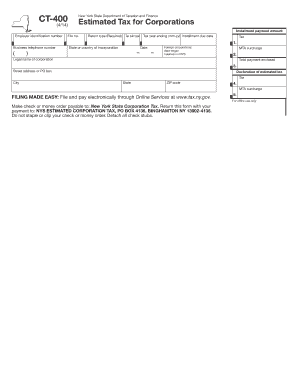

Form CT 400 Tax Ny 2014

What is the Form CT 400 Tax NY

The Form CT 400 Tax NY is an essential document used by businesses in New York State to estimate their corporation franchise tax liability. This form is particularly relevant for corporations that need to project their tax obligations for the upcoming year. It allows businesses to report their expected income and deductions, providing a basis for calculating estimated tax payments. Understanding this form is crucial for maintaining compliance with state tax regulations and ensuring that businesses meet their financial obligations in a timely manner.

How to Use the Form CT 400 Tax NY

Using the Form CT 400 Tax NY involves several key steps. First, businesses must gather relevant financial information, including projected income, expenses, and any applicable deductions. Once this information is compiled, it can be entered into the form. The form requires specific details such as the business's name, address, and tax identification number. After completing the form, businesses should review it for accuracy to avoid potential issues with the tax authorities. Finally, the form can be submitted electronically or via mail, depending on the preferred submission method.

Steps to Complete the Form CT 400 Tax NY

Completing the Form CT 400 Tax NY involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather Financial Information: Collect data on projected income, expenses, and deductions.

- Fill Out the Form: Enter the required information, including business details and financial projections.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: Choose your preferred submission method, either electronically or by mail.

Legal Use of the Form CT 400 Tax NY

The legal use of the Form CT 400 Tax NY is governed by New York State tax laws. This form must be completed accurately to ensure that estimated tax payments are based on truthful projections. Misrepresentation or errors in the form can lead to penalties, including fines or additional tax liabilities. Therefore, it is essential for businesses to understand the legal implications of the information provided on this form and to maintain compliance with all relevant tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 400 Tax NY are crucial for businesses to adhere to in order to avoid penalties. Typically, the estimated tax payments are due quarterly, with specific dates outlined by the New York State Department of Taxation and Finance. Businesses should mark these dates on their calendars to ensure timely submission. It is advisable to check for any updates or changes to deadlines each tax year, as these can vary.

Form Submission Methods

Businesses have multiple options for submitting the Form CT 400 Tax NY. The form can be filed electronically through the New York State Department of Taxation and Finance website, which is often the preferred method due to its convenience and speed. Alternatively, businesses can choose to mail the completed form to the appropriate tax office. In-person submission is also an option, although it may not be as common. Each submission method has its own guidelines and requirements, which should be reviewed before filing.

Quick guide on how to complete form ct 400 tax ny

Complete Form CT 400 Tax Ny seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without hassle. Manage Form CT 400 Tax Ny on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to edit and eSign Form CT 400 Tax Ny with ease

- Locate Form CT 400 Tax Ny and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form CT 400 Tax Ny and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 400 tax ny

Create this form in 5 minutes!

People also ask

-

What are NY CT 400 estimate forms fillable forms?

NY CT 400 estimate forms fillable forms are electronic versions of the New York Estimated Income Tax forms that allow taxpayers to easily input their information. These forms are designed to simplify the filing process and ensure accuracy, which can help avoid penalties. Using airSlate SignNow, you can complete, sign, and securely submit these forms online.

-

How can airSlate SignNow help with NY CT 400 estimate forms fillable forms?

airSlate SignNow provides a user-friendly platform to easily create, edit, and eSign NY CT 400 estimate forms fillable forms. Our solution streamlines the process, allowing you to fill out the forms quickly and ensuring you can submit them on time. Additionally, our secure platform protects your sensitive information.

-

Are there any costs associated with using airSlate SignNow for estimate forms?

Yes, airSlate SignNow offers various pricing plans based on your needs. Depending on the features required for handling NY CT 400 estimate forms fillable forms, you can choose a plan that fits your budget. We provide a cost-effective solution designed to save you time and money.

-

Can I integrate airSlate SignNow with other software for filing NY CT 400 estimate forms?

Absolutely! airSlate SignNow supports integration with numerous applications, enhancing your ability to manage NY CT 400 estimate forms fillable forms effectively. This means you can connect our platform to other tools you already use, making your workflow smoother and more efficient.

-

What features does airSlate SignNow offer for handling NY CT 400 estimate forms fillable forms?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and unlimited cloud storage for NY CT 400 estimate forms fillable forms. Additionally, our eSigning capabilities ensure that you can execute documents securely and swiftly, giving you more control over your documentation process.

-

How secure is the information on airSlate SignNow when using NY CT 400 estimate forms fillable forms?

Security is a top priority at airSlate SignNow. We implement advanced encryption and HIPAA-compliant protocols to protect your data when filling out NY CT 400 estimate forms fillable forms. Rest assured that your information is kept safe and confidential during the entire transaction process.

-

What benefits do businesses gain from using airSlate SignNow for NY CT 400 estimate forms fillable forms?

By using airSlate SignNow for NY CT 400 estimate forms fillable forms, businesses can enhance productivity and reduce turnaround time signNowly. Our platform offers automation features that streamline the completion and signing process, allowing teams to focus on other critical tasks while ensuring compliance and accuracy.

Get more for Form CT 400 Tax Ny

- Faa 1004a designation of ebt alternate card hold form

- Surprise out of network billing dispute resolution request form

- Health e arizona plus application for benefitsarizona department of form

- Phoenix employment relations board phoenix form

- Fictitious name registration check sheet california form

- Dca fictitious renewal form

- Application for a physician and surgeon license forms l1a l1f application for a physician and surgeon license forms l1a l1f

- Application forms l1a l1f application forms l1a l1f

Find out other Form CT 400 Tax Ny

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe