Fha Streamline Worksheet Form

What is the FHA Max Mortgage Worksheet?

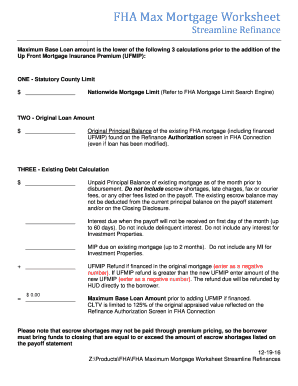

The FHA max mortgage worksheet serves as a crucial tool for individuals looking to determine their eligibility for FHA loans. This worksheet helps potential borrowers calculate the maximum mortgage amount they can obtain based on their income, debts, and other financial factors. It is designed to streamline the process of assessing loan limits and ensures that applicants have a clear understanding of their borrowing capacity under FHA guidelines.

How to Use the FHA Max Mortgage Worksheet

Using the FHA max mortgage worksheet involves several straightforward steps. First, gather all necessary financial information, including your gross monthly income, monthly debts, and any other relevant financial obligations. Next, input these figures into the worksheet, which typically includes sections for income calculation, debt-to-income ratio, and maximum loan limits based on current FHA guidelines. By following the worksheet's structure, you can easily assess your eligibility for an FHA loan.

Key Elements of the FHA Max Mortgage Worksheet

The FHA max mortgage worksheet includes several key elements that are essential for accurate calculations. These elements typically consist of:

- Gross Monthly Income: Total income before taxes and deductions.

- Monthly Debt Obligations: All recurring monthly debts, such as credit card payments, car loans, and student loans.

- Debt-to-Income Ratio: A critical measure that compares your monthly debt payments to your gross monthly income.

- Maximum Loan Amount: The calculated maximum amount you may qualify for based on FHA limits and your financial profile.

Steps to Complete the FHA Max Mortgage Worksheet

Completing the FHA max mortgage worksheet involves a series of steps to ensure accuracy. Begin by entering your gross monthly income in the designated section. Next, list all monthly debts, ensuring to include any obligations that may impact your loan eligibility. Calculate your debt-to-income ratio by dividing your total monthly debts by your gross monthly income. Finally, refer to the FHA guidelines to determine the maximum loan amount you may qualify for based on your calculated figures.

Legal Use of the FHA Max Mortgage Worksheet

The FHA max mortgage worksheet is legally recognized when used correctly in the context of applying for an FHA loan. To ensure its legal standing, it is important to follow all applicable guidelines and regulations set forth by the FHA. This includes providing accurate financial information and using the worksheet as a tool for preliminary assessments rather than a binding agreement. Proper completion and adherence to legal standards can help facilitate a smoother loan application process.

Examples of Using the FHA Max Mortgage Worksheet

Practical examples of using the FHA max mortgage worksheet can illustrate its effectiveness. For instance, a borrower with a gross monthly income of $5,000 and total monthly debts of $1,500 would calculate their debt-to-income ratio as 30 percent. Based on FHA guidelines, this ratio may qualify them for a maximum loan amount of $300,000. Such examples highlight the worksheet's role in helping borrowers understand their financial standing and potential loan eligibility.

Quick guide on how to complete fha streamline worksheet 2021

Complete Fha Streamline Worksheet seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Fha Streamline Worksheet on any device using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

The easiest way to modify and electronically sign Fha Streamline Worksheet effortlessly

- Find Fha Streamline Worksheet and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fha Streamline Worksheet and ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the FHA max mortgage worksheet?

The FHA max mortgage worksheet is a tool designed to help potential homebuyers accurately calculate their maximum allowable mortgage amount under FHA guidelines. This worksheet takes into account several factors, including income, debts, and current interest rates. Utilizing this tool can simplify the home buying process and help you determine what you can afford.

-

How can I access the FHA max mortgage worksheet?

You can access the FHA max mortgage worksheet directly through the airSlate SignNow platform. Simply create an account, and you will find the worksheet readily available in our library of resources. This allows you to complete your calculations quickly and efficiently, enhancing your overall experience.

-

Are there any costs associated with using the FHA max mortgage worksheet in airSlate SignNow?

Using the FHA max mortgage worksheet within airSlate SignNow is part of our cost-effective solution for document management and eSignatures. There are no hidden fees for accessing this worksheet, making it an affordable option for both individuals and businesses looking to simplify their mortgage application process.

-

What features does the FHA max mortgage worksheet offer?

The FHA max mortgage worksheet offers user-friendly features that allow you to input your financial data easily, automatically calculating your maximum mortgage amount. Additionally, it provides step-by-step guidance to ensure accuracy in your entries. This comprehensive approach helps reduce the complexity surrounding FHA mortgage calculations.

-

How does the FHA max mortgage worksheet benefit homebuyers?

The FHA max mortgage worksheet benefits homebuyers by providing a clear and structured way to assess their mortgage eligibility. It empowers users to make informed decisions about their finances and home purchasing options. With this tool, you can identify your budget early on, helping to streamline the loan process.

-

Can the FHA max mortgage worksheet be integrated with other tools?

Yes, the FHA max mortgage worksheet can be seamlessly integrated with other tools within the airSlate SignNow ecosystem. This makes it easier to manage documents and eSign forms related to your mortgage application. By integrating your calculations with your document workflow, you can save time and improve efficiency.

-

Is the FHA max mortgage worksheet suitable for first-time homebuyers?

Absolutely! The FHA max mortgage worksheet is particularly beneficial for first-time homebuyers who need guidance on how much they can afford. It simplifies the complex calculations associated with FHA loans, making it accessible for those unfamiliar with the mortgage process. This user-friendly approach helps empower new buyers in their home purchasing journey.

Get more for Fha Streamline Worksheet

- Restated certificate of incorporation of the company form

- Proxy statement for stockholder action by written consent form

- 18 1080 restated certificate of incorporation justia law form

- Credit agreement by and among by pareteum corp form

- Articles of incorporation multiple classes this form shows

- 1 proposed acquisitions by the company constituting a very form

- 305 to amend the articles of incorporation to a increase the authorized number of shares of form

- Us steel united states steel corporation form

Find out other Fha Streamline Worksheet

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online