection efforts. This legal framework empowers consumers to protect themselves against erroneous or fraudulent claims of debt.

Quick guide on how to complete debt validation letter

Easily Prepare Debt Validation Letter on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Debt Validation Letter on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Edit and Electronically Sign Debt Validation Letter Effortlessly

- Find Debt Validation Letter and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Debt Validation Letter and ensure excellent communication during every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a debt validation letter template?

A debt validation letter template is a standardized document that individuals can use to request verification of a debt. This template facilitates communication between you and the creditor, ensuring that they provide proof of the debt's validity. Utilizing a debt validation letter template helps protect your rights and ensures proper handling of any disputes.

-

How can I create a debt validation letter using airSlate SignNow?

Creating a debt validation letter using airSlate SignNow is straightforward. Simply select our customizable debt validation letter template from our library, fill in the necessary information, and eSign it securely. Our platform ensures that your letter is professional and compliant with legal standards.

-

Is there a cost associated with using the debt validation letter template?

airSlate SignNow offers various pricing plans, including a free trial that allows you to explore our features. The cost of using the debt validation letter template is included in our subscription plans, which provide access to a wide range of document management tools. Consider our pricing options to find the best fit for your business needs.

-

What are the benefits of using a debt validation letter template?

Using a debt validation letter template streamlines the process of requesting debt verification, saving you time and ensuring you don't miss any critical information. It helps you assert your rights as a consumer and provides a clear, structured format for your request. With airSlate SignNow, you can easily manage and send these letters electronically.

-

Can I integrate other tools with airSlate SignNow for my debt validation processes?

Yes, airSlate SignNow offers seamless integrations with various tools to enhance your debt validation processes. You can connect with CRM systems, cloud storage solutions, and other applications to create a smooth workflow. This allows you to automate document management and improve your efficiency when handling debt validation requests.

-

How secure is my information when using the debt validation letter template?

Security is a top priority at airSlate SignNow. When you use our debt validation letter template, your information is protected with industry-standard encryption and secure data storage. We ensure that your personal details and documents remain confidential and safeguarded against unauthorized access.

-

Are there customizable options available for the debt validation letter template?

Absolutely! Our debt validation letter template at airSlate SignNow is fully customizable, allowing you to adapt it to your specific needs. You can modify text, add logos, and personalize fields to ensure it reflects your voice and meets your requirements. This flexibility helps you create more effective communication with creditors.

Get more for Debt Validation Letter

Find out other Debt Validation Letter

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document