Letter Debtor Collection Form

Understanding the Letter Debtor Collection

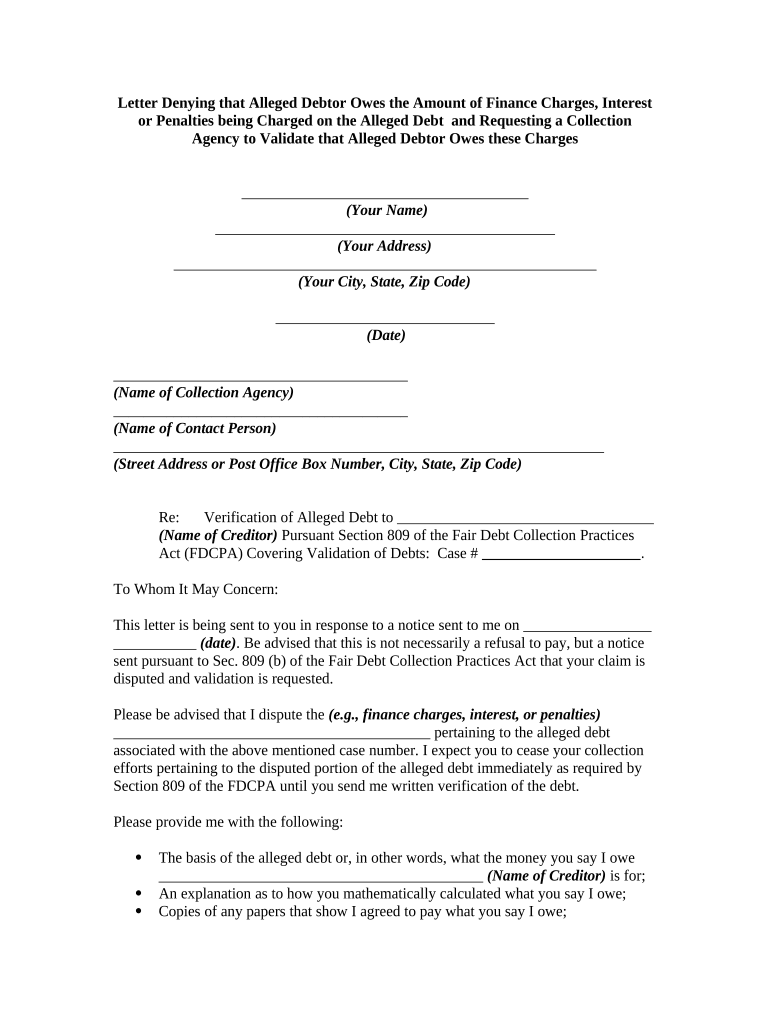

The letter debtor collection serves as a formal communication tool used by creditors to request payment from debtors. This document outlines the amount owed, including any applicable finance charges, and specifies the terms under which the debt must be settled. It is crucial for both parties to understand their rights and responsibilities as outlined in this letter. The letter typically includes details such as the original debt amount, any accrued penalties, and the deadline for payment. By clearly stating these elements, the letter aims to facilitate a resolution while maintaining compliance with legal standards.

Steps to Complete the Letter Debtor Collection

Completing the letter debtor collection involves several key steps to ensure clarity and legal compliance. First, gather all relevant information regarding the debt, including the debtor's details and the original agreement. Next, clearly outline the total amount owed, including any letter finance charges that may apply. It is essential to specify payment methods and deadlines to avoid confusion. Once the letter is drafted, review it for accuracy and completeness before sending it to the debtor. Utilizing a digital signing solution can enhance the process by providing a secure and legally binding signature.

Legal Use of the Letter Debtor Collection

The legal use of the letter debtor collection is governed by various regulations that protect both creditors and debtors. Compliance with the Fair Debt Collection Practices Act (FDCPA) is essential, as it outlines prohibited practices and ensures fair treatment of debtors. The letter must not contain misleading information or threats, and it should provide the debtor with clear options for resolving the debt. By adhering to these legal standards, creditors can effectively communicate their claims while minimizing the risk of disputes or legal repercussions.

Key Elements of the Letter Debtor Collection

Several key elements must be included in the letter debtor collection to ensure it is effective and legally sound. These elements include:

- Creditor Information: Full name and contact details of the creditor.

- Debtor Information: Full name and address of the debtor.

- Debt Details: A clear breakdown of the original debt amount, any letter finance charges, and the total amount due.

- Payment Instructions: Detailed instructions on how the debtor can make the payment.

- Deadline: A specific date by which the payment must be made to avoid additional penalties.

Examples of Using the Letter Debtor Collection

Utilizing the letter debtor collection can vary based on the situation. For instance, a business may send a letter to a customer who has not paid for services rendered, detailing the outstanding balance and any applicable late fees. Another example could involve a landlord sending a letter to a tenant regarding overdue rent payments. In both cases, the letter serves as a formal reminder and provides the debtor with clear information on how to resolve the outstanding amount.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the letter debtor collection can lead to significant penalties for creditors. Non-compliance with the FDCPA may result in legal action from the debtor, including claims for damages. Additionally, improperly executed letters can undermine the creditor's position in any potential court proceedings. It is essential for creditors to ensure that their collection practices, including the use of this letter, adhere to all applicable laws to avoid these consequences.

Quick guide on how to complete letter debtor collection

Effortlessly Prepare Letter Debtor Collection on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Letter Debtor Collection on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and eSign Letter Debtor Collection with Ease

- Obtain Letter Debtor Collection and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize crucial parts of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Amend and eSign Letter Debtor Collection and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are letter penalties in the context of eSigning?

Letter penalties refer to the consequences that businesses may face for failing to comply with legal requirements for document signing. Using airSlate SignNow helps you mitigate these risks by ensuring that all your documents are properly executed and legally binding, thus avoiding any potential letter penalties.

-

How can airSlate SignNow help avoid letter penalties?

airSlate SignNow provides a secure platform for eSigning documents which ensures compliance with legal standards. By employing advanced authentication and audit trail features, you can be confident that your signatures adhere to regulations, thus minimizing the likelihood of facing letter penalties.

-

Are there any costs associated with avoiding letter penalties using airSlate SignNow?

airSlate SignNow offers various pricing plans that provide value for businesses of all sizes. By investing in our platform, you gain peace of mind knowing that you can avoid the potentially high costs associated with letter penalties due to non-compliance.

-

What features does airSlate SignNow offer to help with letter penalties?

airSlate SignNow includes features such as legally binding eSignatures, customizable templates, and real-time tracking, all designed to ensure compliance. These tools not only streamline your workflow but also signNowly reduce the risk of incurring letter penalties.

-

Can airSlate SignNow integrate with my existing software to prevent letter penalties?

Yes, airSlate SignNow offers seamless integrations with popular business tools, such as CRM, document management systems, and cloud storage services. This allows you to maintain your existing workflows while ensuring that all eSignatures adhere to legal requirements, effectively helping you avoid letter penalties.

-

What are the benefits of using airSlate SignNow for document signing?

The primary benefits of using airSlate SignNow include increased efficiency, improved security, and enhanced compliance. By using our platform, businesses can streamline their document signing processes while reducing the risk of letter penalties, thus saving time and resources.

-

How does airSlate SignNow ensure the legality of eSignatures to avoid letter penalties?

airSlate SignNow complies with international eSignature laws, such as ESIGN and UETA, which ensures that eSignatures are legally valid. With features like identity verification and audit logs, you can rest assured that your document signing processes are protected against letter penalties.

Get more for Letter Debtor Collection

- Ccoc complaint submission form

- Request new service central maine powerelectricians examining boardoffice of professional and electricians examining form

- Cmp 1360 form

- 515 form

- Lg920 bar bingo paper sales excludes electronic linked bingo form

- Lg920 form

- Free minnesota firearm bill of sale form wordpdf

- Waiver request form

Find out other Letter Debtor Collection

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement