Wy Corporation Form

What is the Wy Corporation

The Wy Corporation is a formal business entity established under state law, often recognized for its legal protections and benefits. This type of corporation can limit the personal liability of its owners, known as shareholders, and is typically used for various business activities. The Wy Corporation can be structured in different ways, such as a C Corporation or an S Corporation, each offering distinct tax implications and operational guidelines. Understanding the nature and purpose of the Wy Corporation is crucial for individuals or groups looking to form a business in the United States.

How to use the Wy Corporation

Utilizing the Wy Corporation involves understanding its operational framework and compliance requirements. Business owners must register the corporation with the appropriate state authorities, which includes filing necessary documents and paying associated fees. Once established, the Wy Corporation can engage in contractual agreements, hire employees, and conduct business transactions under its name. It is essential for owners to maintain proper records and adhere to corporate formalities to ensure ongoing compliance with state regulations.

Steps to complete the Wy Corporation

Completing the Wy Corporation involves several key steps:

- Choose a name: Ensure the name is unique and complies with state naming regulations.

- File Articles of Incorporation: Submit the required formation documents to the state.

- Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS for tax purposes.

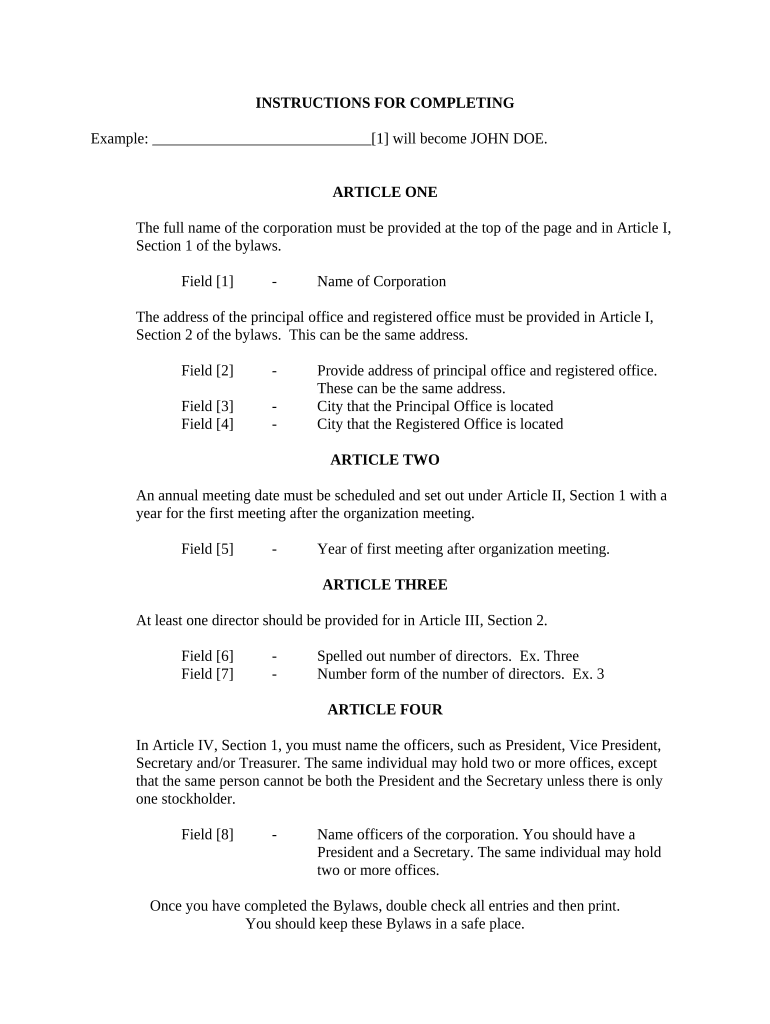

- Draft bylaws: Create internal rules governing the corporation’s operations.

- Hold an organizational meeting: Discuss and approve initial corporate actions.

- Comply with state regulations: Ensure all state-specific requirements are met, including licenses and permits.

Legal use of the Wy Corporation

The Wy Corporation is legally recognized and can be used for a variety of business purposes. It provides a framework for conducting business while protecting the personal assets of its shareholders. To ensure legal use, it is vital to adhere to state laws regarding corporate governance, including holding annual meetings, maintaining accurate records, and filing annual reports. Compliance with these requirements helps to maintain the corporation's good standing and legal protections.

Key elements of the Wy Corporation

Several key elements define the structure and operation of the Wy Corporation:

- Limited liability: Shareholders are typically not personally liable for the corporation's debts.

- Perpetual existence: The corporation continues to exist independently of its owners.

- Transferability of shares: Ownership can be transferred through the sale of shares.

- Centralized management: A board of directors manages the corporation, separate from the shareholders.

Eligibility Criteria

To form a Wy Corporation, certain eligibility criteria must be met. These typically include:

- Age: Incorporators must be at least eighteen years old.

- Residency: While incorporators can be from anywhere, the corporation must be registered in a specific state.

- Business purpose: The corporation must have a lawful purpose as defined by state law.

Quick guide on how to complete wy corporation

Complete Wy Corporation effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Wy Corporation on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Wy Corporation with ease

- Locate Wy Corporation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to store your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Wy Corporation and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to wy corporation?

airSlate SignNow is a digital signing solution that helps businesses like wy corporation send and eSign documents efficiently. Designed to streamline document workflows, it integrates seamlessly into your business processes, ensuring that signing is both quick and secure.

-

How much does airSlate SignNow cost for wy corporation?

Pricing for airSlate SignNow is flexible and tailored to the needs of businesses like wy corporation. Plans start at a competitive rate, and we offer tiered pricing based on the number of users and features required, enabling wy corporation to choose a plan that fits its budget.

-

What features does airSlate SignNow offer for wy corporation?

airSlate SignNow provides a robust set of features including document templates, bulk sending, and custom branding that would benefit wy corporation. Additionally, our platform ensures real-time tracking and notifications, keeping your team informed throughout the signing process.

-

How can airSlate SignNow enhance productivity for wy corporation?

By utilizing airSlate SignNow, wy corporation can experience signNow improvements in productivity. Our intuitive interface allows team members to manage, send, and sign documents faster, reducing the time spent on administrative tasks and enhancing overall workflow efficiency.

-

What integrations are available for wy corporation with airSlate SignNow?

airSlate SignNow offers numerous integrations that can benefit wy corporation, including popular tools like Salesforce, Google Drive, and Zapier. These integrations facilitate a seamless connection between your current systems and our eSigning solution, optimizing your business processes.

-

Is airSlate SignNow secure for wy corporation's sensitive documents?

Yes, airSlate SignNow employs advanced encryption and complies with various data protection regulations to ensure the security of sensitive documents for wy corporation. You can trust our platform to protect your data while providing a smooth signing experience.

-

Can airSlate SignNow be used on mobile devices by wy corporation?

Absolutely! airSlate SignNow is designed to be fully functional on mobile devices, making it convenient for wy corporation employees to send and sign documents on-the-go. This mobile accessibility ensures that your team can work flexibly from anywhere.

Get more for Wy Corporation

- New mexico quit claim deeds us legal forms

- New mexico deed forms us legal forms

- In new mexico does a deed have to specify how multiple form

- Wiatt v state farm insurance companies 560 f supp 2d form

- Docketing statement instructions united states form

- Reyes v statednmjudgmentlawcasemine form

- Alan ellis attorney alan ellis federal sentencing habeas form

- Defendant appell form

Find out other Wy Corporation

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document