Personal Financial Summary Form Citibank

What is the Personal Financial Summary Form Citibank

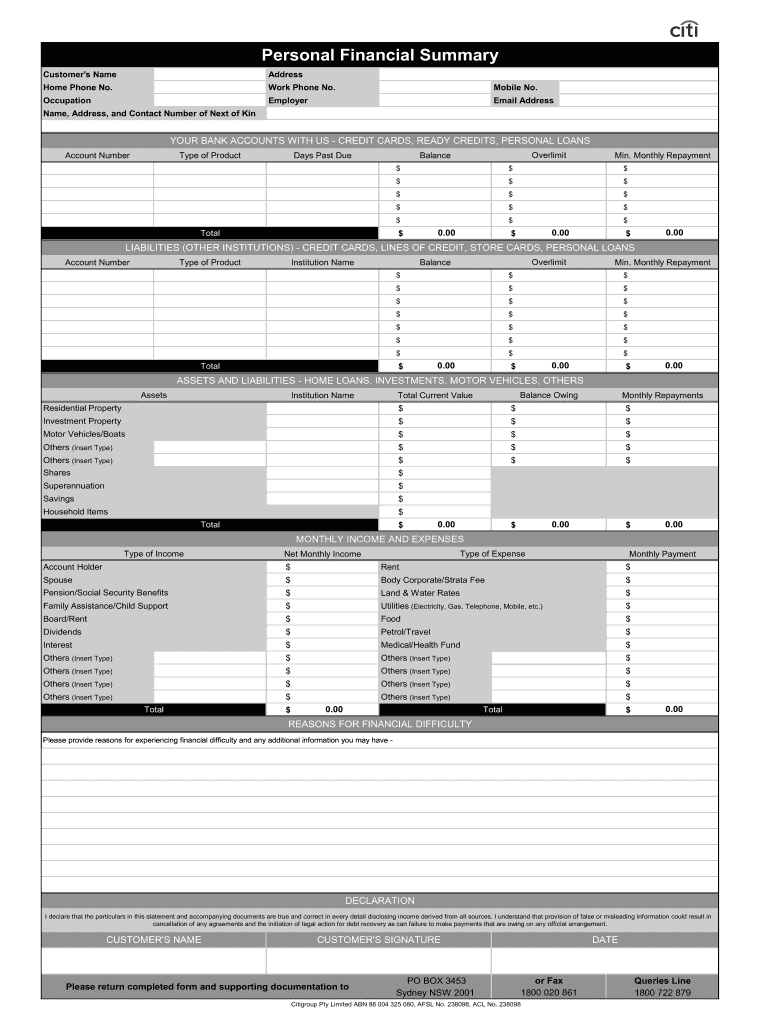

The Personal Financial Summary Form Citibank is a comprehensive document designed to capture an individual's financial status. It includes details about income, expenses, assets, and liabilities, providing a clear snapshot of one's financial health. This form is often required for various financial assessments, such as loan applications or investment evaluations. By compiling all relevant financial information in one place, it helps individuals and financial institutions make informed decisions.

Key elements of the Personal Financial Summary Form Citibank

The key elements of the Personal Financial Summary Form Citibank include:

- Income: A detailed account of all sources of income, including salaries, bonuses, and other earnings.

- Expenses: A breakdown of monthly expenses, such as housing, utilities, and discretionary spending.

- Assets: Information about owned properties, vehicles, savings accounts, and investments.

- Liabilities: Details of outstanding debts, including mortgages, credit cards, and loans.

These components work together to provide a holistic view of an individual's financial situation, essential for effective financial planning and management.

Steps to complete the Personal Financial Summary Form Citibank

Completing the Personal Financial Summary Form Citibank involves several straightforward steps:

- Gather Documentation: Collect all necessary financial documents, including pay stubs, bank statements, and tax returns.

- List Income Sources: Accurately record all sources of income, ensuring to include any additional earnings.

- Detail Expenses: Itemize monthly expenses, categorizing them for clarity and accuracy.

- Outline Assets and Liabilities: Provide a comprehensive list of all assets and liabilities to reflect your financial standing.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the relevant institution.

Following these steps ensures that the form is filled out correctly, which is crucial for any financial assessments or applications.

Legal use of the Personal Financial Summary Form Citibank

The Personal Financial Summary Form Citibank is legally recognized when completed accurately and honestly. It serves as a formal declaration of an individual's financial status and can be used in various legal contexts, such as loan applications or financial disclosures in legal proceedings. Compliance with applicable laws and regulations is essential to ensure that the information provided is valid and enforceable.

How to obtain the Personal Financial Summary Form Citibank

The Personal Financial Summary Form Citibank can typically be obtained through Citibank's official website or by visiting a local branch. Customers may also request the form directly from their financial advisor or representative. It is important to ensure that you are using the most current version of the form to meet any specific requirements set by Citibank or other financial institutions.

Examples of using the Personal Financial Summary Form Citibank

There are several scenarios in which the Personal Financial Summary Form Citibank may be utilized:

- Loan Applications: When applying for a mortgage or personal loan, lenders often require this form to assess creditworthiness.

- Investment Planning: Financial advisors may request this form to create tailored investment strategies based on an individual's financial situation.

- Estate Planning: This form can aid in organizing financial information for estate planning purposes, ensuring all assets and liabilities are accounted for.

These examples illustrate the versatility and importance of the Personal Financial Summary Form in various financial contexts.

Quick guide on how to complete personal financial summary form citibank

Prepare Personal Financial Summary Form Citibank effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Personal Financial Summary Form Citibank on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortlessly adjust and eSign Personal Financial Summary Form Citibank

- Locate Personal Financial Summary Form Citibank and click Get Form to initiate.

- Use the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with specialized tools that airSlate SignNow provides.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Financial Summary Form Citibank and ensure effective communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Australia financial summary income?

airSlate SignNow is a powerful e-signature solution that enables businesses to send and sign documents electronically. This platform simplifies the process of managing essential documents like your Australia financial summary income reports, ensuring they are signed efficiently and securely.

-

How can airSlate SignNow help with managing Australia financial summary income documents?

With airSlate SignNow, you can easily create, send, and manage your Australia financial summary income documents online. The platform offers templates and easy collaboration features, making financial document management seamless for businesses.

-

What pricing options does airSlate SignNow offer for businesses needing Australia financial summary income solutions?

airSlate SignNow provides flexible pricing plans to accommodate different business needs, ideal for managing your Australia financial summary income. You can choose from individual, business, or enterprise plans, each designed to provide essential features at competitive rates.

-

Does airSlate SignNow offer integrations that support Australia financial summary income reporting?

Yes, airSlate SignNow integrates with various accounting and financial software, enhancing the management of your Australia financial summary income. This allows for smoother workflows, making it easy to incorporate signed documents directly into your financial systems.

-

What are the benefits of using airSlate SignNow for Australia financial summary income processing?

Using airSlate SignNow enhances efficiency and security for processing your Australia financial summary income. The platform streamlines document workflows, reduces the risk of errors, and accelerates approval times, helping businesses maintain compliance.

-

Is airSlate SignNow compliant with Australian financial regulations for Australia financial summary income?

airSlate SignNow adheres to industry standards and is designed to be compliant with Australian financial regulations. This ensures that your Australia financial summary income documents are managed securely and meet necessary legal requirements.

-

Can I try airSlate SignNow before committing to a subscription for my Australia financial summary income needs?

Absolutely! airSlate SignNow offers a free trial for potential users to explore its features tailored for managing Australia financial summary income. This allows you to evaluate the platform's capabilities before making a financial commitment.

Get more for Personal Financial Summary Form Citibank

- Incorporation of n a m e o f c o m p a n y inc form

- Unanimous consent to action by the board of trustees of form

- Bylaws board of trusteesuniversity of san francisco form

- Code of ethics for christian leadersethics codes collection form

- A year with the sages rabbi reuven hammer a review form

- How to write a resolution for a non profit or public form

- We the undersigned members of form

- Sample charge conference resolution inumc form

Find out other Personal Financial Summary Form Citibank

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will