Virginia Unsecured Installment Payment Promissory Note for Fixed Rate Virginia Form

What is the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

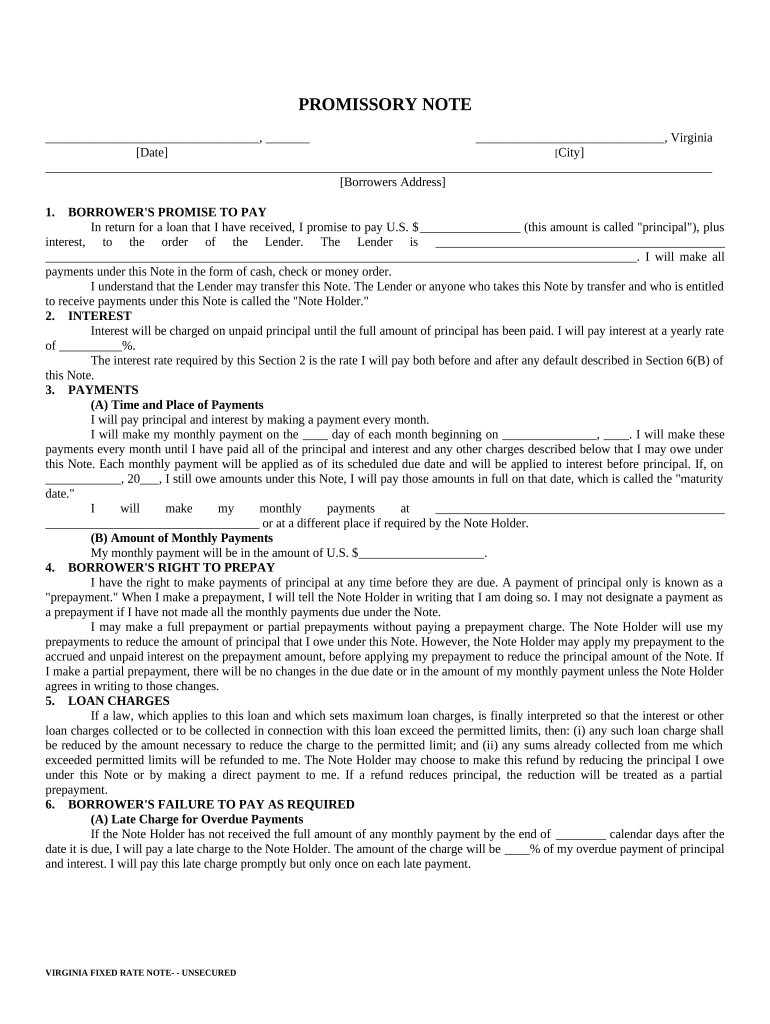

The Virginia Unsecured Installment Payment Promissory Note for Fixed Rate Virginia is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This type of promissory note is unsecured, meaning it does not require collateral to back the loan. It specifies the amount borrowed, the interest rate, the repayment schedule, and the consequences of default. This document serves as a formal acknowledgment of the debt and is crucial for both parties to ensure clarity and legal protection in the transaction.

How to use the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

Using the Virginia Unsecured Installment Payment Promissory Note involves several key steps. First, both the borrower and lender must agree on the loan terms, including the principal amount, interest rate, and repayment schedule. Once agreed upon, the borrower should fill out the note with accurate information. After completing the document, both parties should sign it to make it legally binding. It is advisable to keep a copy for personal records and provide one to the lender for their files. This ensures both parties have access to the agreed terms throughout the loan period.

Steps to complete the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

Completing the Virginia Unsecured Installment Payment Promissory Note involves the following steps:

- Identify the parties involved: Clearly state the names and addresses of both the borrower and lender.

- Specify the loan amount: Indicate the total amount being borrowed.

- Set the interest rate: Define the fixed interest rate applicable to the loan.

- Outline the repayment schedule: Detail the frequency of payments, such as monthly or quarterly, and the duration of the loan.

- Include terms for default: Describe the consequences if the borrower fails to make payments as agreed.

- Sign and date the document: Both parties must sign and date the note to validate it.

Key elements of the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

Several key elements must be included in the Virginia Unsecured Installment Payment Promissory Note to ensure its effectiveness:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total principal being borrowed.

- Interest Rate: The fixed rate that will apply to the loan.

- Repayment Terms: Details on how and when payments will be made.

- Default Terms: Conditions under which the borrower would be considered in default.

- Governing Law: A statement indicating that the note is governed by Virginia law.

Legal use of the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

The legal use of the Virginia Unsecured Installment Payment Promissory Note is essential for both lenders and borrowers. This document provides a clear record of the loan agreement, which can be referenced in case of disputes. It is legally binding as long as it meets the requirements set forth by Virginia law. Both parties must understand their rights and obligations outlined in the note to ensure compliance and protection. In the event of a default, the lender may use the note to seek legal recourse to recover the owed amount.

State-specific rules for the Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

Virginia has specific rules governing the use of promissory notes, including the unsecured installment payment promissory note. It is important for both parties to be aware of these regulations, which may include:

- Requirements for written agreements: The note must be in writing to be enforceable.

- Interest rate limits: Virginia law may impose limits on the maximum interest rate that can be charged.

- Disclosure requirements: Certain disclosures may need to be provided to the borrower regarding the terms of the loan.

Quick guide on how to complete virginia unsecured installment payment promissory note for fixed rate virginia

Effortlessly Prepare Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia effortlessly

- Locate Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Complete button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

A Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia is a legal document that outlines the borrower's promise to repay a loan in fixed installments over a specified period. This type of note is specifically designed for loans that do not require collateral, making it a flexible option for borrowers in Virginia.

-

What are the primary benefits of using a Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

The primary benefits include flexibility in repayment terms and the absence of collateral requirements, which can make it easier for borrowers. Additionally, it provides clear documentation of the loan agreement, which helps both parties understand their obligations.

-

How can airSlate SignNow help me with creating a Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

airSlate SignNow offers customizable templates for a Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia, allowing you to easily create and personalize your document. With our eSigning feature, you can quickly send and sign the document online, streamlining the entire process.

-

What features does airSlate SignNow provide for managing a Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

Our platform includes features such as document tracking, automatic reminders for payments, and secure cloud storage for all your important documents. These features ensure that both lenders and borrowers stay informed and organized throughout the duration of the loan.

-

Is it safe to use airSlate SignNow for my Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

Yes, airSlate SignNow prioritizes security and compliance, offering encrypted data storage and secure access controls. Your Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia will be protected, ensuring that sensitive information remains confidential.

-

What is the pricing structure for using airSlate SignNow to manage my Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

airSlate SignNow offers a cost-effective pricing structure that accommodates various needs, whether you're a small business or a larger enterprise. Details of our plans can be found on our website, and we provide a free trial so you can explore features before committing.

-

Can I integrate airSlate SignNow with other tools for better management of my Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia?

Absolutely! airSlate SignNow offers integrations with popular business tools such as Google Drive, Dropbox, and CRM systems. This ensures that your Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia can be effectively managed alongside your other business documents.

Get more for Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

- Unmarried hereinafter referred to as grantor form

- Does hereby convey and warrant unto a limited liability company organized form

- Notice of completioncorporation llc etc form

- Witness this agreement and authorization by and between farm form

- Missouri mechanics lien law in construction faqs forms

- Referred to as grantors do hereby convey and quitclaim unto a form

- Referred to as grantors do hereby convey and warrant unto a corporation form

- You are advised that there are inherent risks including the risk of serious injury or death form

Find out other Virginia Unsecured Installment Payment Promissory Note For Fixed Rate Virginia

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure