Lien Creditor Form

What is the lien creditor?

A lien creditor is an individual or entity that has a legal claim against another person's property due to a debt or obligation. This claim allows the lien creditor to potentially take possession of the property if the debtor fails to meet their obligations. In the United States, lien creditors can arise from various situations, including unpaid loans, taxes, or judgments. Understanding the role of a lien creditor is crucial for both creditors and debtors, as it affects property rights and financial responsibilities.

How to use the lien creditor

Using the lien creditor involves several steps to ensure that the claim is valid and enforceable. First, the creditor must establish the debt and ensure it is documented properly. This documentation can include contracts, invoices, or court judgments. Next, the creditor must file the necessary paperwork with the appropriate state or local authorities to create a public record of the lien. This filing process varies by state, so it is essential to follow local regulations. Once the lien is filed, the creditor can enforce it if the debtor fails to pay the owed amount.

Key elements of the lien creditor

Several key elements define the lien creditor and their rights. These include:

- Legal documentation: A valid lien must be supported by proper legal documentation that outlines the debt.

- Filing requirements: The lien must be filed with the appropriate authorities to be enforceable.

- Priority: Lien creditors may have different levels of priority based on the type of lien and the order in which they were filed.

- Enforcement rights: Lien creditors have specific rights to enforce the lien, which may include foreclosure or seizure of property.

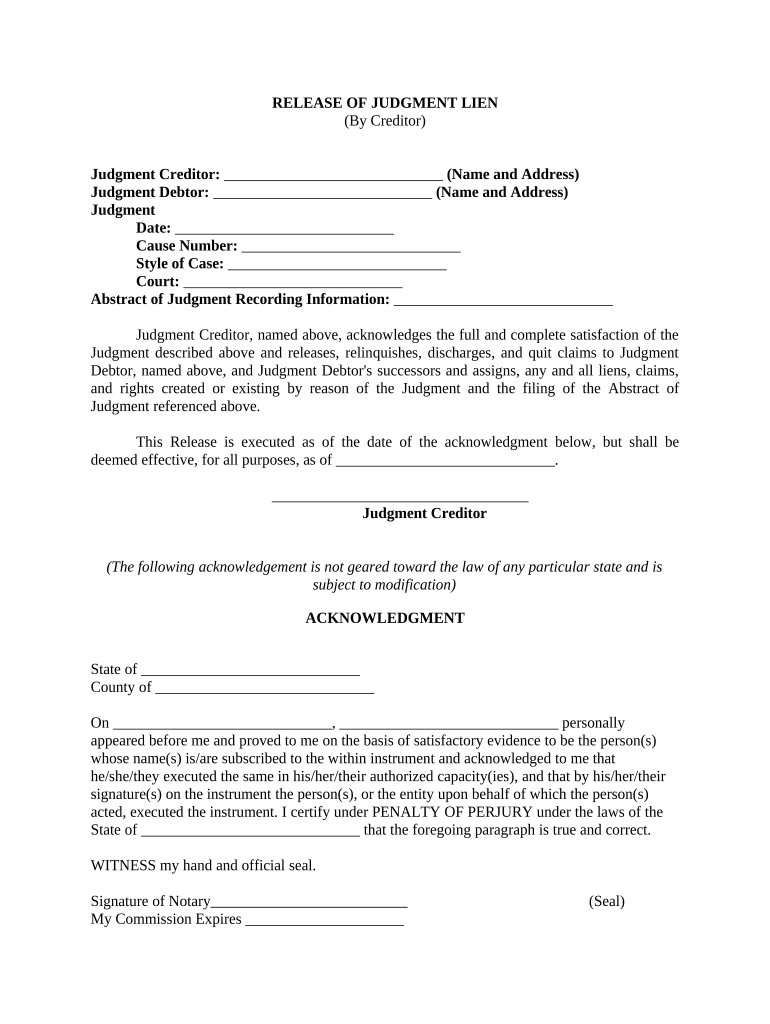

Steps to complete the lien creditor

Completing the lien creditor process involves several important steps:

- Gather all necessary documentation related to the debt.

- Determine the appropriate jurisdiction for filing the lien.

- Complete the required lien forms, ensuring all information is accurate.

- File the lien with the appropriate local or state authority.

- Notify the debtor of the lien filing, as required by law.

- Monitor the status of the lien and be prepared to enforce it if necessary.

Legal use of the lien creditor

The legal use of a lien creditor is governed by state and federal laws. It is essential for lien creditors to understand these laws to ensure compliance and protect their rights. Legal uses include securing debts, enforcing payment through property claims, and following proper procedures for filing and notifying debtors. Failure to adhere to legal requirements can result in the lien being deemed invalid or unenforceable.

State-specific rules for the lien creditor

Each state in the U.S. has its own rules and regulations regarding lien creditors. These rules can vary significantly, affecting how liens are filed, enforced, and prioritized. It is crucial for creditors to familiarize themselves with their state's specific laws to ensure compliance. This includes understanding filing fees, deadlines, and any necessary documentation required for the lien process.

Quick guide on how to complete lien creditor

Easily Prepare Lien Creditor on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to acquire the necessary forms and securely maintain them online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and electronically sign your documents without any holdups. Manage Lien Creditor on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

Easily Modify and eSign Lien Creditor

- Locate Lien Creditor and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Lien Creditor to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien creditor and how does it relate to airSlate SignNow?

A lien creditor is a party that holds a legal right or interest in property, granted until a debt obligation is satisfied. With airSlate SignNow, lien creditors can seamlessly manage and eSign important documents, ensuring that all necessary agreements are legally binding and easily accessible.

-

How can airSlate SignNow benefit lien creditors in their document management?

airSlate SignNow offers lien creditors a streamlined solution to send, receive, and eSign documents electronically, saving time and reducing paperwork. This helps lien creditors maintain compliance while efficiently managing their documentation processes.

-

What features does airSlate SignNow offer that support lien creditors?

Key features of airSlate SignNow for lien creditors include customizable templates, secure eSignature capabilities, and easy document tracking. These features make it simpler for lien creditors to handle their obligations and keep documents organized.

-

Is airSlate SignNow cost-effective for lien creditors?

Yes, airSlate SignNow provides a cost-effective solution tailored for lien creditors. With flexible pricing plans, it allows lien creditors to choose options that best fit their budget while still enjoying robust features and functionalities.

-

Can airSlate SignNow integrate with other tools used by lien creditors?

Absolutely! airSlate SignNow integrates with various business applications, which is beneficial for lien creditors seeking to streamline their operations. Integrations with tools like CRM systems and cloud storage services ensure that lien creditors can work efficiently without disruption.

-

How secure is airSlate SignNow for lien creditor documentation?

airSlate SignNow takes the security of lien creditor documentation seriously, employing encryption and secure cloud storage. This ensures that sensitive documents are protected and meet compliance regulations, giving lien creditors peace of mind in their transactions.

-

What support does airSlate SignNow offer to lien creditors?

airSlate SignNow provides excellent customer support for lien creditors, including online resources, live chat, and phone assistance. This ensures that lien creditors can quickly resolve any issues or questions regarding document management or eSigning.

Get more for Lien Creditor

- Request for deceased individuals social security form

- Name shown on return form

- General business credit form 3800 taxslayer pro support

- Fillable online 510d pass through entity form maryland

- Pdf taxpayer e file opt out election form alabama department of revenue

- Form 6150 alaska oil and gas corporation net income tax

- Pdf cpe unclaimed property listing city of charlotte form

- Ty 2021 502up tax year 2021 502up individual taxpayer form

Find out other Lien Creditor

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free