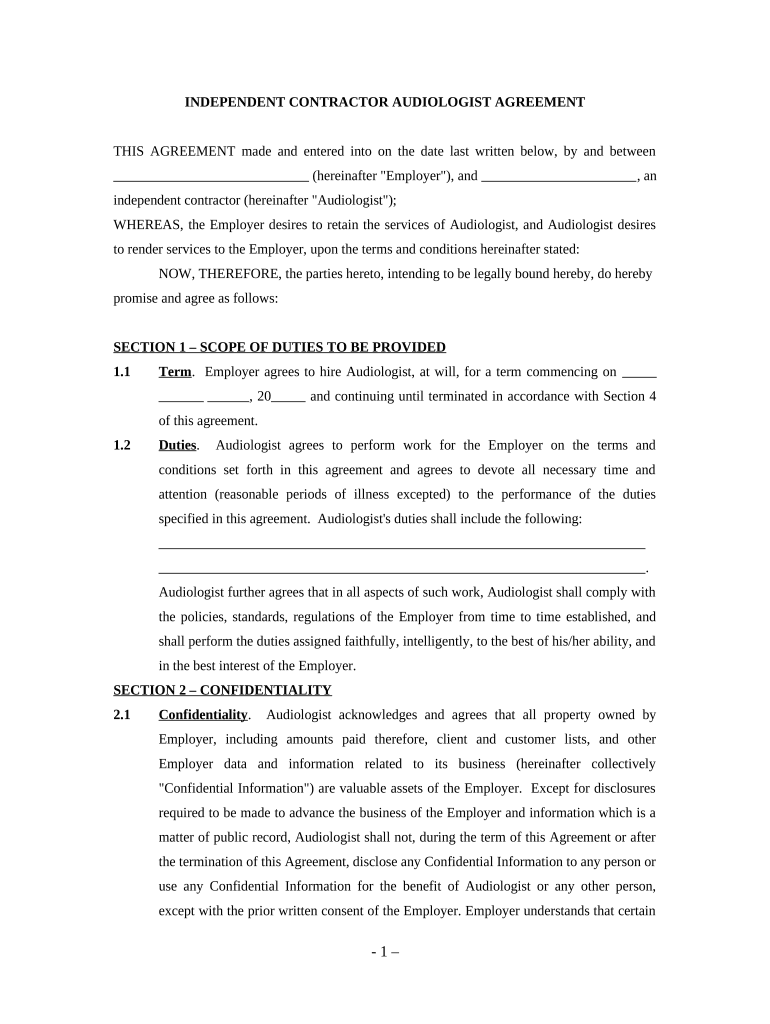

Independent Contractor Employment Form

What is the independent contractor employment?

The independent contractor employment refers to a work arrangement where individuals provide services to a business without being classified as employees. This type of employment allows contractors to operate under their own business name and typically offers flexibility in terms of work hours and project selection. Unlike traditional employees, independent contractors are responsible for their own taxes, benefits, and insurance. Understanding this distinction is crucial for both contractors and businesses to ensure compliance with applicable laws and regulations.

Key elements of the independent contractor employment

Several key elements define independent contractor employment, making it distinct from traditional employment. These elements include:

- Control over work: Independent contractors determine how, when, and where they complete their tasks.

- Payment structure: Contractors are often paid per project or task rather than receiving a regular salary.

- Business autonomy: Contractors typically operate as separate entities, which means they can work for multiple clients simultaneously.

- Tax obligations: Independent contractors must handle their own tax payments, including self-employment taxes.

Steps to complete the independent contractor employment

Completing the independent contractor employment process involves several essential steps to ensure a smooth experience for both the contractor and the hiring business. These steps include:

- Drafting the agreement: Create a clear independent contractor agreement that outlines the scope of work, payment terms, and deadlines.

- Gathering necessary information: Collect relevant details such as the contractor's name, business name, and tax identification number.

- Reviewing legal requirements: Ensure compliance with federal and state laws regarding independent contractor classifications.

- Obtaining signatures: Use a reliable eSignature solution to securely sign the agreement, ensuring it is legally binding.

Legal use of the independent contractor employment

The legal use of independent contractor employment requires adherence to specific regulations and guidelines. It is essential for businesses to correctly classify workers to avoid potential legal issues. Misclassification can lead to penalties and back taxes. Key legal considerations include:

- IRS guidelines: The IRS provides criteria to determine whether a worker is an independent contractor or an employee.

- State regulations: Various states may have additional rules regarding independent contractor classifications.

- Written agreements: Having a formal written agreement helps clarify the relationship and expectations between the contractor and the business.

Examples of using the independent contractor employment

Independent contractor employment is prevalent across various industries. Common examples include:

- Freelance writers: They create content for multiple clients without being tied to a single employer.

- Consultants: Professionals who provide expert advice on a project basis.

- Graphic designers: Creatives who work on specific design projects for various businesses.

- IT specialists: Contractors who offer technical support and services to different organizations.

Eligibility criteria for independent contractor employment

Eligibility for independent contractor employment generally involves meeting specific criteria set by the IRS and state laws. Key factors include:

- Nature of work: The work should be distinct from the company's core business operations.

- Independence: The contractor must have the ability to control how the work is performed.

- Business setup: Contractors should operate under their own business entity, such as an LLC or sole proprietorship.

Quick guide on how to complete independent contractor employment 497337178

Effortlessly Prepare Independent Contractor Employment on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Independent Contractor Employment on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to Edit and Electronically Sign Independent Contractor Employment with Ease

- Obtain Independent Contractor Employment and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and has the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Independent Contractor Employment and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is independent contractor employment?

Independent contractor employment refers to a working arrangement where individuals provide services to businesses without being classified as employees. This model allows contractors to have flexible working hours, control over their projects, and the autonomy to work with multiple clients. Understanding the implications of independent contractor employment can help optimize your business structure.

-

How can airSlate SignNow assist with independent contractor employment agreements?

airSlate SignNow streamlines the process of creating and managing independent contractor employment agreements. With customizable templates and electronic signatures, businesses can easily draft contracts that are legally binding and tailored to their needs. This simplifies compliance and ensures that both parties are clear about the terms of their working relationship.

-

What are the pricing options for using airSlate SignNow for independent contractor employment?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes looking to manage independent contractor employment effectively. Plans typically include features like document management, eSigning, and integrations with popular tools. A cost-effective solution can help businesses optimize their spending while ensuring compliance with contractor agreements.

-

What features does airSlate SignNow provide for managing independent contractors?

Key features of airSlate SignNow for managing independent contractors include customizable templates, bulk sending options, and real-time tracking of document status. Additionally, its secure eSignature functionality facilitates faster agreement execution, which is crucial in independent contractor employment scenarios. These features help maintain efficiency and transparency in contractor onboarding.

-

Are there any benefits of using airSlate SignNow for independent contractor employment documentation?

Using airSlate SignNow provides numerous benefits for independent contractor employment documentation, such as reduced paperwork and increased efficiency. By digitizing the signing process, businesses can save time and enhance their workflow. This means quicker turnaround times for contract execution, ultimately benefiting both the company and the contractor.

-

Does airSlate SignNow integrate with other tools to support independent contractor employment?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, including CRM systems and project management tools. These integrations enhance the management of independent contractor employment by allowing businesses to create a cohesive workflow across platforms. This connectivity ensures that contractor details are easily accessible within the associated systems.

-

How secure is the platform for independent contractor employment documents?

airSlate SignNow prioritizes security, ensuring that all documents related to independent contractor employment are securely encrypted. The platform adheres to industry standards for data protection, allowing businesses to confidently store and manage sensitive information. This commitment to security helps build trust with contractors when handling their agreements.

Get more for Independent Contractor Employment

- 2021 d 101a form 1 es instructions estimated income tax for

- Us census bureau annual financial report form

- Ampquotinformation onlyampquot formsinternal revenue servicedor attachments wisconsin8175 special computation formats forms and

- 2020 schedule 3k 1 partners share of income deductions credits etc form

- 2021 w 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld

- Sales and use tax report wisconsin department of revenue form

- 2021 2021 quarter form 941me 99 2106200 maine revenue

- Form me uc 1 maine unemployment cssf upaf contributions

Find out other Independent Contractor Employment

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple