Chapter 13 Plan Template Form

What is the Chapter 13 Plan Template

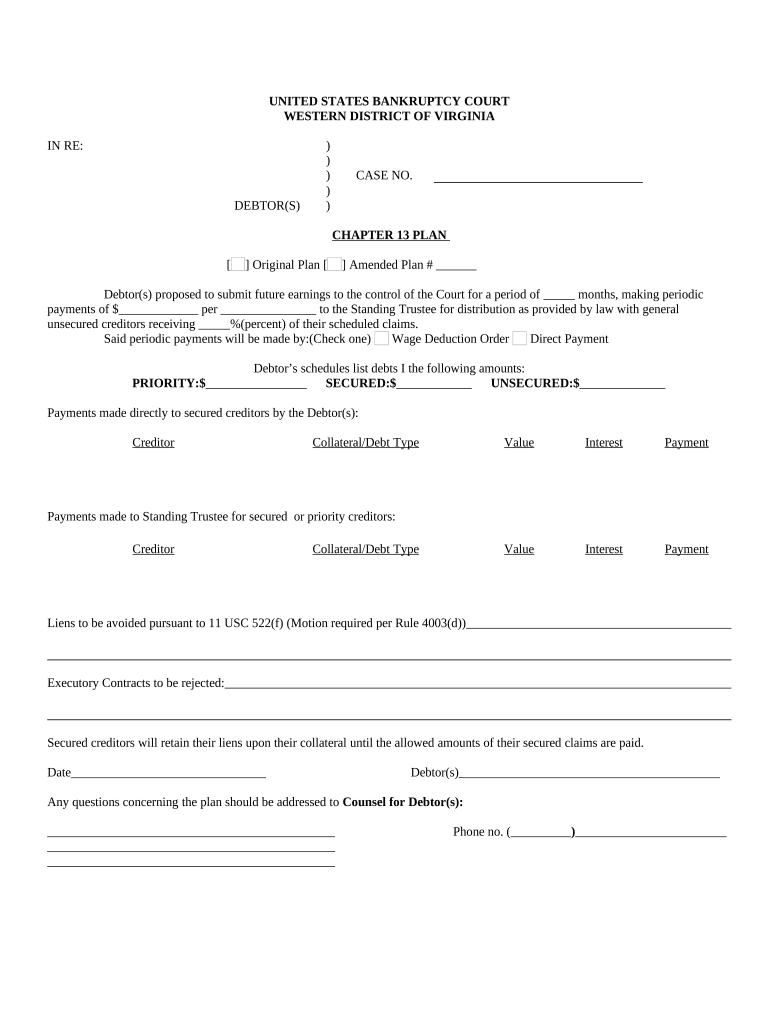

The Chapter 13 plan template is a legal document used in bankruptcy proceedings to outline how a debtor intends to repay creditors over a specified period, typically three to five years. This template serves as a framework for individuals who are seeking to reorganize their debts while retaining their assets. It includes detailed information about the debtor's income, expenses, and the proposed repayment plan, which must be approved by the bankruptcy court. The template ensures that all necessary elements are included for compliance with legal standards.

How to use the Chapter 13 Plan Template

Using the Chapter 13 plan template involves several key steps to ensure that the document is filled out accurately and comprehensively. First, gather all financial documents, including income statements, expense reports, and a list of debts. Next, fill in the template with your personal information, including your name, address, and case number. Clearly outline your proposed repayment plan, specifying how much you will pay to each creditor and the timeline for these payments. Finally, review the completed template for accuracy and completeness before submitting it to the court.

Steps to complete the Chapter 13 Plan Template

Completing the Chapter 13 plan template requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your full name, address, and bankruptcy case number.

- List all your creditors along with the amounts owed and the type of debt (secured or unsecured).

- Detail your monthly income and necessary expenses to demonstrate your financial situation.

- Outline your repayment plan, specifying the monthly payment amount and duration of the plan.

- Include any additional provisions, such as treatment of secured debts or special circumstances.

- Sign and date the document to affirm its accuracy and completeness.

Legal use of the Chapter 13 Plan Template

The legal use of the Chapter 13 plan template is essential for ensuring that the repayment plan is recognized by the bankruptcy court. To be legally binding, the plan must comply with the requirements set forth in the U.S. Bankruptcy Code. This includes providing a feasible repayment plan that prioritizes the interests of creditors while allowing the debtor to maintain necessary living expenses. Additionally, the plan must be filed within the appropriate timelines established by the court to avoid dismissal of the bankruptcy case.

Key elements of the Chapter 13 Plan Template

Several key elements must be included in the Chapter 13 plan template to ensure its effectiveness:

- Identification of Debtor: Full name and address of the debtor.

- Creditor Information: A complete list of all creditors, including the amounts owed.

- Income and Expenses: A detailed account of monthly income and necessary living expenses.

- Proposed Payments: Clear outline of how much will be paid to each creditor and the payment schedule.

- Duration of Plan: Specification of the repayment period, typically three to five years.

How to obtain the Chapter 13 Plan Template

The Chapter 13 plan template can typically be obtained through various sources. Many bankruptcy courts provide official templates on their websites, ensuring that debtors have access to the most current version. Additionally, legal aid organizations and bankruptcy attorneys often offer templates and guidance on how to fill them out correctly. It is important to use the most recent version of the template to ensure compliance with current legal standards.

Quick guide on how to complete chapter 13 plan template

Accomplish Chapter 13 Plan Template effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Chapter 13 Plan Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to edit and eSign Chapter 13 Plan Template with ease

- Find Chapter 13 Plan Template and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that intention.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form browsing, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Chapter 13 Plan Template and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 plan template?

A chapter 13 plan template is a structured document that outlines how individuals can repay their debts over a specified period. It is an essential tool for those filing for Chapter 13 bankruptcy, as it ensures adherence to court regulations and helps manage monthly payments effectively.

-

How does the airSlate SignNow chapter 13 plan template simplify the process?

The airSlate SignNow chapter 13 plan template simplifies the process by providing a user-friendly interface that allows users to input their financial information easily. This ensures accurate documentation tailored to individual needs, making it simpler to file with the bankruptcy court.

-

Is there a cost associated with using the chapter 13 plan template on airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow and accessing the chapter 13 plan template. However, it is designed to be cost-effective, providing signNow savings compared to hiring a bankruptcy attorney for document preparation.

-

What features are included in the airSlate SignNow chapter 13 plan template?

The chapter 13 plan template includes features like customizable fields, automated calculations, and eSigning capabilities. These make it easier for users to tailor their payment plans and securely send documents, enhancing efficiency and accuracy.

-

Can I integrate the chapter 13 plan template with other tools?

Yes, the airSlate SignNow chapter 13 plan template can seamlessly integrate with various tools like Google Drive and Dropbox. This integration allows for easy document management, ensuring you have all your essential files in one accessible location.

-

Who can benefit from using the chapter 13 plan template?

Individuals considering Chapter 13 bankruptcy can greatly benefit from the chapter 13 plan template. It offers a straightforward way to draft their repayment plans, making the bankruptcy process less stressful and more manageable.

-

What are the benefits of using airSlate SignNow's chapter 13 plan template?

Using airSlate SignNow's chapter 13 plan template provides a range of benefits, including ease of use, speed in document preparation, and cost savings. Additionally, its eSigning feature allows for quick approvals, ensuring timely submissions to the bankruptcy court.

Get more for Chapter 13 Plan Template

- 1st ltr req for hearing not filed form

- Chapter 16 writing letters and memoswrite for business form

- Name vs form

- Division cause no form

- Our firm represents name form

- This confirms our telephone conversation of date wherein we agreed that the estate of form

- This is to confirm our telephone conversation of date wherein you informed me that you

- United states environmental protection agency correspondence and form

Find out other Chapter 13 Plan Template

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer