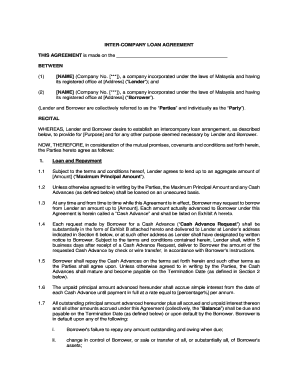

Inter Company Loan Agreement Template Form

What is the Inter Company Loan Agreement Template

An intercompany loan agreement template is a structured document that outlines the terms and conditions under which one company lends money to another within the same corporate group. This template serves as a legal framework to ensure that both parties understand their obligations, including the loan amount, interest rate, repayment schedule, and any collateral involved. By utilizing a standardized template, businesses can streamline the process of creating these agreements while ensuring compliance with relevant regulations.

Key elements of the Inter Company Loan Agreement Template

When drafting an intercompany loan agreement, several key elements are essential for clarity and legal validity. These include:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: A detailed schedule outlining when payments are due and the total duration of the loan.

- Purpose of the Loan: A description of how the borrowed funds will be used.

- Default Clauses: Conditions that define what constitutes a default and the consequences thereof.

- Governing Law: The jurisdiction that will govern the agreement.

How to use the Inter Company Loan Agreement Template

To effectively use the intercompany loan agreement template, follow these steps:

- Download the Template: Obtain a reliable version of the template that meets your business needs.

- Fill in the Details: Customize the template by entering specific information such as the loan amount, interest rate, and repayment terms.

- Review for Accuracy: Ensure all details are correct and comply with internal policies and legal requirements.

- Obtain Signatures: Have authorized representatives from both companies sign the agreement to make it legally binding.

- Store the Document: Keep a secure copy of the signed agreement for future reference and compliance purposes.

Legal use of the Inter Company Loan Agreement Template

Using an intercompany loan agreement template legally requires adherence to specific regulations and guidelines. It is crucial to ensure that the terms reflect fair market conditions to avoid tax implications. The agreement should comply with the Internal Revenue Service (IRS) guidelines regarding transfer pricing, which dictate that loans between related entities must be conducted at arm's length. Additionally, proper documentation and record-keeping are essential to demonstrate compliance during audits.

Steps to complete the Inter Company Loan Agreement Template

Completing the intercompany loan agreement template involves several systematic steps:

- Identify the Parties: Clearly state the names and addresses of both the lending and borrowing entities.

- Specify Loan Details: Include the loan amount, interest rate, and repayment schedule.

- Outline Terms and Conditions: Define any conditions related to the loan, including default terms and collateral requirements.

- Legal Review: Have legal counsel review the agreement to ensure compliance with applicable laws.

- Finalization: Once reviewed, finalize the document with signatures from both parties.

Quick guide on how to complete inter company loan agreement template

Complete Inter Company Loan Agreement Template effortlessly on any device

Digital document management has become popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Inter Company Loan Agreement Template on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Inter Company Loan Agreement Template without hassle

- Find Inter Company Loan Agreement Template and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Inter Company Loan Agreement Template and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement lender?

An agreement lender is a financial institution or company that provides loans under specific terms. With airSlate SignNow, businesses can create and manage agreements with lenders efficiently, ensuring all documentation is eSigned and securely stored.

-

How can airSlate SignNow help streamline the loan agreement process?

airSlate SignNow simplifies the loan agreement process by allowing businesses to send, manage, and eSign agreements digitally. This reduces paperwork, minimizes errors, and accelerates the overall approval process with agreement lenders.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to suit different business needs. Each plan includes essential features for managing agreements with lenders, ensuring that you get the best value for your investment in eSigning and document management.

-

Can airSlate SignNow integrate with other software used by agreement lenders?

Yes, airSlate SignNow offers seamless integrations with popular software applications that agreement lenders often use. This allows for a smooth workflow, enabling businesses to manage agreements alongside their existing tools.

-

What are the benefits of using airSlate SignNow for agreement lenders?

Using airSlate SignNow provides signNow benefits for agreement lenders, such as enhanced security, reduced turnaround time for document approval, and easy access to signed agreements. These features help lenders manage their workflow more efficiently, improving customer satisfaction.

-

Is it safe to send loan agreements through airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your loan agreements and sensitive information. Encryption and secure storage ensure that your agreements with lenders remain confidential and secure.

-

How can I track the status of my loan agreement with an agreement lender on airSlate SignNow?

airSlate SignNow provides tracking features that allow you to monitor the status of your loan agreements in real-time. You can see when a document is sent, viewed, and signed, making it easy to stay updated with your agreement lender.

Get more for Inter Company Loan Agreement Template

- Steven r berger a new york new york ny corporate form

- 40 guide for hearing officers in nlrb representation and form

- Rules of practice in air safety proceedings federal register form

- Medicare program payment policies under the physician fee form

- 28th aug issuu form

- Navigating the amended new york false claims act latest form

- Bank of california v connolly california court of form

- New york business corporation law section 904 a merger or form

Find out other Inter Company Loan Agreement Template

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement