Repossession Form

What is the repossession order?

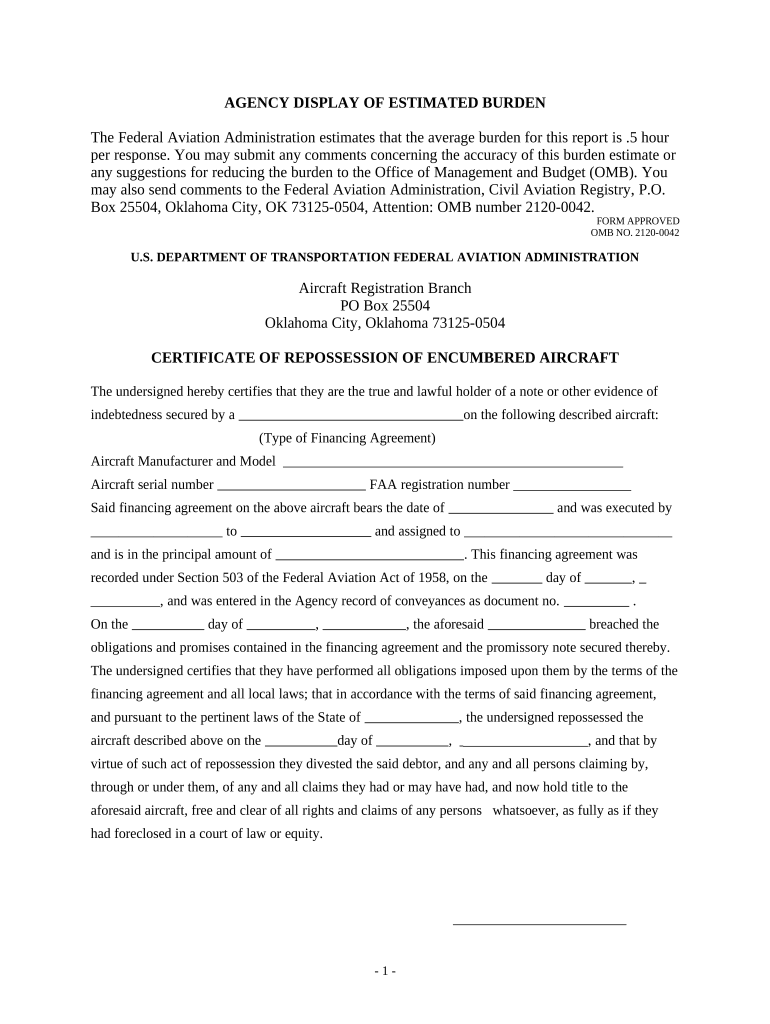

A repossession order is a legal document that allows a lender or creditor to reclaim property from a borrower who has defaulted on their loan or lease agreement. This process typically occurs when the borrower fails to make payments as agreed. The repossession order serves as a formal notice that the lender has the right to take back the property, which may include vehicles, equipment, or other financed items. Understanding this order is crucial for borrowers, as it outlines their rights and responsibilities during the repossession process.

Steps to complete the repossession order

Completing a repossession order involves several key steps to ensure compliance with legal requirements. First, the lender must verify that the borrower is in default, which typically means missed payments. Next, the lender should prepare the repossession order, ensuring it includes necessary details such as the borrower's information, the property description, and the reason for repossession. After the order is drafted, it must be filed with the appropriate court. Once approved, the lender can then proceed with the repossession process, often involving coordination with local law enforcement if necessary.

Legal use of the repossession order

The legal use of a repossession order is governed by state laws and regulations, which can vary significantly across the United States. It is essential for lenders to understand these laws to ensure that their repossession actions are lawful. This includes adhering to notification requirements, allowing the borrower a chance to rectify the default, and following proper procedures during the repossession. Failure to comply with these legal standards can result in penalties, including lawsuits or damages awarded to the borrower.

Key elements of the repossession order

Several key elements must be included in a repossession order for it to be considered valid. These elements typically include:

- The name and contact information of the lender and borrower

- A detailed description of the property being repossessed

- The specific terms of the loan or lease agreement

- The reason for the repossession, such as missed payments

- The date the order was issued

Inclusion of these elements helps ensure clarity and legality, protecting both the lender's rights and the borrower's interests.

State-specific rules for the repossession order

Each state has its own rules and regulations governing repossession orders, which can affect how the process is conducted. For example, some states require lenders to provide a notice of default before initiating repossession, while others may have specific timelines for how quickly a repossession must occur after default. It is important for both lenders and borrowers to familiarize themselves with their state's laws to avoid potential legal issues. Consulting with a legal expert can provide guidance tailored to specific situations.

Required documents for repossession

To initiate a repossession order, certain documents are typically required. These may include:

- The original loan or lease agreement

- Proof of default, such as payment records

- The completed repossession order form

- Any relevant correspondence with the borrower regarding the default

Having these documents prepared and organized can streamline the repossession process and help ensure compliance with legal requirements.

Penalties for non-compliance with repossession laws

Failure to adhere to repossession laws can result in significant penalties for lenders. These penalties may include financial damages awarded to the borrower, loss of the right to repossess the property, and potential legal action against the lender. Additionally, non-compliance can damage a lender's reputation and lead to regulatory scrutiny. It is crucial for lenders to follow all legal protocols to avoid these consequences and ensure a fair process for all parties involved.

Quick guide on how to complete repossession 497337014

Effortlessly Complete Repossession on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Repossession on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to Modify and eSign Repossession with Ease

- Obtain Repossession and click on Get Form to commence.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or mask sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Repossession to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a repossession order and how does it work?

A repossession order is a legal document that grants a lender the right to reclaim property due to non-payment. Once issued, this order allows authorized personnel to seize the asset in question. Understanding the process is crucial for both lenders and borrowers to navigate potential repossession situations.

-

How can airSlate SignNow help with repossession order documentation?

airSlate SignNow streamlines the document signing process, making it easier to manage repossession orders. With our eSigning capabilities, you can quickly send, receive, and store important documents securely. This simplifies the legal process and ensures compliance with relevant laws and procedures.

-

What are the pricing options for using airSlate SignNow for repossession orders?

airSlate SignNow offers competitive pricing plans to suit various business needs. Our pricing tiers include essential features for managing repossession orders efficiently. You can choose a plan that best fits your volume of documents and specific requirements.

-

Are there any specific features offered for handling repossession orders?

Yes, airSlate SignNow includes features specifically designed for managing repossession orders, such as customizable templates, advanced security options, and automated workflows. These features help ensure that all documentation is created accurately and efficiently. This reduces the risk of errors in legal documents related to repossession.

-

Can airSlate SignNow integrate with other platforms for repossession order management?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like CRM systems and document management software, enhancing your repossession order management workflow. This integration allows you to automate processes and improve efficiency in tracking and handling repossession documents.

-

What are the benefits of using airSlate SignNow for repossession order management?

Using airSlate SignNow for repossession order management enhances efficiency and reduces turnaround time on documents. Our platform ensures that all parties can quickly eSign and access important documents. This creates a smoother process for compliance and communication regarding repossession orders.

-

Is airSlate SignNow secure for handling sensitive repossession order information?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your repossession order information. This ensures that all documents are stored securely and accessible only to authorized users.

Get more for Repossession

Find out other Repossession

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form