Correction Form 2013

What is the Correction Form

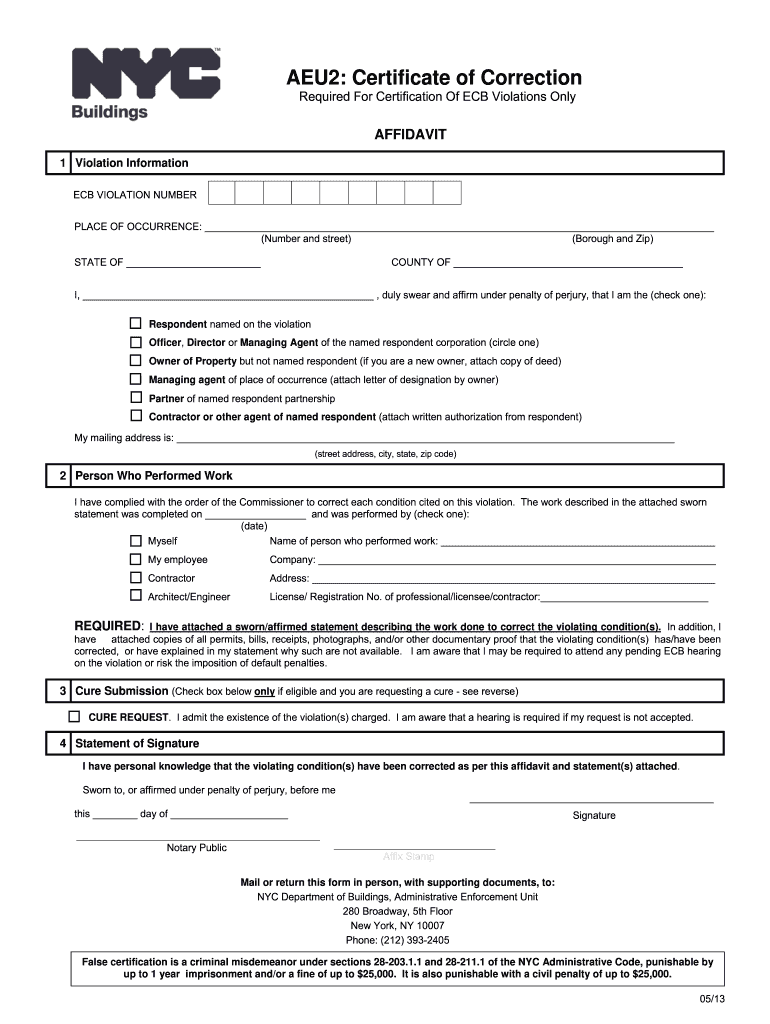

The Correction Form is a document used to amend or correct previously submitted information. This form is essential in various contexts, including tax filings, legal documents, and business records. Its purpose is to ensure that any inaccuracies are rectified, maintaining the integrity of the information held by governing bodies or organizations. Understanding the specific requirements and usage of the Correction Form is crucial for compliance and accuracy in documentation.

How to use the Correction Form

Using the Correction Form involves several steps to ensure that the amendments are made correctly. First, identify the specific information that needs correction. Next, fill out the form with the accurate details, ensuring that all required fields are completed. After filling out the form, review it for any errors before submission. Depending on the context, the form may need to be submitted online, via mail, or in person. Always keep a copy for your records.

Steps to complete the Correction Form

Completing the Correction Form can be straightforward if you follow these steps:

- Gather necessary information, including any previous submissions that need correction.

- Obtain the latest version of the Correction Form from the appropriate source.

- Fill in the form with accurate information, clearly indicating what is being corrected.

- Double-check all entries for accuracy and completeness.

- Submit the form through the designated method, whether online, by mail, or in person.

- Retain a copy of the submitted form for future reference.

Legal use of the Correction Form

The legal validity of the Correction Form hinges on its proper completion and adherence to relevant regulations. It is important to ensure that the form complies with local laws and guidelines. This may include specific requirements for signatures, notarization, or additional documentation. Utilizing a reliable platform for drafting and submitting the Correction Form can help ensure compliance and reduce the risk of errors.

Key elements of the Correction Form

Several key elements must be included in the Correction Form to ensure its effectiveness:

- Identification Information: Details such as name, address, and identification numbers.

- Correction Details: A clear description of the information being corrected.

- Supporting Documentation: Any necessary documents that substantiate the correction.

- Signature: A signature may be required to validate the form.

Examples of using the Correction Form

There are various scenarios in which a Correction Form may be utilized:

- Correcting tax information submitted to the IRS.

- Amending business registration details with state authorities.

- Updating personal information in legal documents.

- Adjusting financial records for accuracy in accounting.

Quick guide on how to complete correction form

Handle Correction Form anytime, anywhere

Your daily business activities may necessitate additional attention when managing region-specific business documents. Reclaim your work hours and reduce the costs associated with document-based operations using airSlate SignNow. airSlate SignNow offers a variety of pre-loaded business forms, including Correction Form, that you can utilize and distribute to your associates. Handle your Correction Form seamlessly with robust editing and eSignature features and deliver it directly to your recipients.

How to obtain Correction Form in a few clicks:

- Choose a form pertinent to your state.

- Click Learn More to access the document and confirm its accuracy.

- Select Get Form to begin using it.

- Correction Form will automatically appear in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Select the Sign feature to create your signature and electronically sign your document.

- When finished, click Done, save changes, and access your document.

- Send the form via email or SMS, or use a link-to-fill option with your associates or allow them to download the document.

airSlate SignNow signNowly conserves your time managing Correction Form and enables you to find essential documents in one place. A comprehensive collection of forms is organized and designed to support key business operations required for your organization. The sophisticated editor minimizes the risk of mistakes, allowing you to swiftly correct errors and review your documents on any device before distribution. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

Find and fill out the correct correction form

FAQs

-

How do I fill out the DU UG form correctly?

Hey! There . Looks like you are very much troubled , calm down and make sure you write all the details very correctly ( it should match with the documents you are attaching ).You won't be able to make any modifications later.1. Write all the marks in descending order , keeping best 4 on top.2. I would suggest you to get all the documents scanned in given size and formats. Don't compromise with quality.3. Keep your username and password simple . You have to use this potal throughout 3 years of college.Hope it helped.In case of any other doubt/query feel free to contact me.For make info visit : Step by Step Instructions to fill the Application Form

-

While filling out my JEE Mains application form, I have done a silly mistake. How can I correct it?

Thanks for A2A!After the deadline for form filling is over, students are provided with the the last chance for correction of mistakes in the form. It's date is generally after 1 week of the last date for form filling. So don't worry about that and plz be updated and keep checking the site regularly so that you can correct your silly mistakes because that is the last you are provided.

-

What is the IRS form W-10 and how is it correctly filled out?

While you may have never heard of IRS Form W-10, you will if you’re currently paying or planning to pay someone to care for a child, dependent, or spouse? If you are, then you may qualify to claim what’s called the Child and Dependent Care credit on your federal income tax return. To claim this credit, your care provider must fill out a W-10. You may also need to fill out the form if you receive benefits from an employer sponsored dependent care plan.It’s certainly worth it to see if you qualify (and for this we recommend that you consult with a tax professional). The child and dependent care credit can be up to 35 percent of qualifying expenses, depending on adjusted gross income. For 2011, filers may use up to $3,000 of expenses paid in a year for one qualifying individual or $6,000 for two or more qualifying individuals. (When it comes time to figure your qualifying expenses, remember that they must be reduced by the amount of any dependent care benefits provided by your employer, if those benefits were deducted or excluded from your income.)Do You Qualify for the Credit?To see if you need to have your care provider fill out a W-10, first determine if you qualify for the credit for child and dependent care expenses. To qualify, the care must have been provided for one or more qualifying persons, generally a dependent child age 12 or younger when the care was provided. Certain other individuals, spouses and those who are incapable of self-care, may also be considered qualifying persons. (Note: each qualifying individual must be listed on your tax return.)Remember also that the amount you can claim as a credit is reduced as your income rises. According to the Tax Policy Center, “Families with income below $15,000 qualify for the 35 percent credit. That rate falls by 1 percentage point for each additional $2,000 of income (or part thereof) until it signNowes 20 percent for families with income of $43,000 or more.”Next, consider why the care was provided. To qualify, the person (or couple, if married and filing jointly) claiming the credit must have sought care so they could work or search for employment. Further, the individual or couple filing must be considered earned income earners. Wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment all qualify individuals as having earned income. For married filers, one spouse may be considered as having earned income if they were a full-time student, or if they were unable to care for themselves.Who did you pay for care? Qualifying funds spent for care cannot be paid to a filer’s spouse, a dependent of the filer, or to the filer’s child, unless that child will signNow age 19 or older by the end of the year. (The rule for payments to the filer’s child does not change, even if the child is not the filer’s dependent.) Filers must identify care providers on their tax return.There are just a few more qualifying details. To qualify, filing status must be single, married filing jointly, head of household or qualifying widow(er) with a dependent child. The qualifying person must have lived with the person filing for over one half of the year. There are exceptions, for the birth or death of a qualifying person, and for children of divorced or separated parents.IRS Form W-10So, if you meet those criteria, then its time to make sure your care provider fills out a W-10. The form is simple to fill out, requiring only the provider’s name, address, signature and taxpayer identification number (usually their social security number). The form is only for your records; details about the provider will come when you fill out form 2441 for Child and Dependent Care Expenses.Source: The Child and Dependent Care Credit and IRS W-10 Form

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

By fault I've entered the wrong name of my college while filling out the GATE form. How do I correct it? Would it create trouble in future?

Actually it is not a big deal. There are corrections in many forms and the organizing institutes do entertain such corrections.All you need to do is write a mail to the GATE office and after 5th oct i.e., deadline of form filling, you can make the corrections. Just keep track of the official website.http://gate.iitg.ac.in

Create this form in 5 minutes!

How to create an eSignature for the correction form

How to generate an electronic signature for the Correction Form in the online mode

How to create an eSignature for the Correction Form in Chrome

How to generate an eSignature for putting it on the Correction Form in Gmail

How to generate an eSignature for the Correction Form straight from your mobile device

How to create an eSignature for the Correction Form on iOS

How to create an eSignature for the Correction Form on Android devices

People also ask

-

What is a Correction Form in airSlate SignNow?

A Correction Form in airSlate SignNow is a digital document that allows users to easily request changes or corrections to previously signed documents. This feature ensures that all parties can address necessary updates efficiently, maintaining the integrity of the original agreement while facilitating quick adjustments.

-

How can I create a Correction Form using airSlate SignNow?

Creating a Correction Form with airSlate SignNow is simple and user-friendly. Just log into your account, select the document that needs correction, and utilize the 'Request Correction' feature to generate a new form. This process streamlines communication and helps keep all stakeholders informed.

-

Are there any costs associated with using the Correction Form feature?

The Correction Form feature is included in airSlate SignNow's subscription plans, which are designed to be cost-effective for businesses of all sizes. You can choose from various pricing tiers based on your needs, ensuring you only pay for the features you will use, including the Correction Form functionality.

-

What are the benefits of using a Correction Form in airSlate SignNow?

Using a Correction Form in airSlate SignNow offers numerous benefits, including improved accuracy and efficiency in document management. It allows for quick amendments to contracts without the need for printing or rescanning, ultimately saving time and reducing the risk of errors.

-

Can I integrate the Correction Form feature with other applications?

Yes, airSlate SignNow supports integration with various applications, enhancing your workflow. You can seamlessly connect the Correction Form feature with tools like CRM systems, cloud storage, and project management software, which streamlines your document processes and improves overall productivity.

-

Is the Correction Form feature secure?

Absolutely! The Correction Form feature in airSlate SignNow adheres to stringent security protocols to ensure your documents are safe. With advanced encryption and compliance with industry standards, you can trust that your sensitive information remains protected throughout the correction process.

-

How does the Correction Form improve collaboration among team members?

The Correction Form in airSlate SignNow enhances collaboration by providing a clear and structured way for team members to request and implement changes. It allows all relevant parties to stay informed about amendments, ensuring that everyone is on the same page and reducing the likelihood of miscommunication.

Get more for Correction Form

Find out other Correction Form

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure