Ut Lien Form

What is the Ut Lien

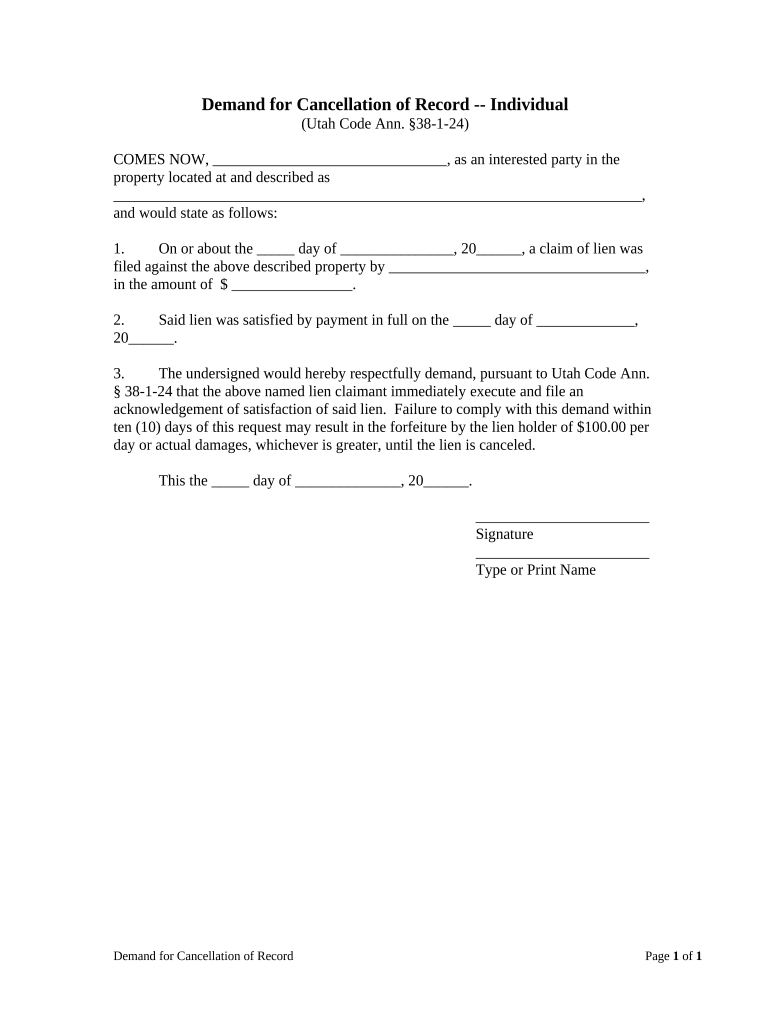

The Ut Lien is a legal document used to establish a claim against a property for unpaid debts or obligations. This form is essential for creditors seeking to secure their interests in real estate or personal property. By filing a Ut Lien, creditors can ensure that they have a legal right to recover debts owed to them, which can include loans, unpaid services, or other financial obligations. The lien remains in effect until the debt is satisfied or the lien is released, making it a crucial tool in debt recovery processes.

How to Use the Ut Lien

Using the Ut Lien involves several steps to ensure that the document is properly executed and legally binding. First, the creditor must gather all relevant information, including the debtor's details and the nature of the debt. Next, the creditor fills out the Ut Lien form accurately, providing all required information. Once completed, the form must be filed with the appropriate state or local authority, often accompanied by a filing fee. It is important to keep a copy of the filed lien for personal records and future reference.

Steps to Complete the Ut Lien

Completing the Ut Lien requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information about the debtor and the debt.

- Obtain the Ut Lien form from the appropriate authority or website.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the relevant office, along with any required fees.

Legal Use of the Ut Lien

The legal use of the Ut Lien is governed by state laws, which dictate how and when a lien can be filed. It is crucial for creditors to understand these regulations to ensure compliance. The Ut Lien must be filed within a specific timeframe after the debt becomes due, and failure to do so may result in the loss of the right to collect the debt. Additionally, the lien must be properly served to the debtor, notifying them of the claim against their property.

Key Elements of the Ut Lien

Several key elements must be included in the Ut Lien to ensure its validity:

- The debtor's full name and address.

- The creditor's information, including name and contact details.

- A clear description of the debt or obligation.

- The property subject to the lien, including a legal description.

- The date the lien is filed.

Filing Deadlines / Important Dates

Filing deadlines for the Ut Lien vary by state and type of debt. It is essential to be aware of these deadlines to maintain the validity of the lien. Generally, creditors should file the lien as soon as the debt is due. Some states may have specific timeframes, such as within a few months after the debt becomes delinquent. Keeping track of these dates can prevent complications in the debt recovery process.

Quick guide on how to complete ut lien

Complete Ut Lien effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as one can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, adjust, and eSign your documents quickly without delays. Handle Ut Lien on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign Ut Lien without exertion

- Locate Ut Lien and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from a device of your choice. Adjust and eSign Ut Lien and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'ut lien' and how does it relate to airSlate SignNow?

The term 'ut lien' refers to a legal claim or right against assets that can enhance workflow in document management. With airSlate SignNow, you can efficiently manage and eSign documents related to 'ut lien,' ensuring that your contracts are legally binding and secure.

-

What features does airSlate SignNow offer for managing 'ut lien' documents?

airSlate SignNow provides features like customizable templates, advanced security options, and workflow automation specifically for 'ut lien' documentation. These tools help ensure that your signing processes are streamlined and compliant with legal requirements.

-

How does airSlate SignNow ensure the security of 'ut lien' document eSignatures?

AirSlate SignNow prioritizes the security of your 'ut lien' documents by offering encryption, audit trails, and secure storage. These features ensure that all eSignatures are verifiable and that your sensitive information remains protected.

-

Is there a free trial available for airSlate SignNow's services related to 'ut lien'?

Yes, airSlate SignNow offers a free trial that allows you to explore its capabilities, including those for 'ut lien' documents. This trial lets you test features like eSigning, document sharing, and workflow automation without commitment.

-

How does airSlate SignNow integrate with other tools for managing 'ut lien' documents?

AirSlate SignNow offers seamless integrations with various platforms such as Google Drive, Salesforce, and Dropbox, making it easy to manage 'ut lien' documents across different tools. This integration capability enhances productivity and simplifies document workflows.

-

What are the pricing plans for airSlate SignNow for 'ut lien' document management?

AirSlate SignNow provides flexible pricing plans tailored to different business needs, including options for 'ut lien' document management. Plans vary based on features needed, user count, and monthly or annual billing, facilitating cost-effective solutions.

-

Can airSlate SignNow help in complying with regulations related to 'ut lien'?

Absolutely! AirSlate SignNow is designed to help businesses comply with legal requirements associated with 'ut lien' documents. Its built-in compliance features ensure that all signed documents meet industry standards and regulations.

Get more for Ut Lien

Find out other Ut Lien

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer