Disclosure of Social Security Number Andor Federal Taxpayer Identification Number 2021

What is the disclosure of social security number and federal taxpayer identification number?

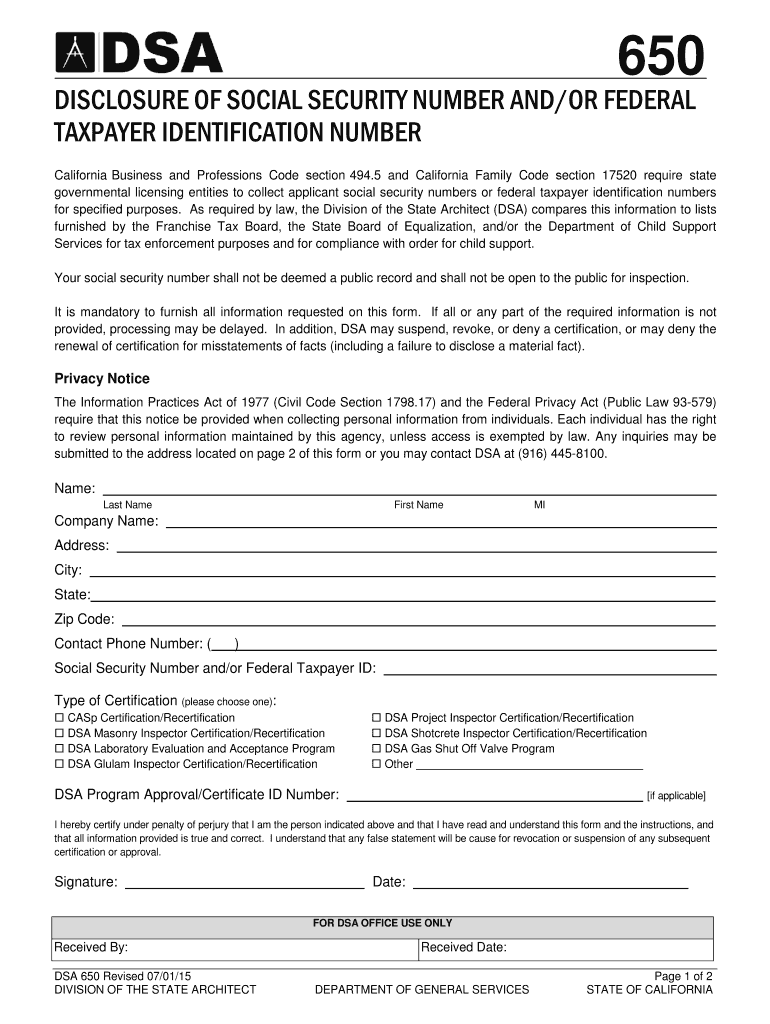

The disclosure of social security number and federal taxpayer identification number is a formal process where individuals or entities provide their unique identifiers to comply with various legal and tax obligations. This information is crucial for the Internal Revenue Service (IRS) and other governmental agencies to track income, tax contributions, and eligibility for certain benefits. The social security number (SSN) is primarily used for individual identification, while the federal taxpayer identification number (TIN) can apply to businesses and other entities. Understanding the purpose and requirements of this disclosure is essential for maintaining compliance with U.S. regulations.

How to use the disclosure of social security number and federal taxpayer identification number

Using the disclosure of social security number and federal taxpayer identification number involves several steps. First, ensure that you are providing this information to a legitimate entity that requires it for valid purposes, such as tax reporting or employment verification. Next, complete the necessary forms, such as the W-9 for individuals or businesses, ensuring that all details are accurate. It is important to submit the form securely, especially if done online, to protect sensitive information. Lastly, keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to complete the disclosure of social security number and federal taxpayer identification number

Completing the disclosure of social security number and federal taxpayer identification number involves the following steps:

- Identify the purpose of the disclosure and the requesting entity.

- Gather necessary information, including your SSN or TIN, name, and address.

- Fill out the appropriate form, such as the W-9, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form securely, either electronically or by mail, as instructed by the requesting entity.

- Retain a copy of the submitted form for your records.

Legal use of the disclosure of social security number and federal taxpayer identification number

The legal use of the disclosure of social security number and federal taxpayer identification number is governed by various federal and state laws. Entities must ensure that they collect and use this information only for legitimate purposes, such as tax reporting, employment verification, or financial transactions. Unauthorized use or disclosure of this information can lead to legal penalties, including fines and potential criminal charges. It is essential for both individuals and organizations to understand their rights and responsibilities regarding the handling of these sensitive identifiers.

Key elements of the disclosure of social security number and federal taxpayer identification number

Key elements of the disclosure process include:

- Accuracy: Providing correct information is crucial to avoid complications with tax authorities.

- Legitimacy: Ensure that the request for disclosure comes from a valid and authorized source.

- Security: Use secure methods for submitting sensitive information to prevent identity theft.

- Record-keeping: Maintain copies of any forms submitted for future reference and compliance verification.

Examples of using the disclosure of social security number and federal taxpayer identification number

Examples of situations where the disclosure of social security number and federal taxpayer identification number is necessary include:

- When starting a new job, employers typically require a W-4 form that includes your SSN for tax withholding purposes.

- Freelancers and independent contractors often need to provide a W-9 form to clients for tax reporting on payments received.

- Businesses may need to disclose their TIN when applying for loans or opening bank accounts.

Quick guide on how to complete disclosure of social security number andor federal taxpayer identification number 390634456

Complete Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number without any hassle

- Find Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct disclosure of social security number andor federal taxpayer identification number 390634456

Create this form in 5 minutes!

People also ask

-

What is the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number in e-signatures?

The Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number refers to the secure handling and sharing of sensitive information when e-signing documents. With airSlate SignNow, you can manage this disclosure effectively, ensuring compliance and protecting personal information through encrypted signatures.

-

How does airSlate SignNow ensure the security of Social Security Numbers and Taxpayer Identification Numbers?

airSlate SignNow employs advanced encryption technologies and robust security protocols to protect the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number. Our platform meets industry standards, ensuring that sensitive data remains confidential throughout the signing process.

-

Are there costs associated with managing the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number?

While airSlate SignNow offers competitive pricing, managing the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number is included in our comprehensive service. You can choose from various subscription plans that provide flexible and cost-effective solutions for all your e-signatory needs.

-

What features does airSlate SignNow offer for handling sensitive information like Social Security Numbers?

airSlate SignNow includes features such as customizable templates, secure storage, and audit trails to facilitate the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number. These tools help businesses maintain compliance while ensuring that sensitive information is handled securely.

-

Can airSlate SignNow integrate with other software handling Social Security Number disclosures?

Yes, airSlate SignNow can seamlessly integrate with popular third-party applications and systems. This capability enhances your ability to manage the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number and streamline your workflow across different platforms.

-

What benefits does using airSlate SignNow bring for disclosing Social Security Numbers?

Utilizing airSlate SignNow for the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number allows for faster document turnaround times, improved accuracy, and enhanced security. Businesses can enjoy hassle-free e-signing while keeping sensitive information protected effectively.

-

What types of documents typically require the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number?

Documents like tax forms, employment agreements, and financial contracts often require the Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number. AirSlate SignNow helps you manage these documents securely, ensuring compliance with various regulatory requirements.

Get more for Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number

- Quitclaim deed from husband and wife to an individual alabama form

- Warranty deed from husband and wife to an individual alabama form

- Quitclaim deed husband wife 497295512 form

- Warranty deed two individual grantors to one individual grantee alabama form

- Answer to complaint form

- Marital legal separation and property settlement with adult children alabama form

- Notice of lien for furnishing of materials corporation or llc alabama form

- Alabama disclaimer 497295517 form

Find out other Disclosure Of Social Security Number Andor Federal Taxpayer Identification Number

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template